Market Update

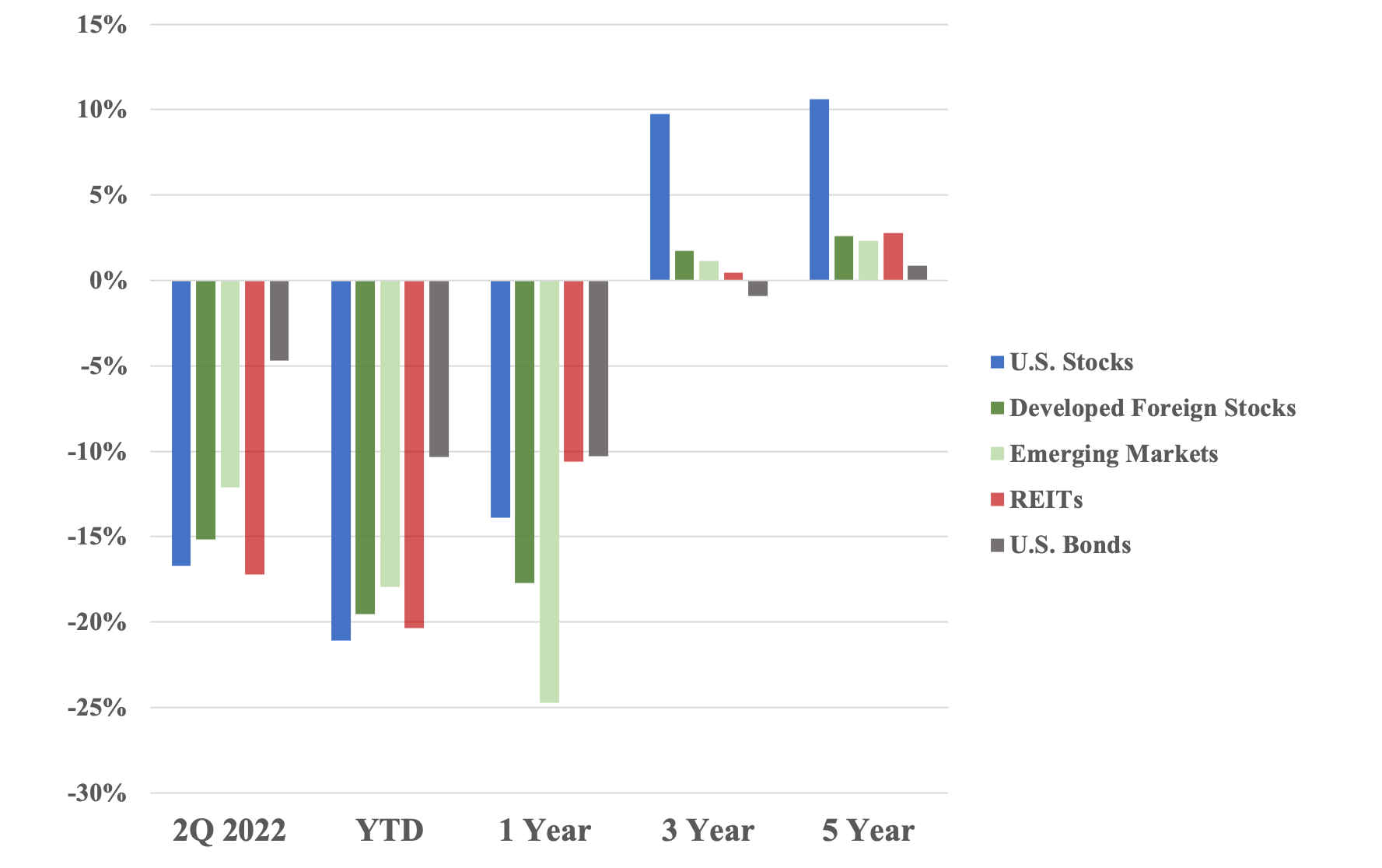

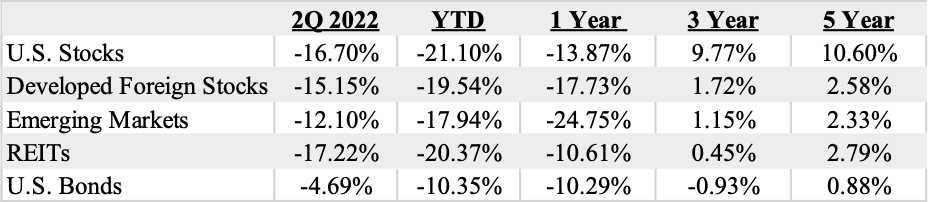

After U.S. markets entered bear market territory in the second quarter of 2022, it’s a good time to remind ourselves of some facts regarding markets and our investment philosophy.

A bear market is defined as a 20% drop in an index. It should be noted that “bear markets” (20% drops) or “corrections” (10% drops) are arbitrary sign posts. Nothing materially changed when the index fell from 9.9% to 10.0% or from 19.9% to 20.0%. And while these labels help us categorize the environment we’re in, they do nothing to provide us with real insight into what the future will be. Bear markets don’t equal “everything is over.”

***

I’ve been asked how one invests in a market like this. My answer is simply, “the way that puts us in the best position to earn the most money.”

Which is??

Our bet is that global Real GDP will continue to grow over the long-term. Companies across the globe will continue to strive to create goods and services that governments and people want. That’s our singular macro view because we know that this drives investment returns. As such, we invest to capture this global growth via index funds because they are cheap and tax-efficient. In other words, more of this growth gets into client hands versus being swept away by intermediaries through costs.

Our straightforward thesis doesn’t mean that it will be a piece of cake. Global growth won’t be linear each year. There will be fits and starts, such as what we’ve experienced in 2022.

But research shows that timing these or adjusting strategies based on other macro trends will result in less money in the end.

Lastly, consider this fact:

The last “all-time-market high” was on Monday, January 3rd, 2022 when the S&P closed at 4,796. The market closed at the end of June at 3,785.

For us to reach our next all-time-high, the markets will be up 24%.

Are you willing to bet that there will never again be another all-time-high? (By the way there were 70 of them in 2021). If you think there’s a future out there, the markets will soon be up 24%. Would you miss out on that?

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI EM Index, S&P Global REIT Index, US Aggregate Bond Index. Returns as of 6/30/2022

Economic Update

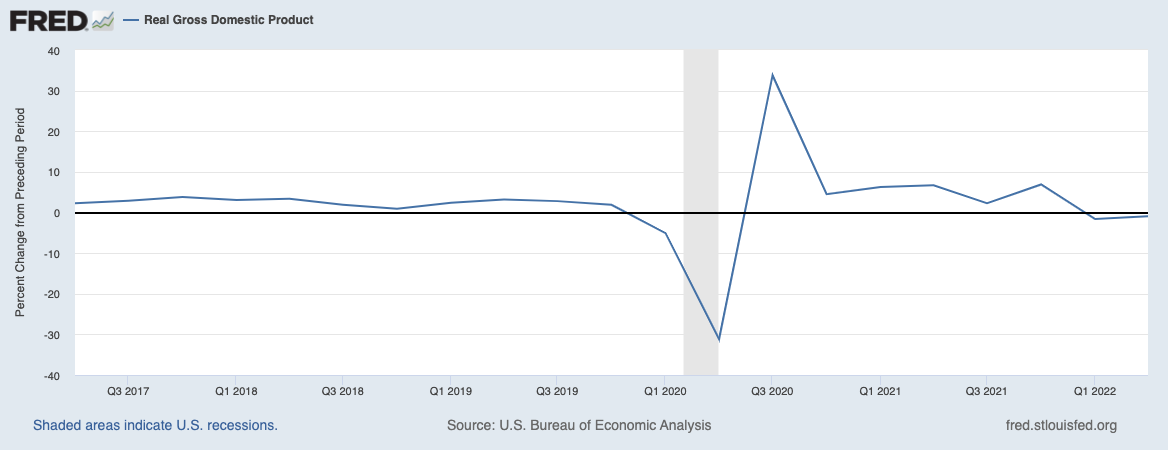

Real GDP (inflation adjusted) has fallen (-1.9%) over the 1st Quarter in 2022 and (-0.9%) over the 2nd Quarter. For some this fits a common definition of a recession (defined as 2 negative quarters of Real GDP). The U.S. Government uses a different measure that’s a bit more arbitrary. Whichever bias you want to confirm, this doesn’t change our overall viewpoint of sticking with a strategy. What we call it doesn’t matter as much as what we do. We know that markets move in cycles and if now is the time for contraction, then we’ll buckle up and focus on what we can control.

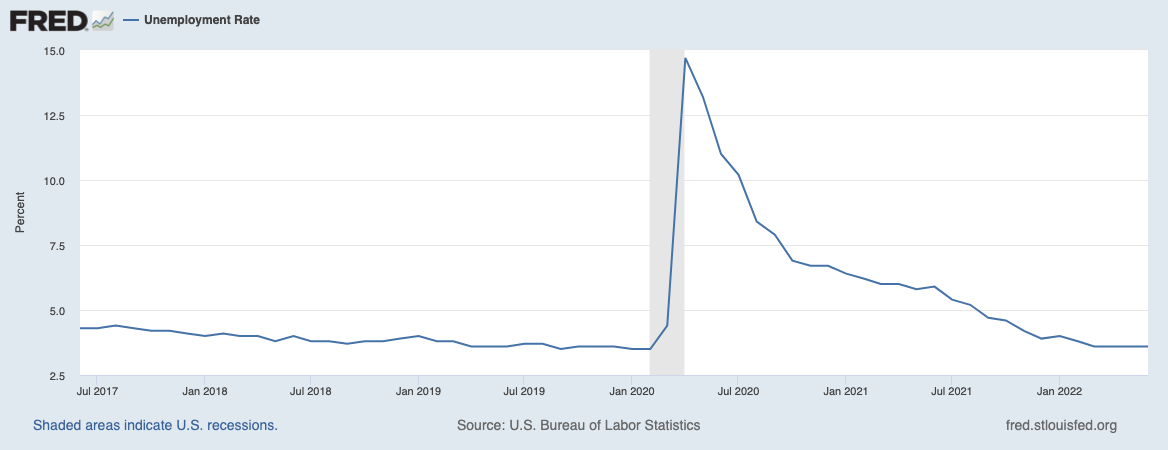

Unemployment stayed to 3.6% through June. We are still operating in a tight labor market for the time being.

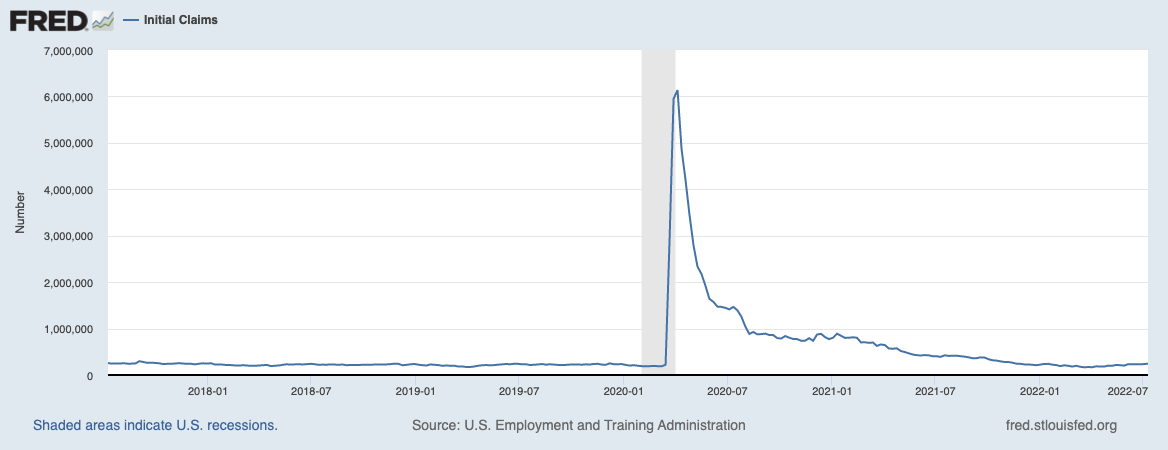

Initial unemployment claims have increased slightly but still match pre-pandemic levels.

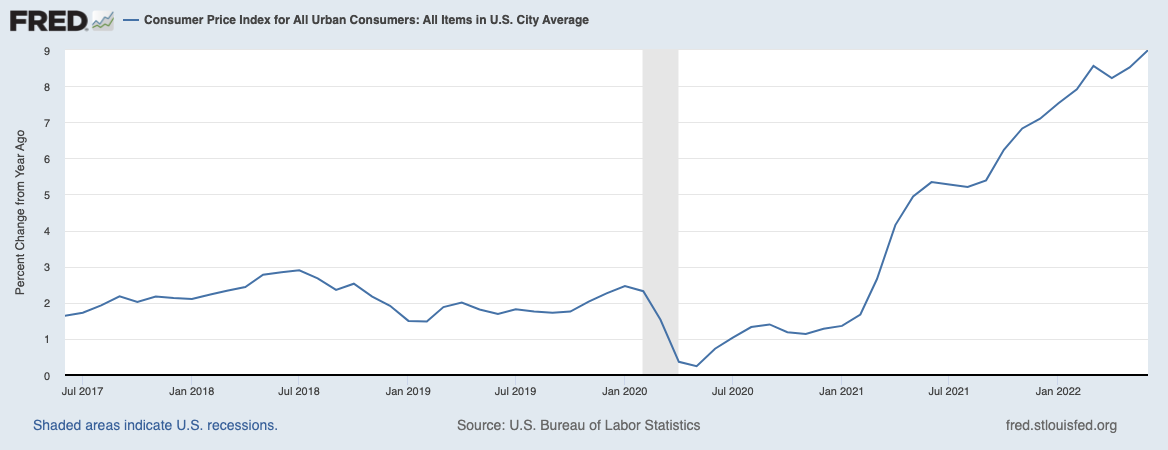

We are all aware of this one! Consumer prices are up 9% over this time last year (aka inflation).

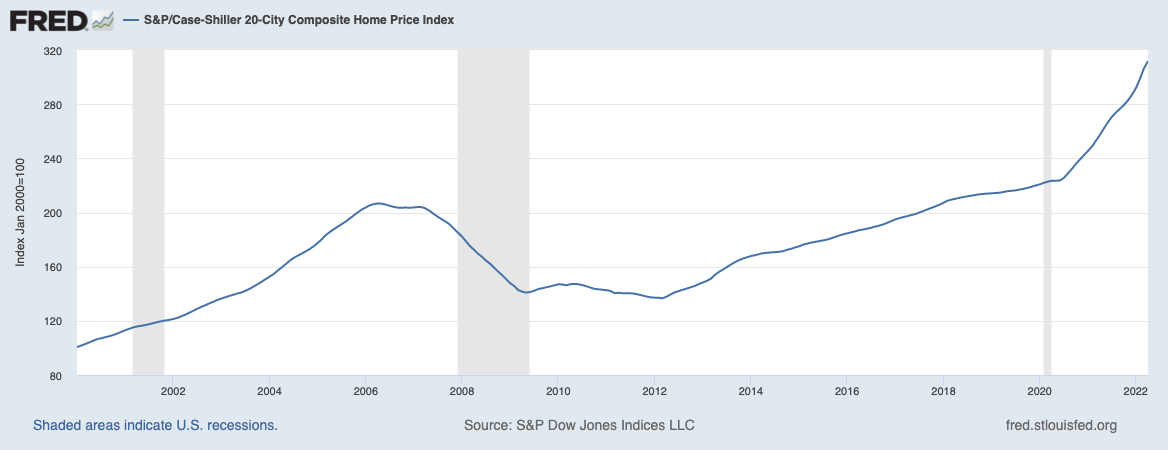

Housing prices are still higher than this time last year. Anecdotally, I’ve seen housing price cuts from the original listings, but the final sales prices are still higher than last year. It seems that people are not willing to pay anything for a house anymore.