My goal for these blog posts is to provide useful information so that you can make more accurate decisions.

Below are some basic definitions that I found helpful from a book called “Investment Management: Portfolio Diversification, Risk and Timing – Fact and Fiction” by Robert Hagin:

- Facts & data are both descriptive measures of things that have happened

- News includes all new facts and data

- Knowledge is required to translate news, facts and/or data into useful information

- Noise is facts/data/news that cannot be processed into useful information (<— WHAT MOST STUFF IS)

- Useful information can be used to make more accurate decisions (<— WHAT I’M TRYING TO PROVIDE)

Since there is an endless and ever growing amount of things to learn, I hope that these posts are helpful in summarizing important topics related to investing.

Each post will include three things that I’ve learned from books, podcasts, articles, newsletters and company call/presentation transcripts that I’ve been reading and/or listening to.

#1

Housel, Morgan. The Art of Spending Money: Simple Choices for a Richer Life. Portfolio/Penguin, 2025.

Quote: “There’s almost no end to this. The millionaires look at the centimillionaires, who look at the billionaires, who look at the decabillionaires, who look at the centibillionaires. And what do the centibillionaires want? Immortality.” – Morgan Housel

Stephen and I are big fans of Morgan Housel and his newest book did not disappoint. There’s lots of helpful wisdom to digest here but I especially loved this quote for exposing the foolishness of comparing ourselves to others – particularly when it comes to our finances.

#2

Mauboussin, Michael. More Than You Know: Finding Financial Wisdom in Unconventional Places. Updated and expanded ed., Columbia University Press, 2013.

Quote: “… the first comprehensive study of the performance of all stocks wasn’t published until 1964. In that paper, University of Chicago professors Lawrence Fisher and James Lorie documented that stocks delivered about a 9% return from 1926 to 1960.” – Michael Mauboussin

This might seem random and/or outdated, but this line struck me as notable since the first mutual fund was started 40 years earlier. I would have loved to hear some of the sales pitches from the mutual fund companies in those early days. I’m imagining that they went something like this:

Mutual fund salesperson: “Would you like to invest in our fund?”

Potential investor: “How has performance been relative to the market overall?”

Mutual fund salesperson: “We don’t really know since nobody has ever tracked overall market performance before… would you still consider investing in our fund?”

#3

Yardeni, Ed. “A Bubble in Bubble Fears?” Yardeni QuickTakes, Yardeni Research, 5 Oct. 2025, www.yardeniquicktakes.com/a-bubble-in-bubble-fears/.

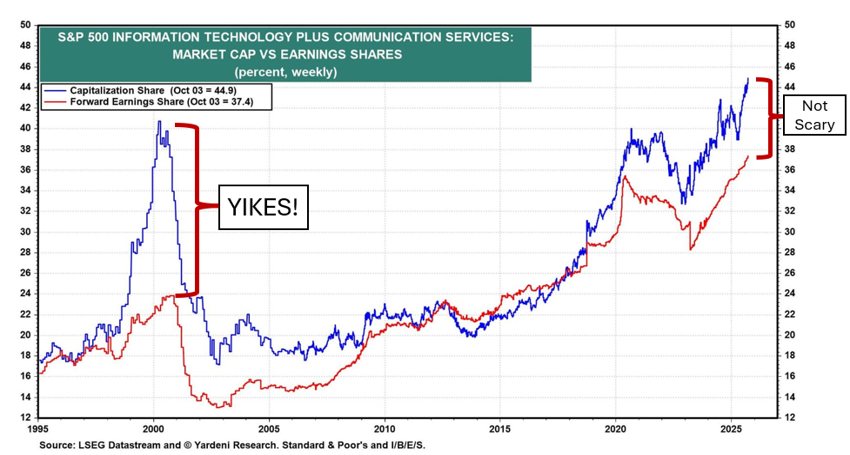

Given how many prominent voices have recently called today’s stock market a “bubble”, I found this chart helpful in highlighting one simple difference between today’s stock market and “the dot-com bubble” which peaked on March 10, 2000.

Today, if we combine the IT sector (which includes NVDA, AAPL & MSFT) and communication services sector (which includes META & GOOGL), we get a 45% share of the S&P 500 market cap and 38% share of the S&P 500 earnings – pretty close!

If we look back at where things stood at the peak in 2000, the market cap share for these sectors was in a similar ballpark (~42%) yet the earnings contribution was meaningfully lower at only 24%. Based on my favorite investing rule of thumb (“stocks follow earnings”), there was clearly a different level of optimism being baked into the share prices of the companies in these two sectors back in 2000 than is the case today.