Market Update

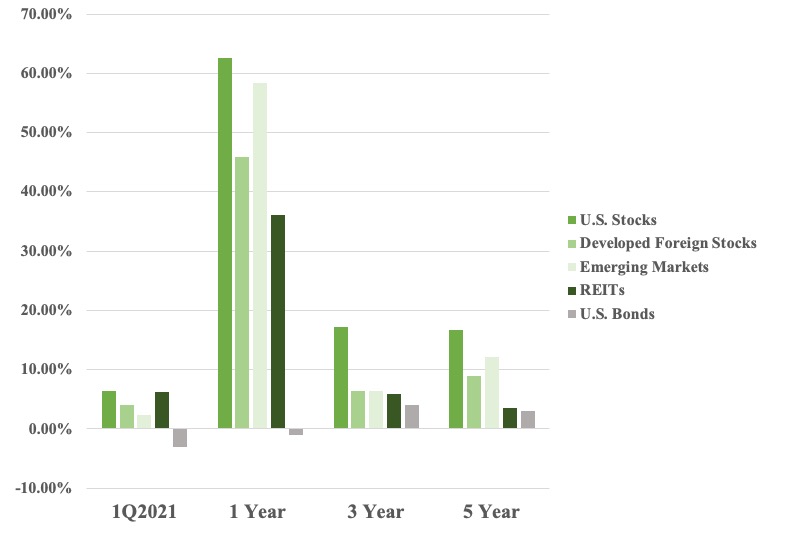

Global markets were off to a strong start for the first quarter. US, developed, and emerging markets were all positive. The prior 12-month returns are almost unbelievable. I had to cross reference my sources to make sure I was seeing things correctly. The US market is up over 60% from this time last year. As we remember the market bottomed toward the end of March in 2020, so the astronomical gains are because these two dates are lining up.

Small cap stocks continue to lead returns and value has finally made a big comeback over growth (11.9% vs. 1.2%, respectively). Considering the last year, real estate (REITs) has not been the drag one might have thought. In fact, they’re pacing closely to the US market for the quarter (6.2%). Yields have risen in the quarter pushing bond prices down.

Markets shift. Different sectors pull back and others surge – usually dramatically. Average returns are never what you experience. To go from being down 30% to up 30% in a year is quite the jolt, but it is how the markets behave. Big swings are the norm rather than small steps upward.

As we look ahead, the case for diversification could never be stronger. Because of it you take part in all the winnings and limit the losers. There’s no one strategy that does well in all markets nor is there one that knows exactly what’s going to happen around the corner. This is why we build portfolios for an unpredictable world. I pity those who need the markets to follow their exact predictions.

Keeping expenses low, limiting taxes, and staying disciplined are the mandates we’ve put in place for ourselves. We know this puts the odds in our favor over the long-term to do really well for ourselves and our families.

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future of results. Russell 3000 Index, MSCI World ex USA Index, MSCI EM Index, S&P Global REIT Index, BBgBarc Global Agg Bond Index. Returns as of 3/31/2021.

Economic Update

The first quarter is a tale of two surges. The American Rescue Plan is said to add $1.2 trillion in additional spending in the next 6 months to further stimulate the economy. I have to type that number out: $1,200,000,000,000. Additionally, we’re seeing vaccinations rising to close to 3 million doses per day. All the data I’m reading points to herd immunity by this fall at the latest.

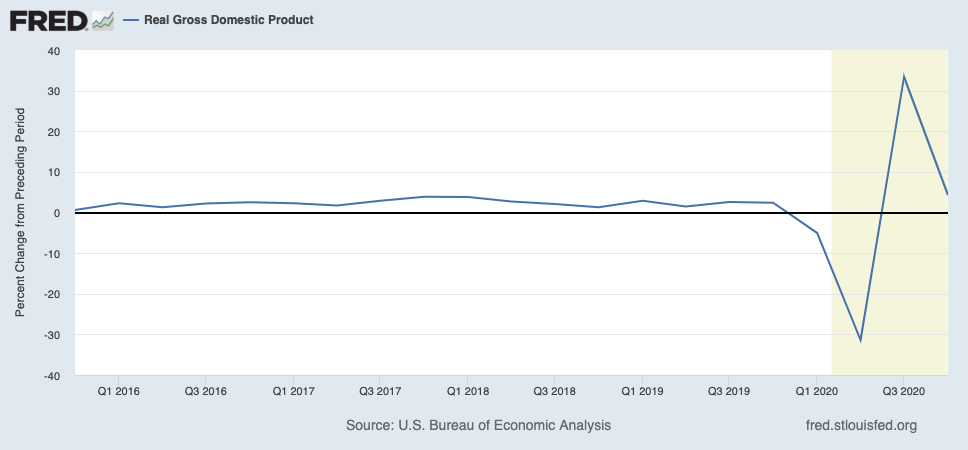

Real GDP at the end of 2020 increased by 4.3%, a strong sign things are doing much better.

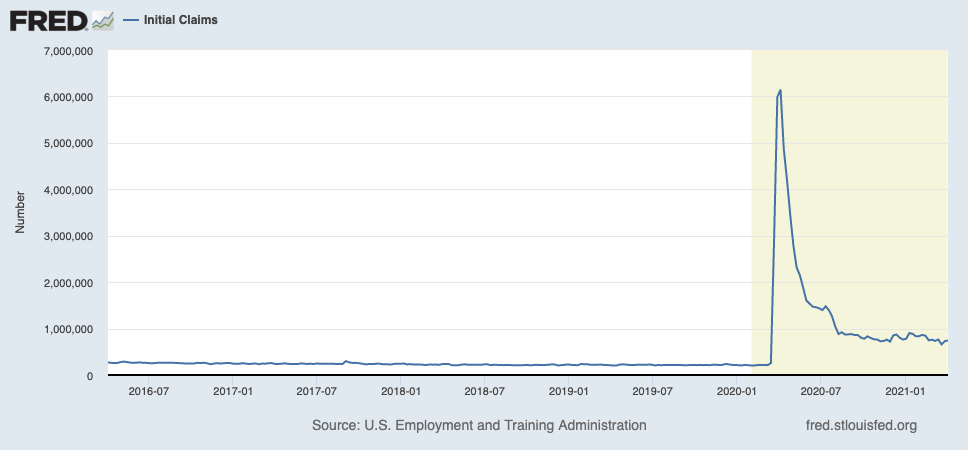

Unemployment is still elevated at 6.2%, but should rapidly come down once the service sector can reopen. Here in California the unemployment rate sits at 8.5%. The Federal Reserve has signaled that low interest rates will continue until unemployment is below 4%. The last weekly initial claims number came in at 744,00.

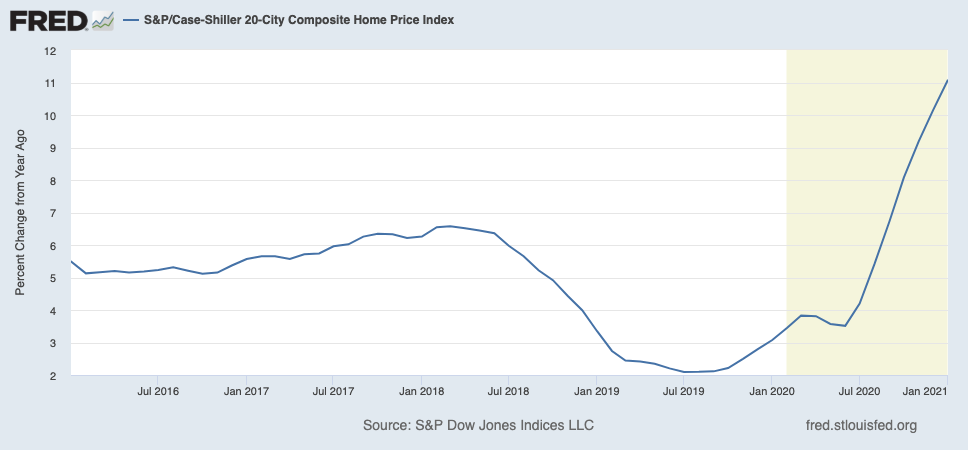

While workers fled the office and commercial real estate suffered, residential housing prices continue to boom. Prices have increased just over 11% in January from the year prior.

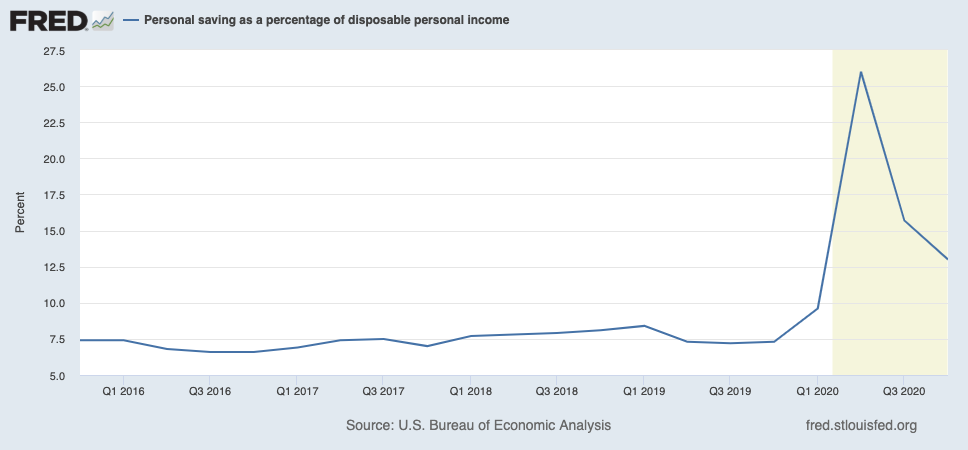

Due to the pandemic, Americans have been saving more of their disposable income recently than they have for the past 70 years. At the end of last year this number stood at 13%. This bodes well for the economy once things are fully opened as people will be able to spend what they’ve been saving.

Tax, Legal and Legislative Updates

Here were some of the main takeaways from the new American Rescue Plan:

- Round 3 of stimulus checks of $1,400 has much faster phaseout limitations than the previous two stimulus’

- Depending on where your income lands, you might not get as much as you were expecting in a stimulus check

- There are provisions for a “true-up” to be made later this year if your income in 2020 dropped, but you have to file your tax return by August 15th. If you extend, don’t wait until the October 15th deadline to file

- Good news for parents with children (or who have dependent elders who can’t care for themselves)

- Expansion of the Child Tax Credit to $3,000 and fully refundable (plus a portion of the 2021 credit may be paid in advance!)

- Enhancement to the Child and Dependent Care Tax Credit

- Health insurance relief

- New provision permitting several months of “free” COBRA

- Items not included:

- No RMD relief

- No increase in the minimum wage to $15/hr

- No elimination of cost-of-living adjustments for retirement plan contributions

As always, I will be reviewing clients’ tax returns to make sure the new changes have been captured correctly on their returns.