Market Update

Markets dabbled in correction territory at the start of the year and then claimed some of the losses back in the second half of March. U.S. stocks, developed foreign stocks, and emerging markets were down 5.3%, 5.2%, and 6.7%, respectively. In this past quarter, small cap underperformed large cap by 2.4% and value stocks handed growth the business by outperforming by 8.4% to start off the year.

Bonds were down this first quarter as well with shorter-term bonds down around 2.5% (2 year treasuries) and longer term bonds down over 11% (30 year treasuries). Contrary to popular belief, bonds can lose value and are risky! Albeit much less than equities, there’s still the potential for loss. It’s rare that we see all asset classes down at the same time.

According to the Consumer Sentiment Index (how confident people are about future returns in the markets) people feel worse now than they did in the midst of the pandemic. The interesting thing to note is that when sentiment is bad, the market goes on to perform very well. When you least feel like you should invest…that’s exactly when you should invest.

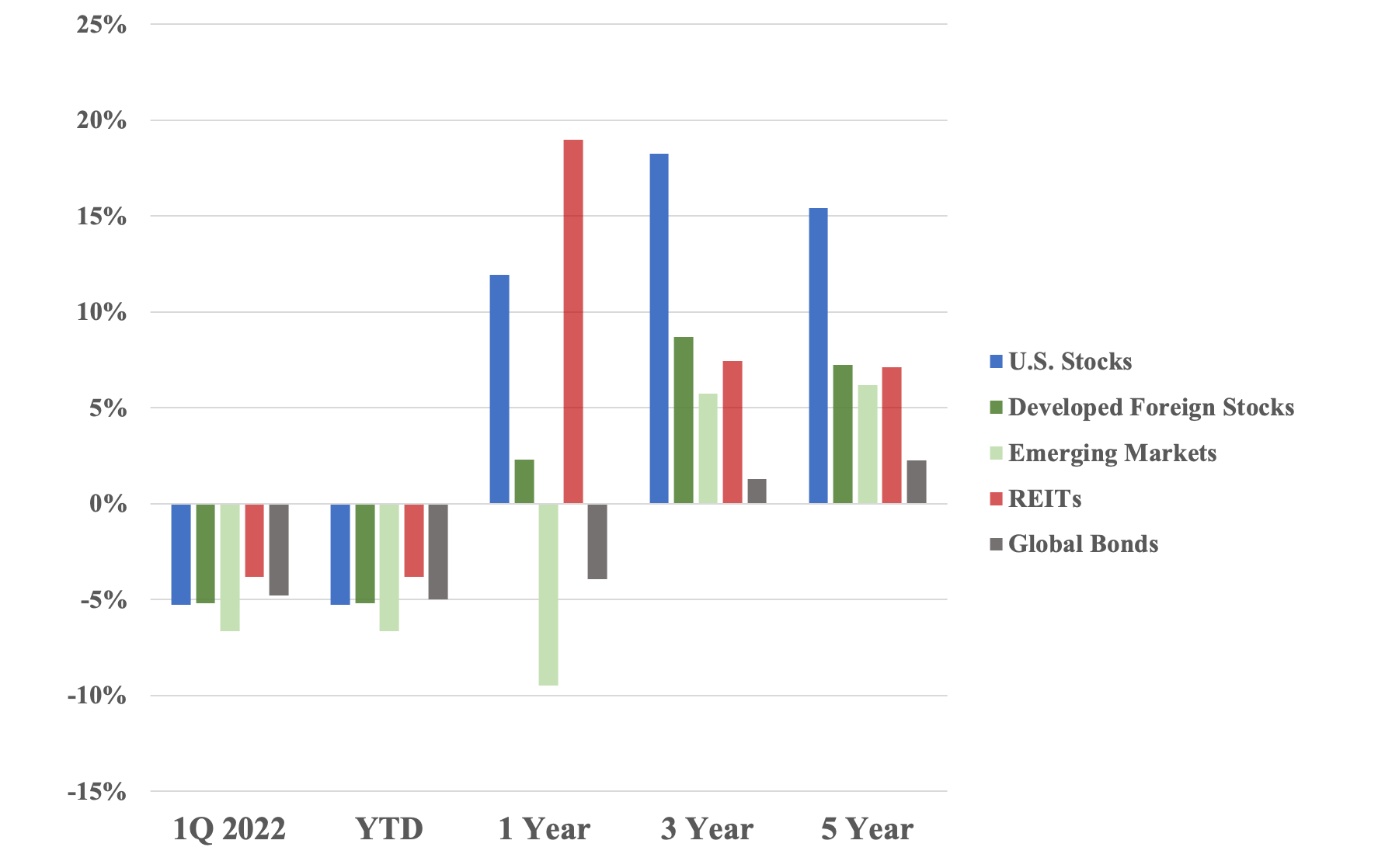

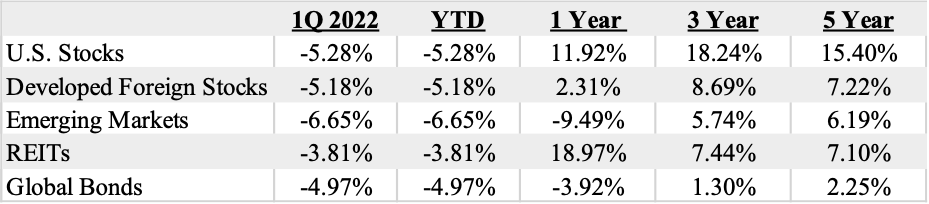

I update the below chart every quarter, but I’m especially fond of this quarters’. It’s easy to be excited when every time period is up and positive, but this first quarter of performance left a lot to be desired. What this chart shows is that even with the craziness of the present, we can run the clock back 3, 5 years and see that we are still much, much better off and performance is right where we want it.

Anything can happen in the short-run. We’ll have many more periods like this past quarter in the future, I’m sure of that. But we can also be positive that our strategy will provide great long-term results, which are the ones that matter.

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI EM Index, S&P Global REIT Index, BBgBarc Global Agg Bond Index. Returns as of 3/31/2022

Economic Update

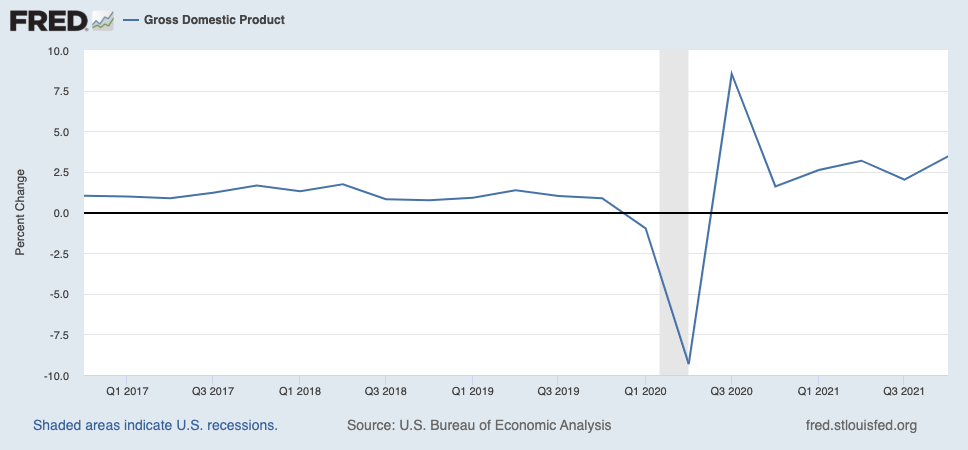

GDP was up 3.4% over the preceding quarter and Real GDP was up 1.7%.

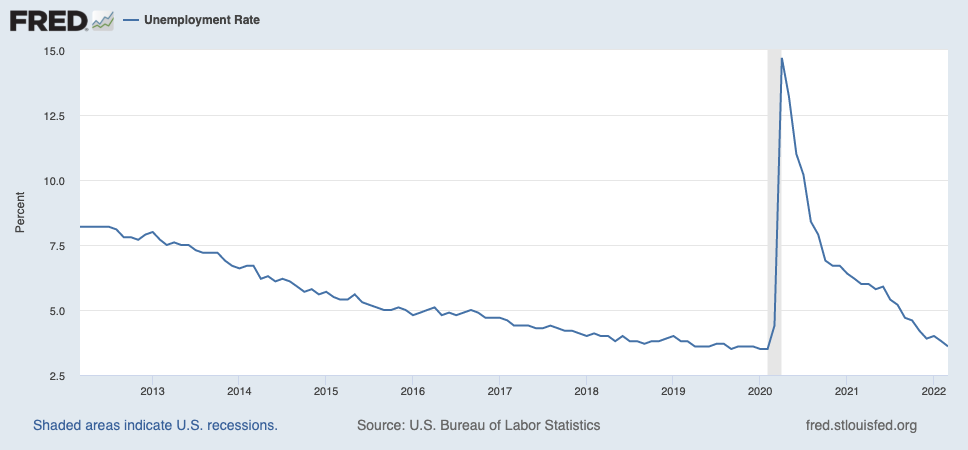

At my last writing, unemployment sat at 4.2%. It is now at 3.6%.

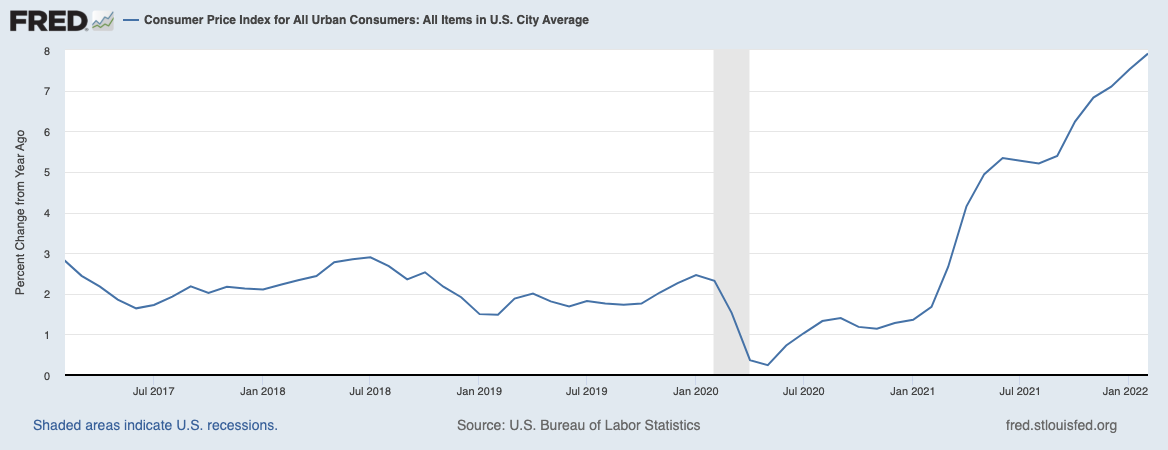

Consumer prices (inflation) are up 7.9% over this time last year. It’s interesting to see the price increases beginning in the spring and summer of last year to remind ourselves that this isn’t new. Only when we are able provide ‘causation’ or a reason for price hikes (as in the Ukraine war) do they become salient.

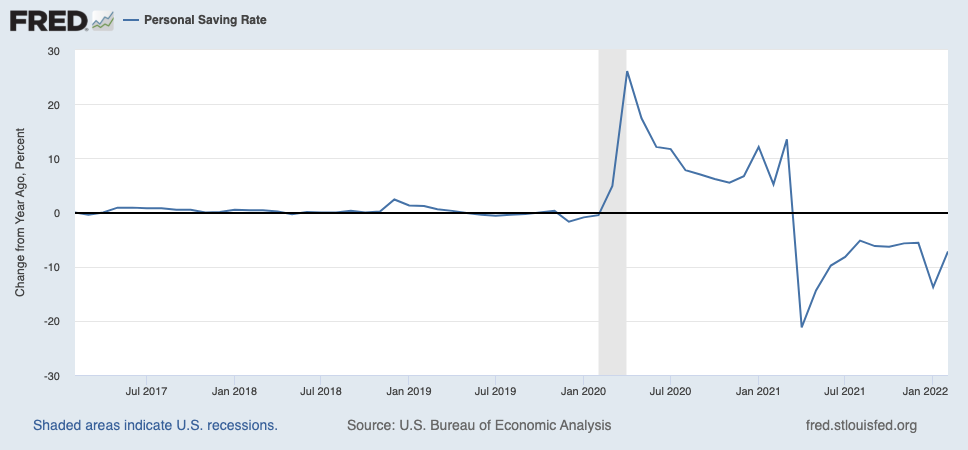

Personal savings rates are 7.2% lower than this time last year meaning that people are spending money to purchase houses, cars or invest in the capital markets.

Tax, Legal & Legislative Updates

The House approved the Securing a Strong Retirement Act (“SECURE 2.0”) in an overwhelming 414-5 vote.

We don’t plan until it’s passed as things could definitely change, but here’s some major highlights. I personally don’t see much issue with this legislation as it may provide longer periods of time to implement Roth Conversions and a boost to IRA accounts.

- Increasing RMD age from 72 to 75

- Higher catch-up contribution limits (up to $10,000 for IRAs)

- Provide incentives for small businesses to establish retirement plans