Market Review

Trust and confidence. That’s what financial markets boil down to.

Rising trust leads to rising stock prices. Lack of trust….look out below!

In March, we saw the evaporation of that confidence and the subsequent run on Silicon Valley Bank and First Republic. I won’t expound on all the details as you’ve probably read it from other sources over the past couple of months. My only point is this: Day-to-day we take for granted that trust is what we all operate on. And it amazes me how quickly it can evaporate.

Thankfully, trust has eroded intermittently and in silos. This has happened countless times in our past and will happen again in our future. However, history has shown we’ve been able to slowly maintain trust on the whole as the years go by. But this doesn’t mean we can go all-in on one bet knowing it will pay off in the years to come.

While that may be true, life circumstances happen and you never want to be caught in a state of unpreparedness. That’s why we stay fully diversified and keep a ‘war chest’ of cash and bonds always at the ready for clients.

Operate off of trust, but always be prepared.

***

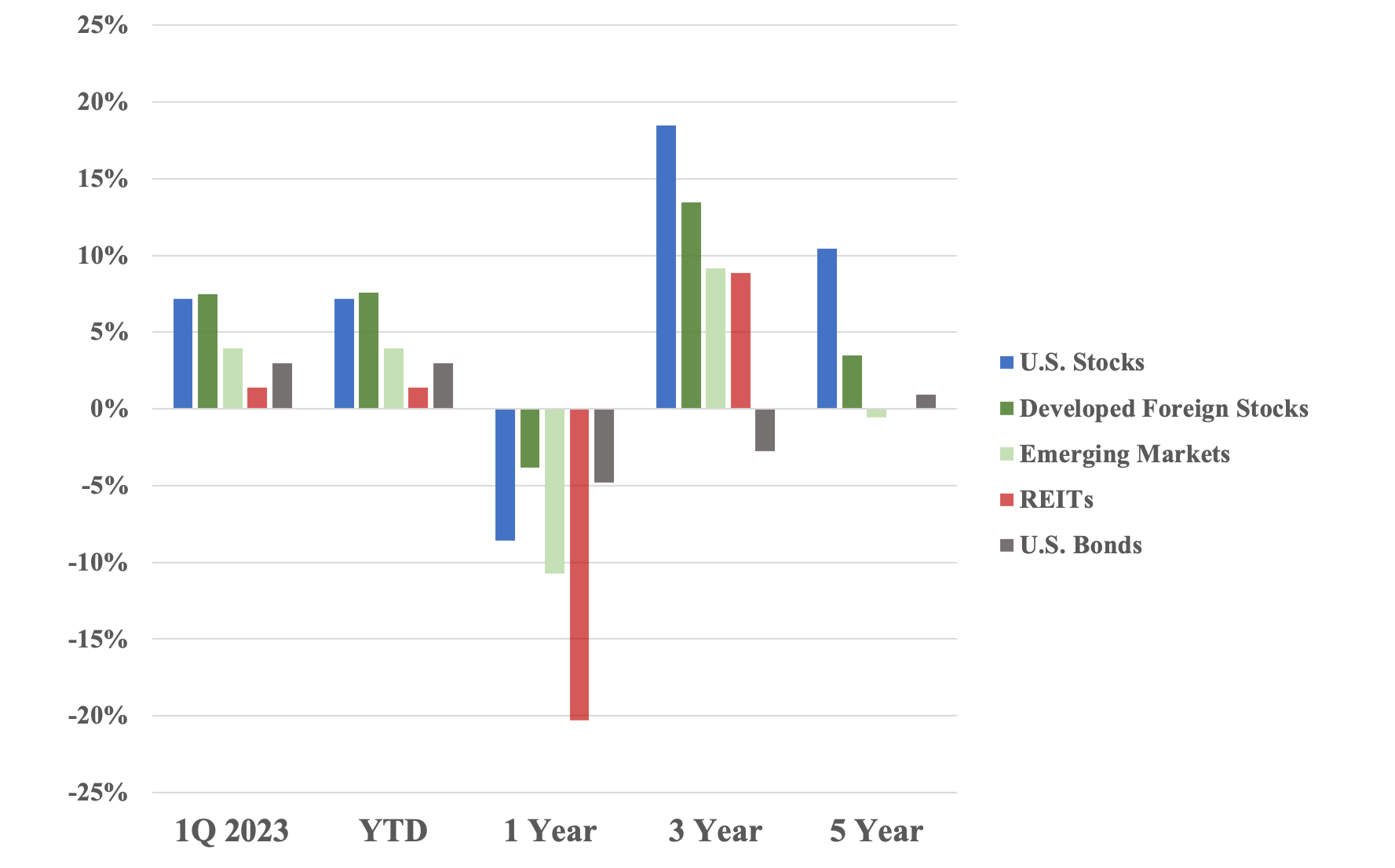

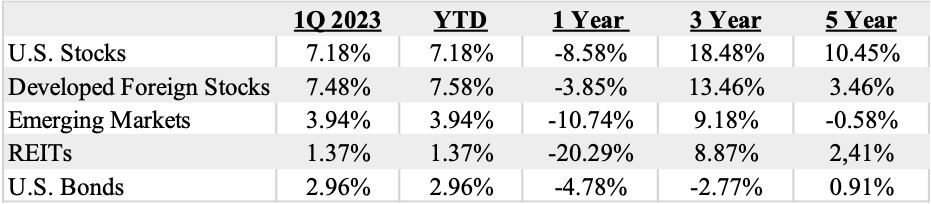

The first quarter of this year produced positive returns across the board. International stocks took the blue ribbon and US stocks weren’t far behind.

Per usual, you can see how the asset classes have played out over the last quarter to prior 5 years in chart and graph form.

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI EM Index, S&P Global REIT Index, US Aggregate Bond Index. Returns as of 03/31/2023.

Economic Review

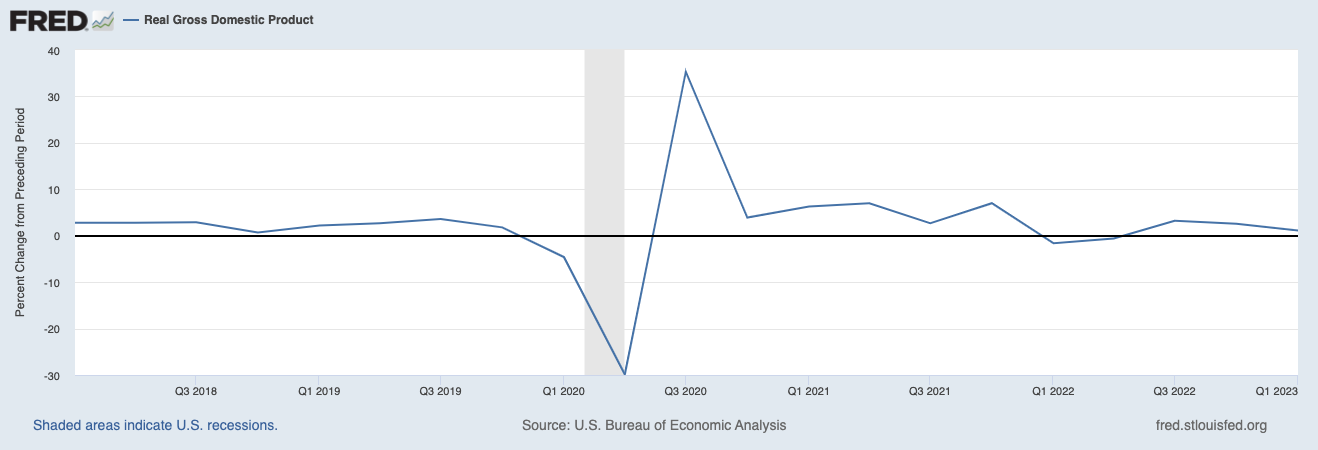

Real GDP has increased 1.1% in the 1st quarter over Q4 2022.

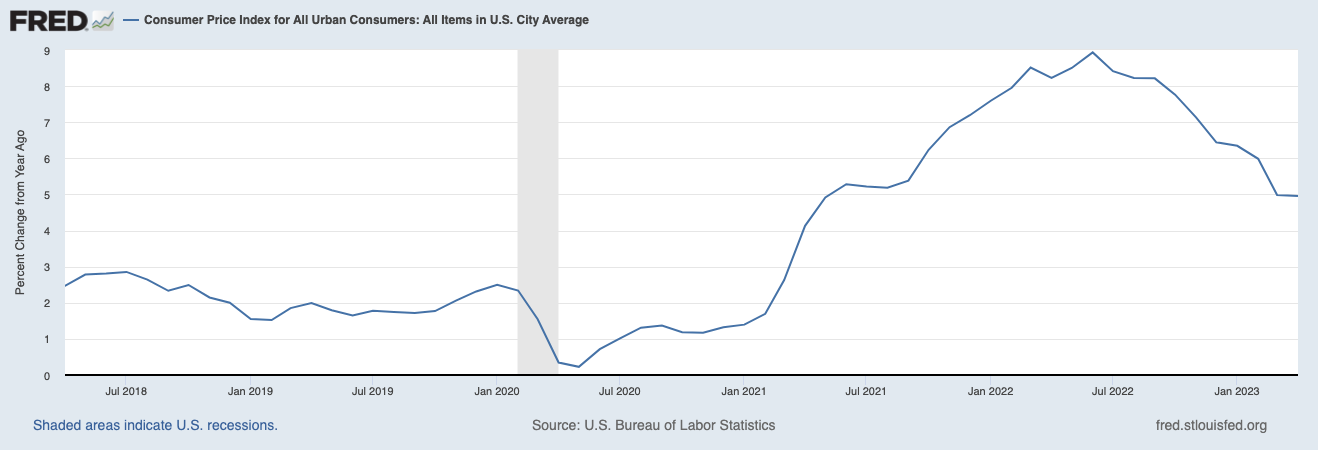

Inflation in April was up 5.0% over this time last year. We’re definitely not out of the woods yet, but the rate of increases is falling.

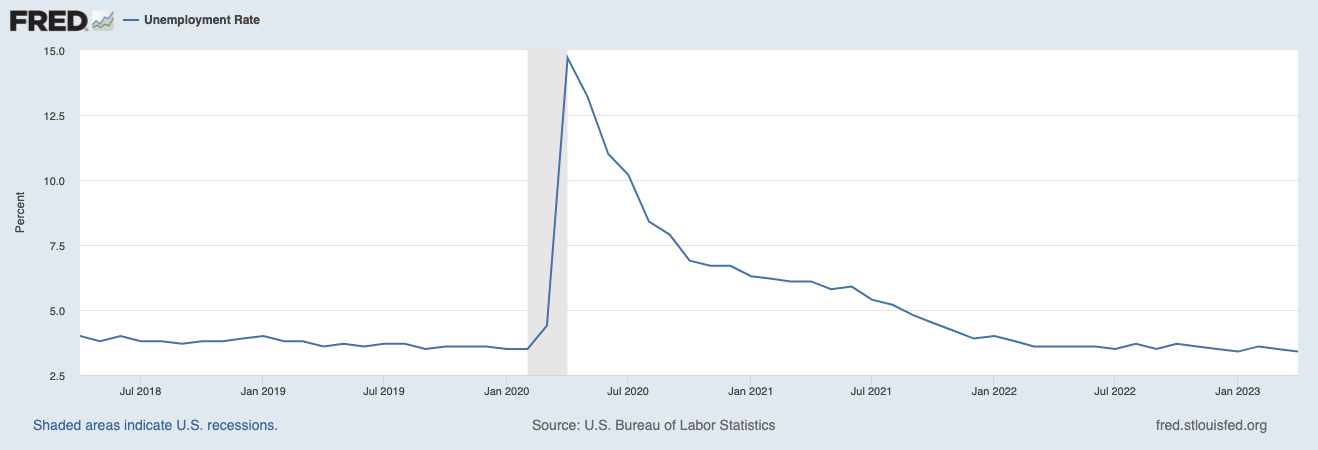

Unemployment is at 3.4% through April.

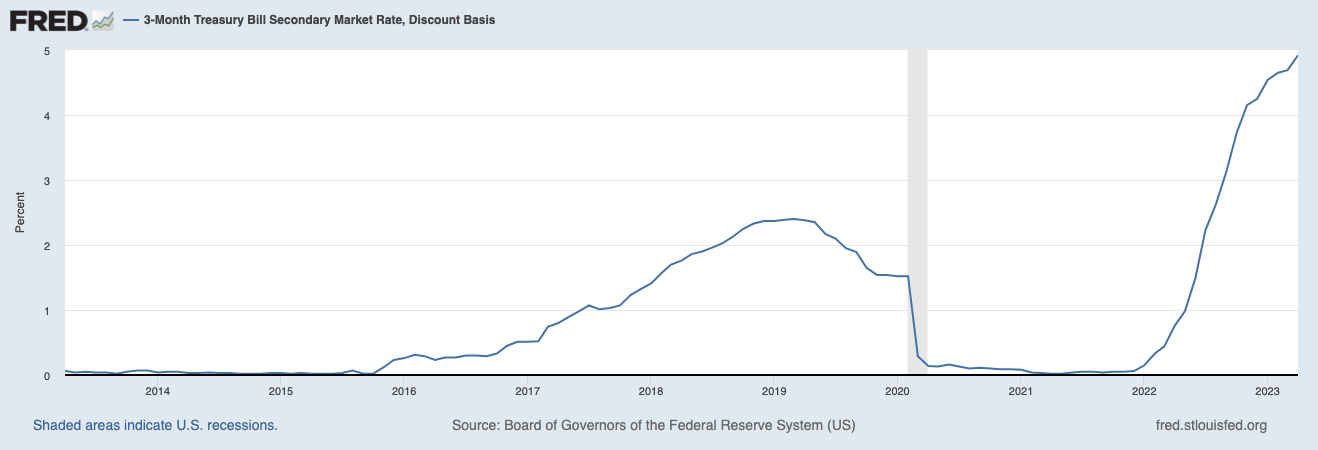

3-month US Treasury rates continue to rise. They are now paying 4.92% in April.

U.S. home prices have fallen in this first quarter and were flat in April.