Market Review

1st quarter in the books. Let’s check out what transpired.

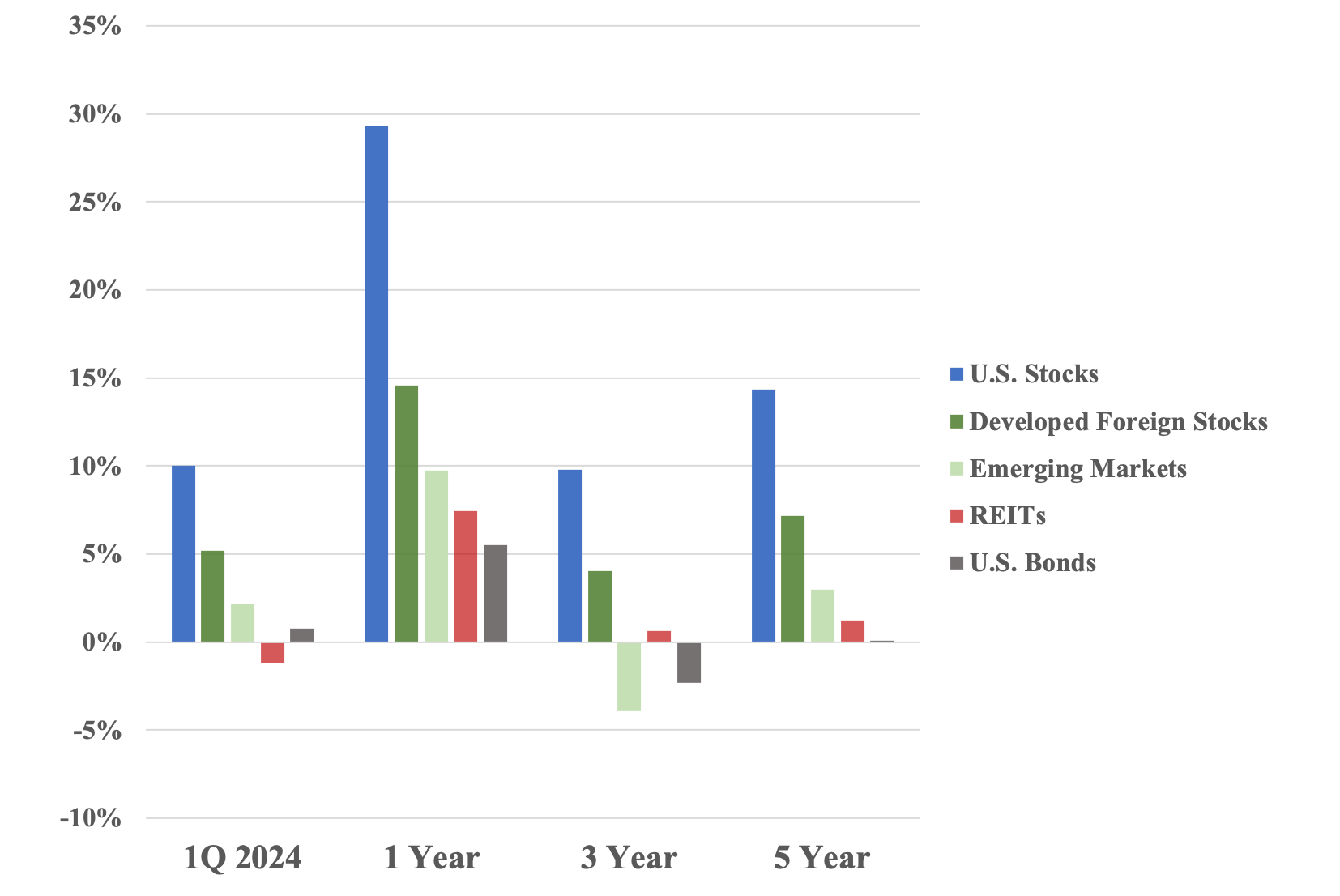

U.S. stocks returned 10% and developed international stocks earned over 5%. U.S. bonds were up a hair at 0.8% and REITs were down -1.2%.

While we all know this, it’s worth repeating: stocks are volatile and for the last 3 months they were volatile in the direction all of us like (read: UP!). This would be a totally different story if stocks were down 10% in 3 months. It would well be within the range of possibilities but the headlines would be much different than they are now. As it stands, positive quarterly returns of this size barely register in our psyche. Isn’t that weird?!

Let’s all agree to keep this up and react the same way when the markets are down 10%.

The usual visuals are below:

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI EM Index, S&P Global REIT Index, US Aggregate Bond Index. Returns as of 3/31/2024.

Economic Review

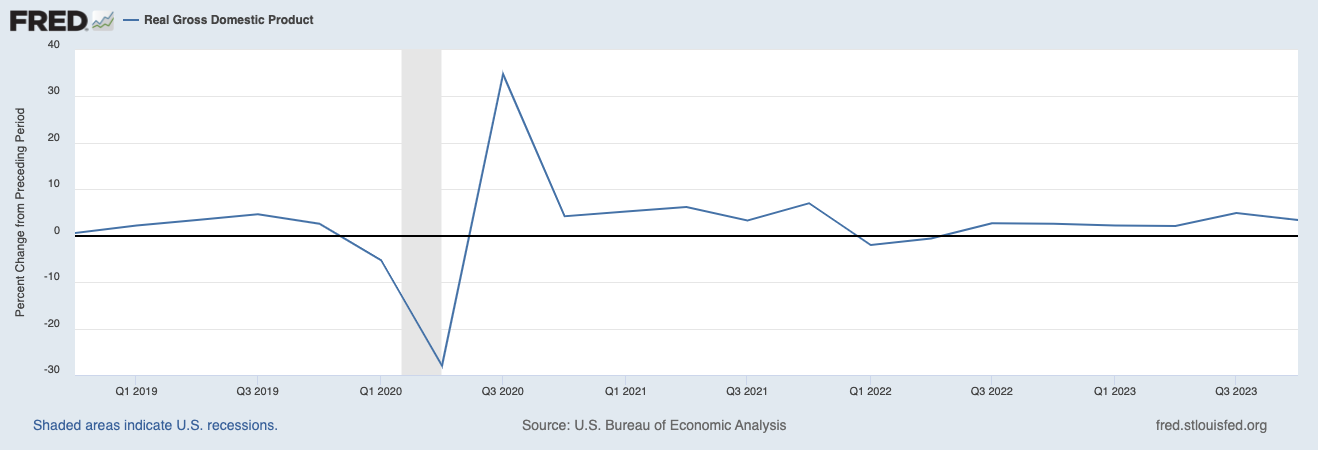

At the end of last year, Real (inflation adjusted) GDP grew at 3.4%. This has recently been revised upwards. The U.S. economy still continues to be robust and unemployment remains low.

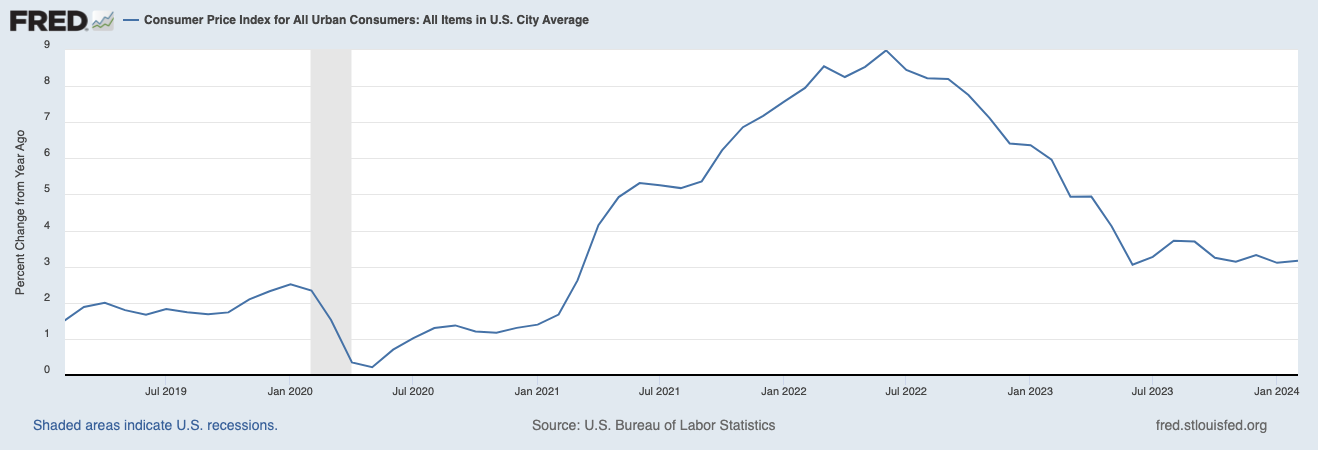

Inflation has come down over the last 2 years (thankfully!) It appears to have leveled out around 3%.

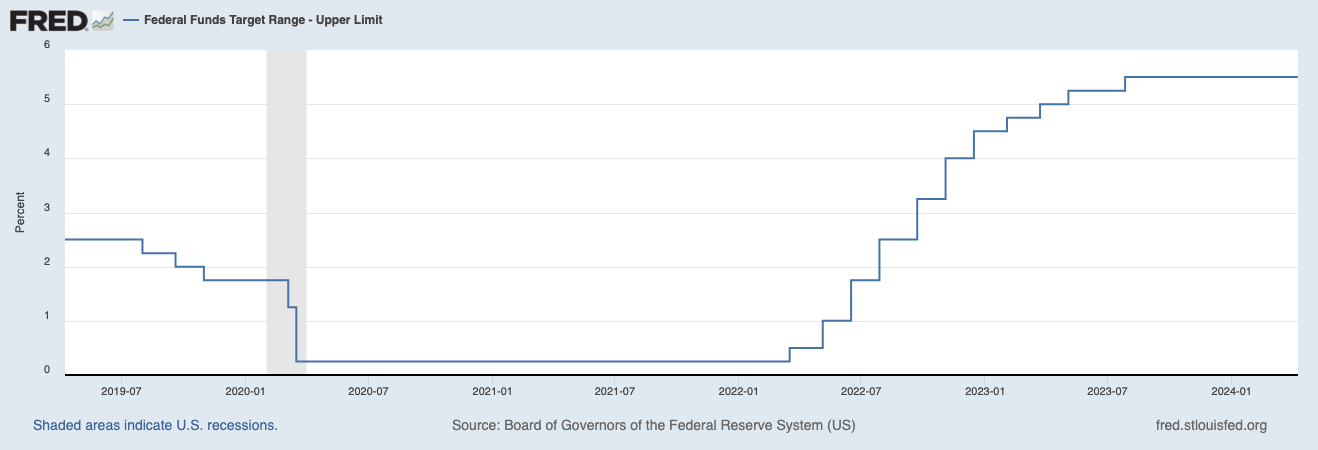

Federal funds rates are being held steady at a target range of 5.25-5.5%. The current status of any rate cut is now in question (it seemed like such a sure thing!).

The Fed seems to be taking a strategy out of Charlie Munger’s joke book:

“I sometimes tell my friends, ‘I’m doing the best I can. But I’ve never grown old before. I’m doing it for the first time. And I’m not sure that I’ll do it right.’”

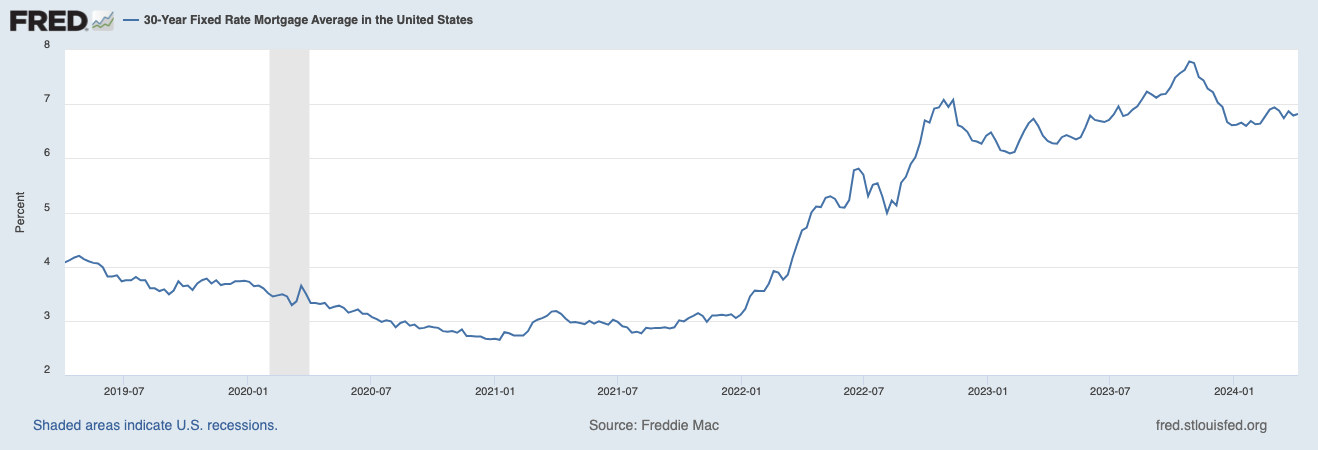

30-year mortgages have cooled and now stand at 6.8%, down a tad from the peak of 7.8% in October.

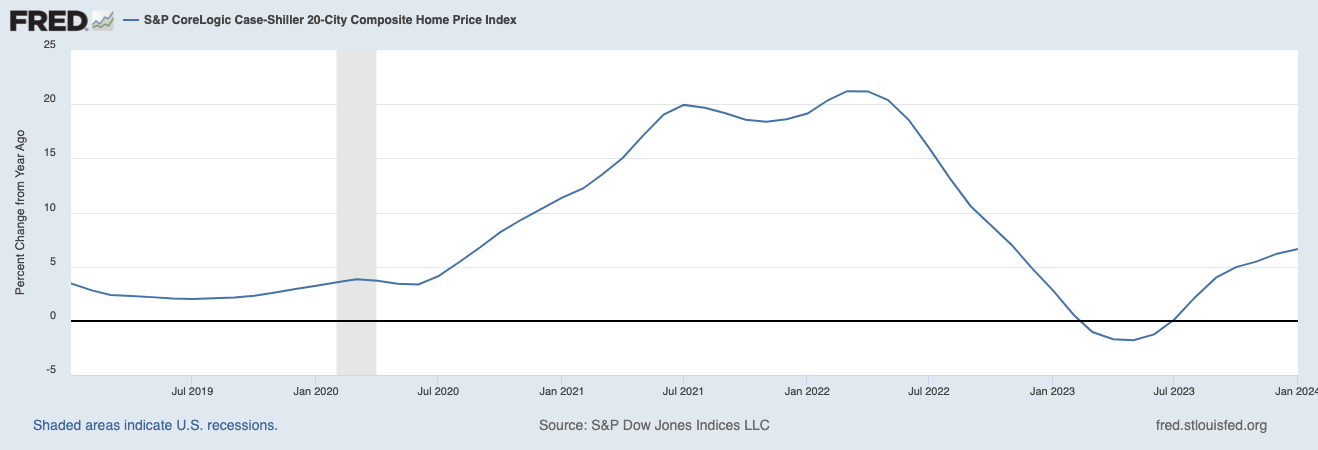

This reduction in mortgage rates has driven home prices up. In January housing prices were up 6.6% over a year ago. Prices actually fell for a brief period last spring.

Tax, Legal, & Legislative Updates

- Nothing to add for this quarter