Market Update

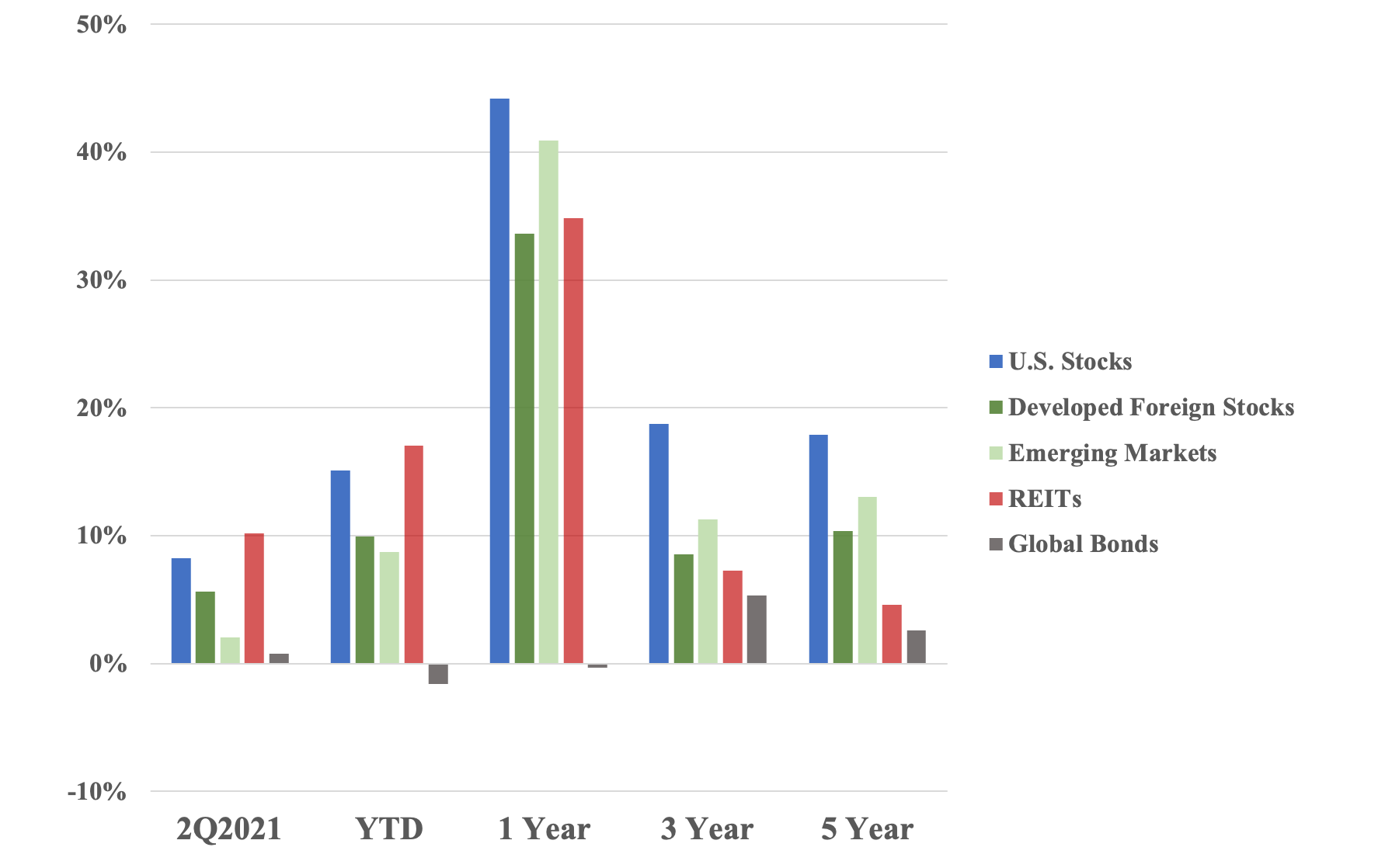

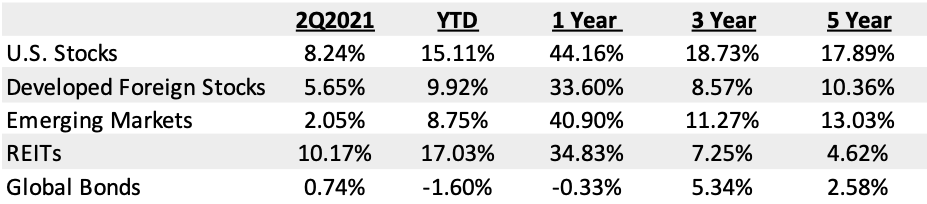

Markets continued to showcase strong performance through the second quarter of this year. The U.S. market was up 8.2%, foreign markets up 5.7%, and emerging markets up 2%.

Small caps lagged behind large stocks by -4.2%. And we saw a reversal back to growth outperforming for the quarter (6.22% over value). Real estate continues to lead the way in terms of performance across the globe and has been the top performing asset class through the first half of the year. Bond yields dropped slightly bringing the returns of bond prices up for the quarter (0.74%), but are still down this year (-1.6%).

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI EM Index, S&P Global REIT Index, BBgBarc Global Agg Bond Index. Returns as of 6/30/2021.

Whenever the markets do well for a period of time, questions start peppering in on whether we’ll get a drop. “What do you think is going to happen next?” I hope I can say that I’ve been consistent with this answer: I don’t know. Does the market get expensive over its historical average sometimes? Yes, absolutely. There’s also periods where it gets relatively cheap. But trying to make investment decisions on valuation markers or any other measurement you can dig up doesn’t mean things in the future will work out as they did in the past. It’s been tried by pretty much everyone and pretty much everyone hasn’t gotten it right.

This is what we signed up for: a heck of a lot of uncertainty, fear, greed, questions, and answers that don’t resolve. I welcome you to being an investor. As much as we want our portfolios to spit out consistent 5% returns so we can count on it, that doesn’t happen. It would be very unkind of me to say anything different.

Good news is that while markets change, a well-structured and thought-out plan rarely has to. Our financial plans know that downturns are coming and have incorporated them already. While we must stay vigilant on changes and new information (my job), we don’t have to devote our whole time to understanding every minutia. We can get back to living the rest of our lives, which is vastly more interesting and exciting.

Economic Update

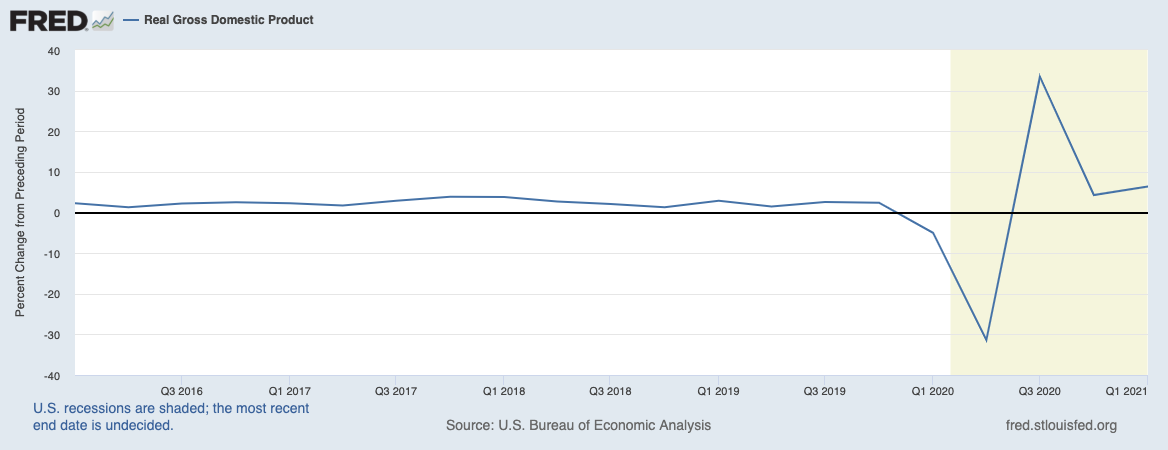

Our economy continues its recovery and posted another strong showing through the end of April ‘21 (which is the most recent data). Real GDP was up 6.4% over the preceding quarter.

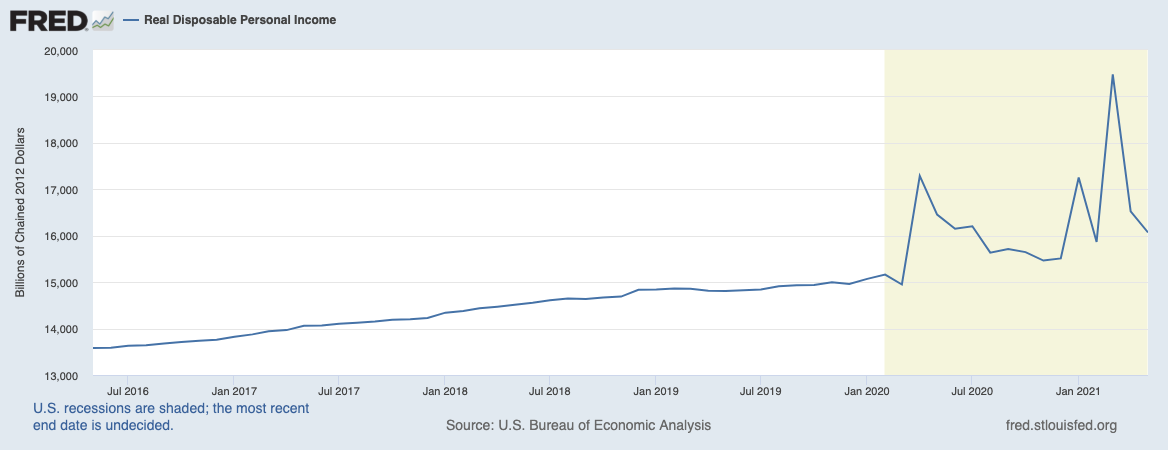

Real Disposable Personal Income continues its high, positive trend. The reason for the three spikes are due to the stimulus checks sent to Americans.

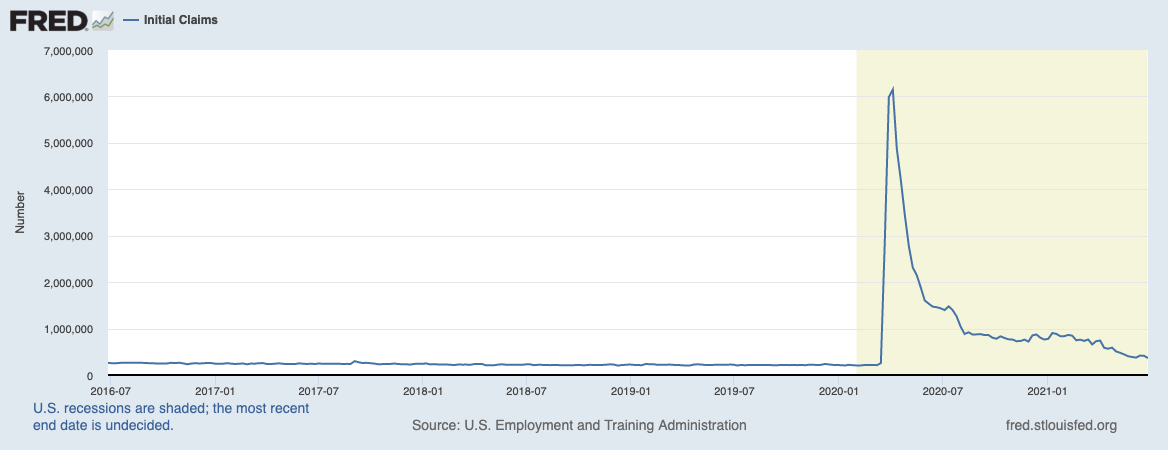

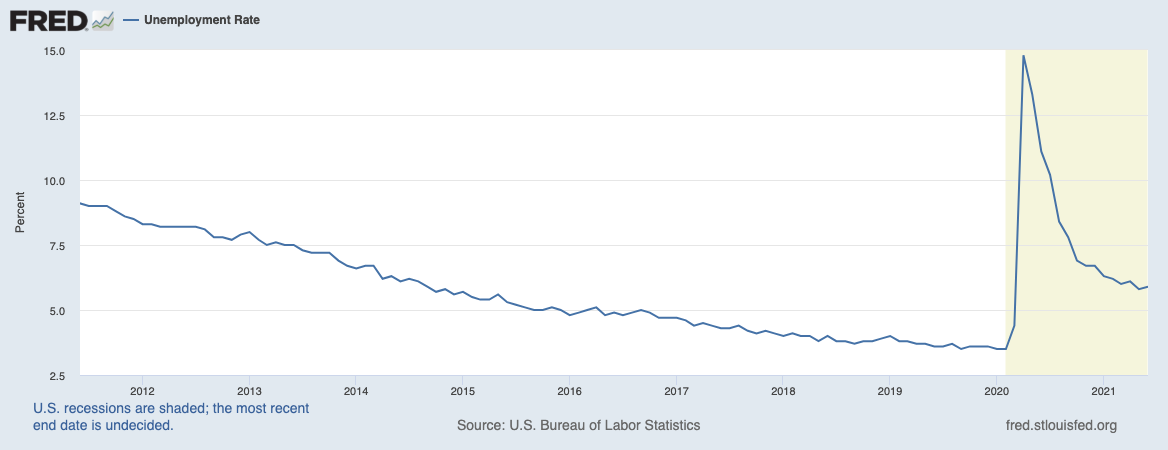

The Unemployment Rate has fallen to 5.9%. Considering what we just went through, it’s crazy to think that unemployment was worse at this time of year back in 2014. The last weekly initial claims number came in at 364,000 – about half of where it was when I wrote my last Market Review.

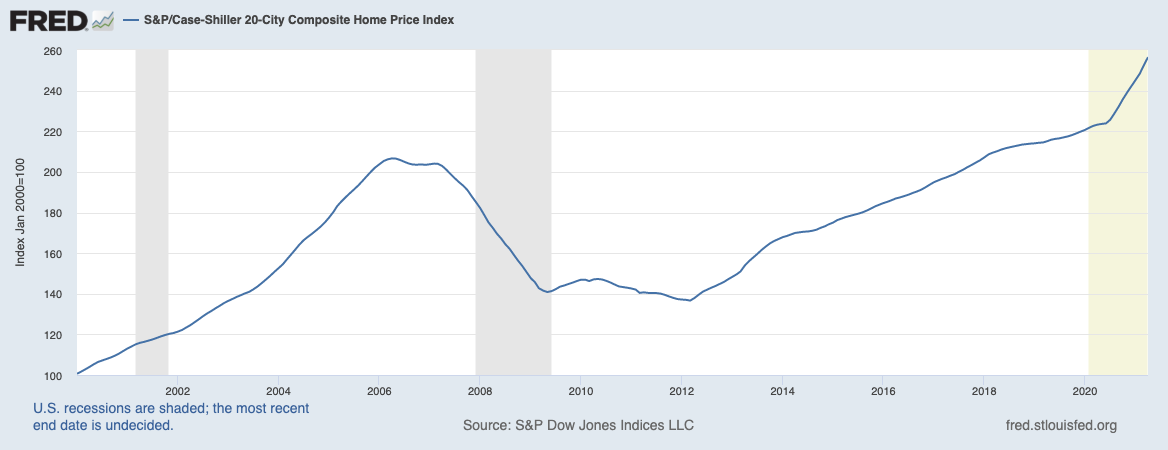

Housing Prices continue to shoot up as active listings remain near historic lows. They are up almost 15% in April from a year ago.

Tax, Legal and Legislative Updates

This spring President Biden proposed a new tax policy. It is important to be reminded that nothing has been signed or put in place yet. Very rarely does the initial proposal make it through in the end. The tax proposal would increase the top brackets back to 39.6%, double capital gains taxes for taxpayers making more than $1,000,000, tax capital gains at death (eliminate ‘step-up basis’) for gains over $2,000,000 for married couples, and extend tax cuts for families with children. As of today, nothing is set in stone.

For you and I, the best course of action is to not panic over these proposals and make quick changes to well-laid plans. Wherever you fall on the political spectrum, both parties haven’t put forth a proposal that involves decreasing government spending. They both spend but have different ways of going about paying for it. We have a good chance that taxes in general will increase over the decades to come. That’s why no matter who is in office, we evaluate clients’ tax situations each fall – proactively harvesting gains and performing Roth conversions. We won’t wait for Washington to figure things out before we take small, prudent actions and we’ll adjust if big changes do come down the pike.