Market Review

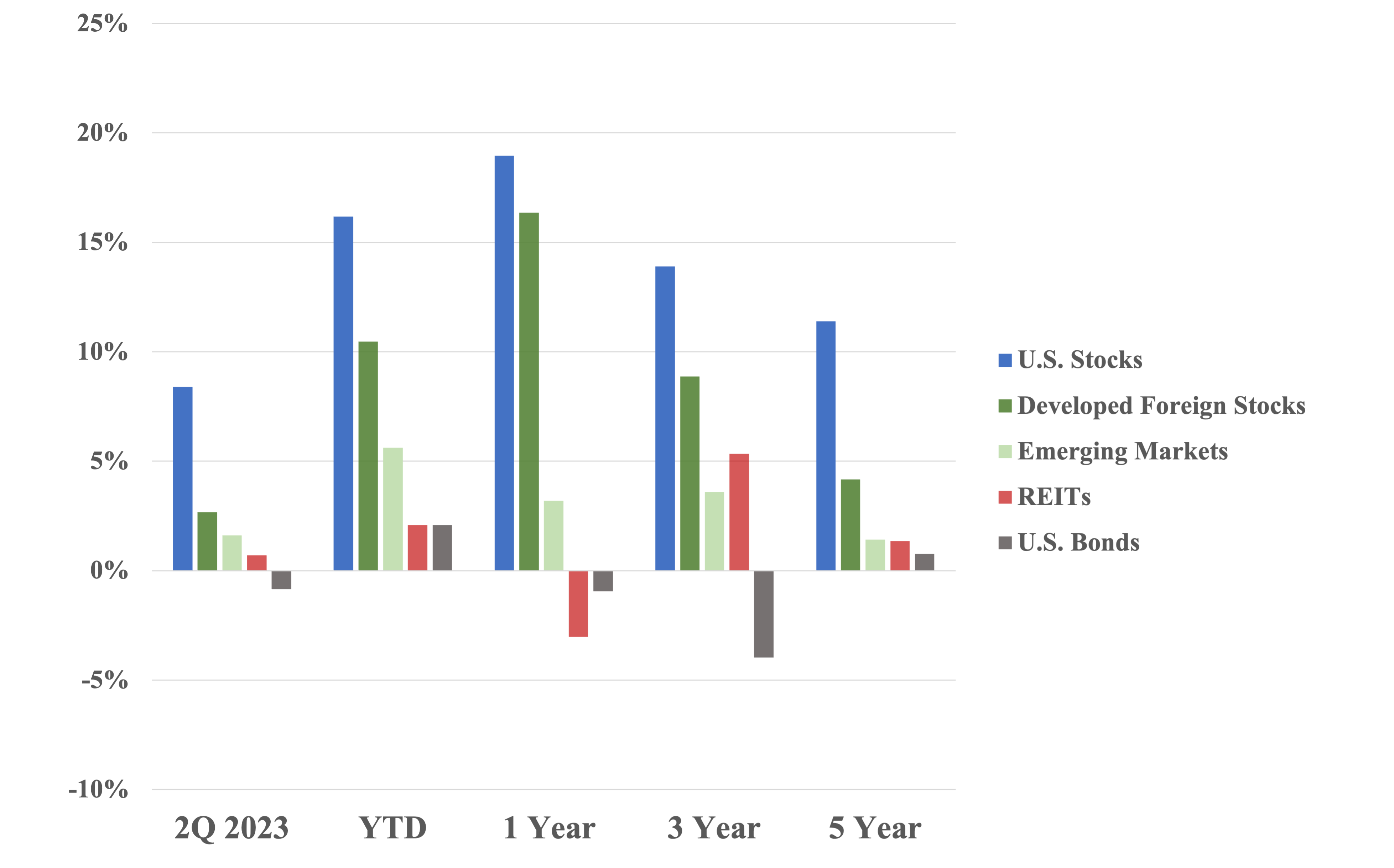

Very quietly markets have punched another robust quarter. U.S. stocks lead the charge (up 8.4%) resulting in year-to-date returns over 16%. Developed foreign and emerging markets were 2.7% and 1.6%, respectively for the quarter. Bonds were slightly negative. Market volatility went down and hit the lowest level in June.

Remember the regional banking crisis that occurred earlier this year? We’ve already moved on. This, of course, is how markets work. Moments of terror followed by solid returns which no one notices because they’re too busy trying to get back to normalcy.

Per usual, you can see how the asset classes have played out over the last quarter to prior 5 years in chart and graph form.

Economic Review

The largest worries have been two-fold: high, persistent inflation which would lead us into a recession. Recently, those risks have tempered a bit. Headline inflation has slid from 9.1% in June last year to 4% in May and 3% in June of this year. This is encouraging news.

The odds of a ‘soft-landing’ – the Fed being able to return inflation levels to 2% without incurring a recession – are going up.

The Feds target rate currently sits at 5-5.25%. The magnitude and frequency of rate hikes has slowed down. This rate is the Fed’s primary lever for influencing the economy. Lower rates = more business investment/higher activity. Higher rates = slowing business activity. These recent rate increases has been the Fed’s attempt to wrestle inflation back down. It appears to be working as inflation has fallen since 2022.

Above we see inflation’s downward trend. It ended June up 3.1% over this time last year.

Real GDP continues to grow steadily. The most recent revision has 1Q Real GDP at 2%. This is a slight decrease from the 4th Quarter of 2022, which was at 2.6%.

The unemployment rate remains low at 3.6% through June.

U.S. home prices have fallen from where they were a year ago last April. Rising mortgage rates have softened the market, but we’re still dealing with a limited supply of homes for sale. It’s tough for current homeowners to part with an all-time low mortgage rate and buy something else at a much higher rate.

Tax, Legal, & Legislative Updates

The Supreme Court ruled against President’s Biden’s student loan cancellation plan. Loan payments will resume and we’ll get back to paying those off.