Market Review

It seems hard to believe now that we’re sitting at or near all-time highs again for U.S. equities. As recently as April 8th, this year had gotten off to the fourth-worst start (down 15%) of any year since 1928. The past few months have been another great reminder of how quickly things can change when investing in public markets.

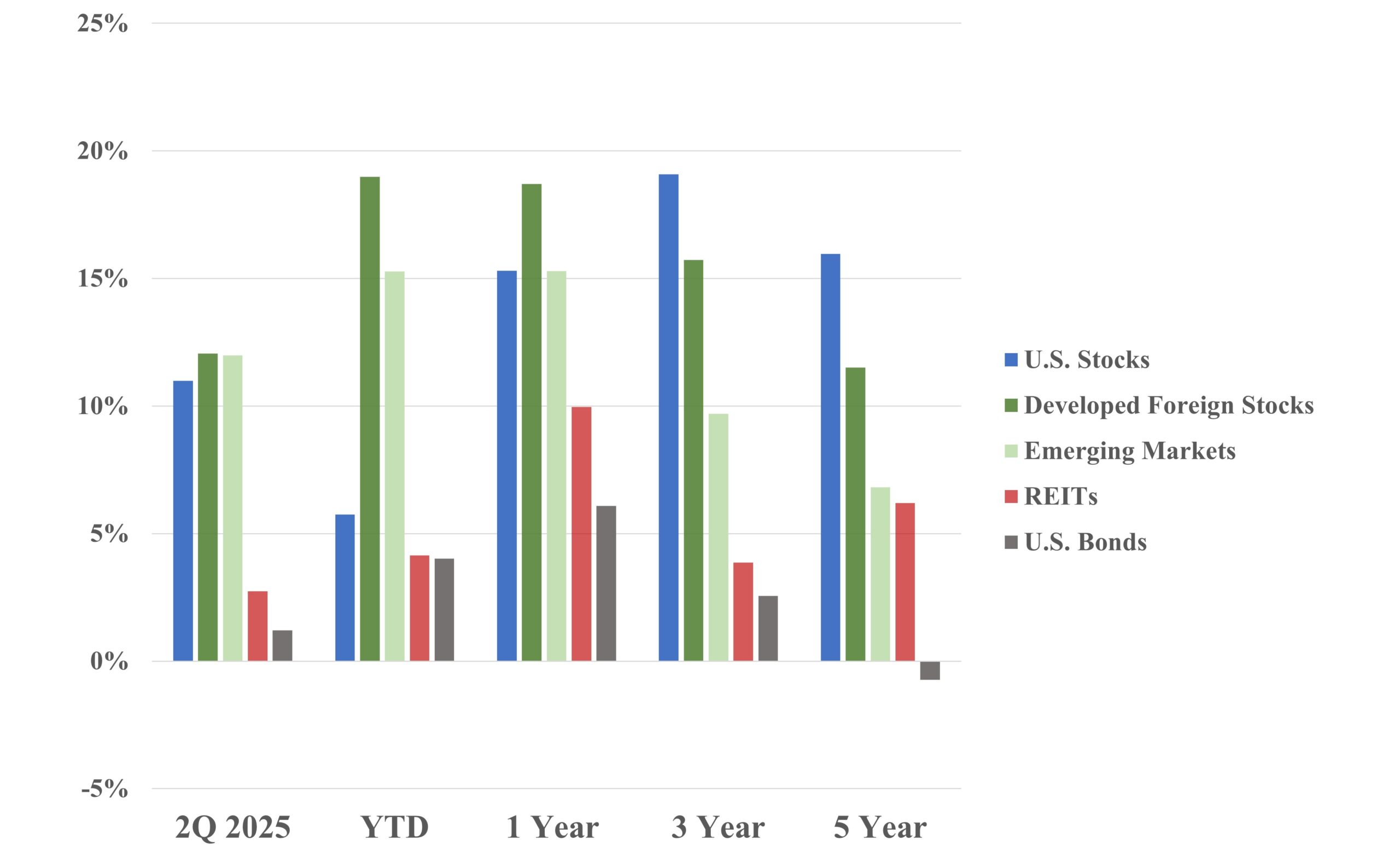

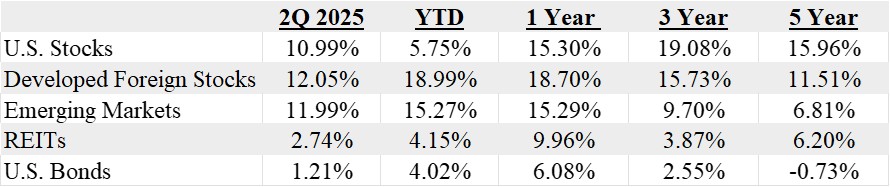

The second quarter saw U.S. stocks rebound after a tough Q1 while international stocks continued to benefit from a combination of ongoing rotation out of U.S. stocks (at least partly due to cheaper valuations overseas) as well as fiscal stimulus in some parts of the world (notably in European defense spending). Bonds and REITs continued to chug along (+1% and +3% respectively) and showed their desired stability during a volatile period for equities.

Bonds remain in their longest drawdown on record (dating back to 2022) but have continued to claw back from the depths as rates have stabilized and look set to potentially decrease from here with the Fed likely to start cutting rates again (possibly as soon as July).

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI EM Index, S&P Global REIT Index, US Aggregate Bond Index. Returns as of 6/30/2025.

Economic Review

[Keep in mind: the economic data usually lags a bit]

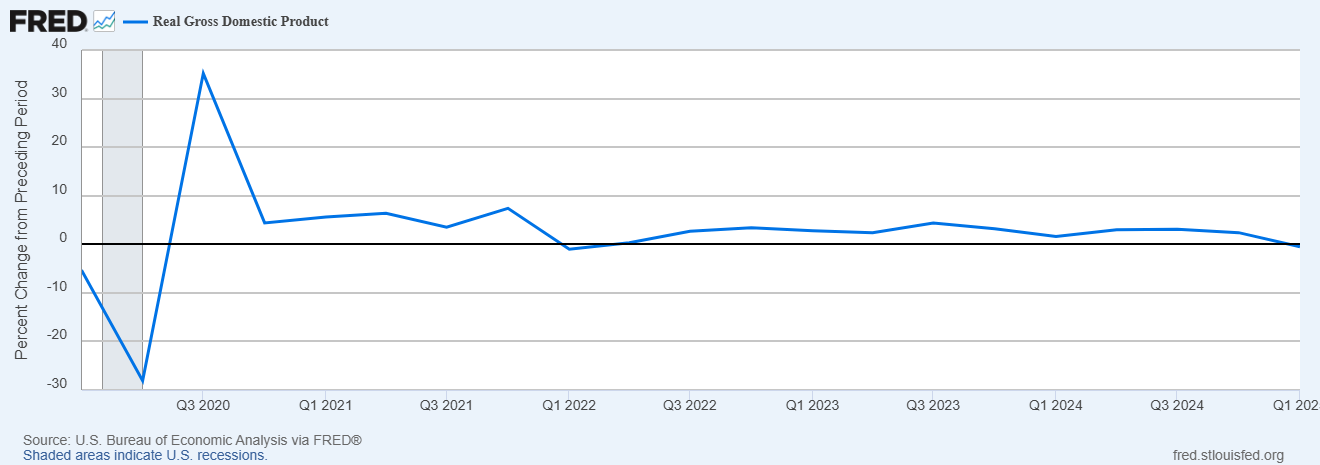

Real (inflation adjusted) GDP growth went negative in Q1 (down 0.5%) as tariff-driven inventory builds had a negative impact.

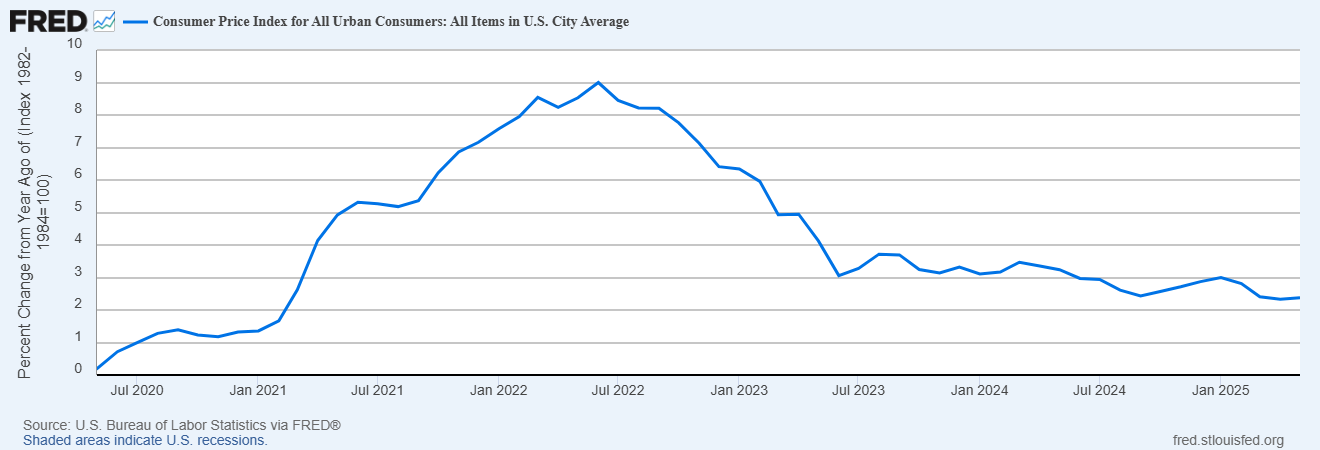

Inflation continued the downward trend since 2022 with March, April & May coming in at 2.3-2.4%.

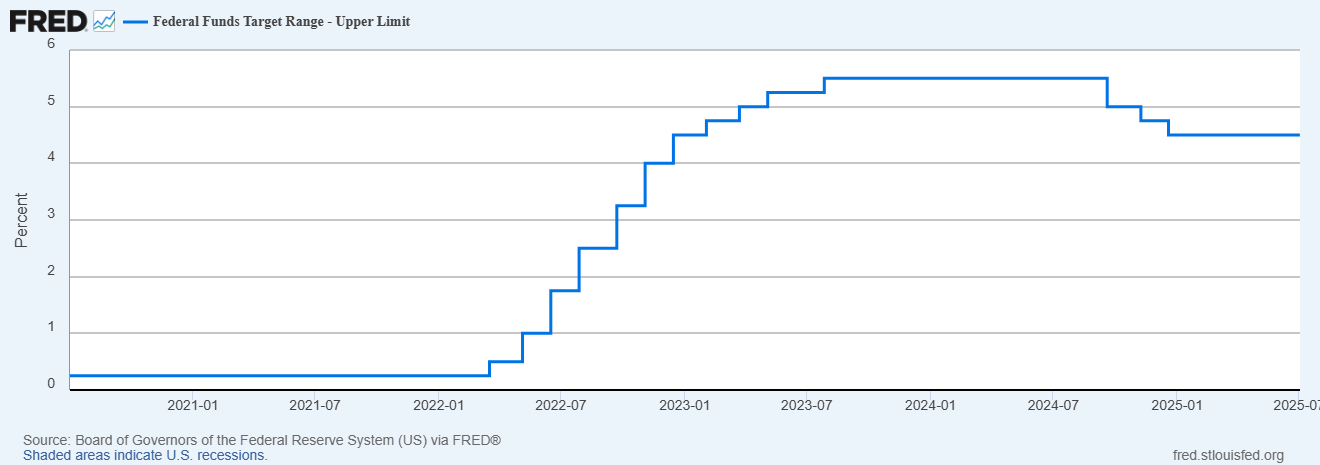

The Fed has held the Federal Funds rate steady since December, when they lowered their target to the current 4.25-4.50% range. At the June meeting, Fed officials reiterated their expectation of two more 25bp rate cuts in 2025, implying a range of 3.75-4.00% at year-end based on their economic projections.

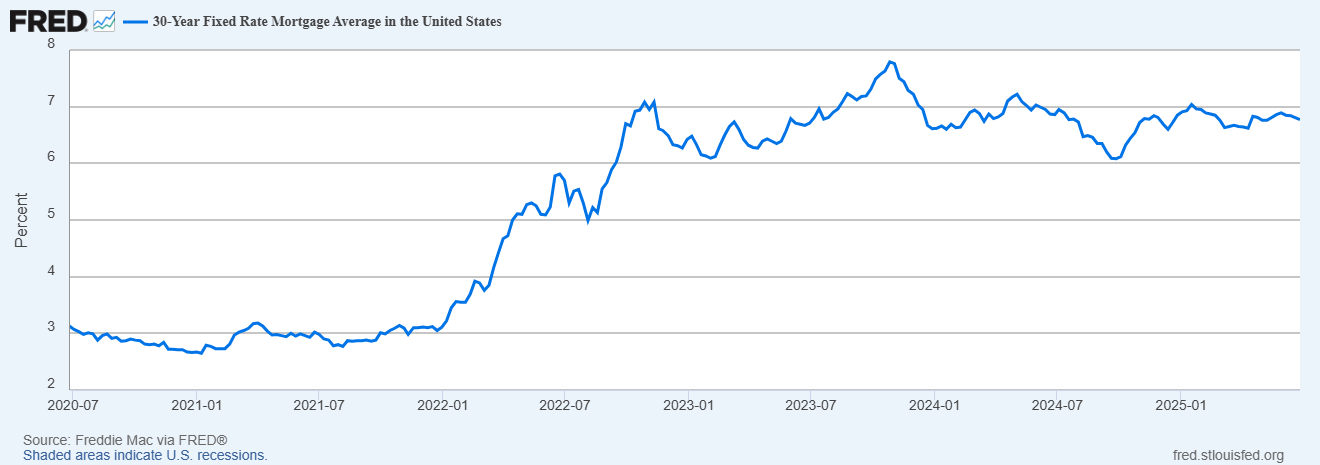

30-year mortgage rates continued to bounce around the around the 7% level during the second quarter.

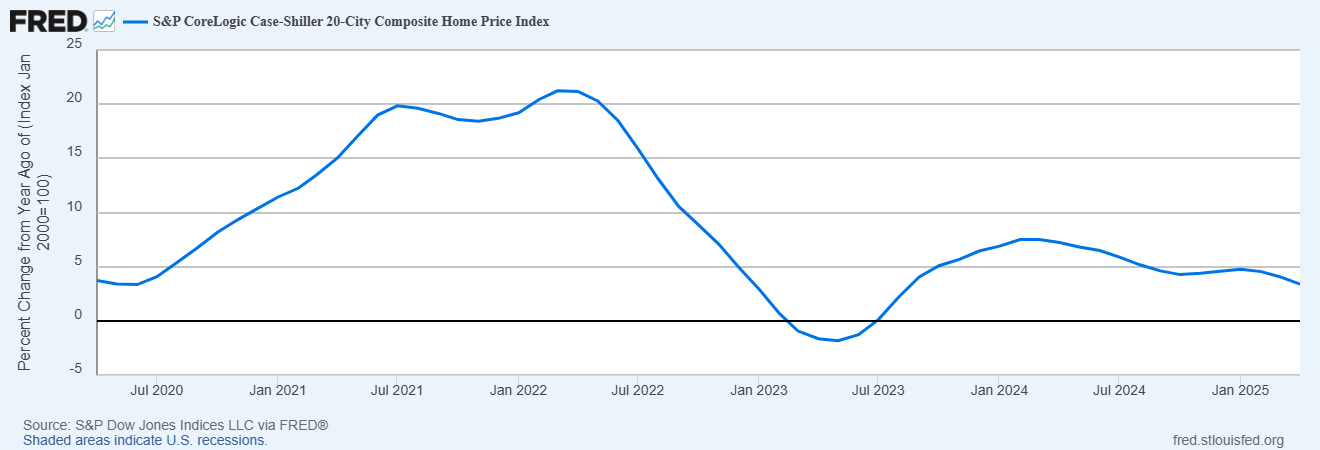

Home values have softened a bit recently (due to affordability constraints driven by stubbornly high mortgage rates) with April prices coming in just +3% higher than last year.

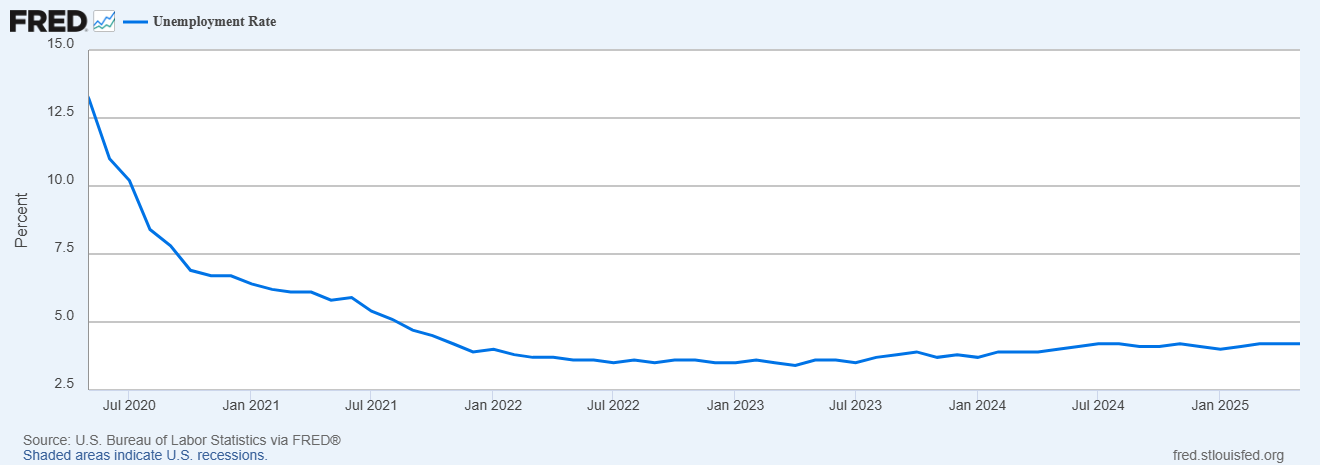

The unemployment rate remained at 4.2% through the second quarter as the labor market remains solid.

Tax, Legal, & Legislative Updates

The “Big Beautiful Bill” has been signed into law as of July 4th. In summary, this new bill makes permanent a lot of provisions that were in the 2018 Tax Cuts and Jobs Act and set to expire by the end of this year. They also threw in a few tweaks. Here are some of the most notable tax law changes:

- Social Security is NOT exempt from taxes. This has been spun around the news, but it’s not true. There ARE some new tasty deductions for those over 65, but nothing is changed from a tax perspective on Social Security.

- Individual tax brackets. They will remain at current levels (10%/12%/22%/24%/32%/35%/37%).

- The doubling of the standard deduction is solidified. The standard deduction amount in 2025 will be $15,750 for Single filers and $31,500 for married Joint filers (and will rise with inflation beyond 2025).

- For each spouse that is older than 65, you’ll receive an additional deduction of $1,600 ($3,200 for couple over 65, or $2,000 if filing Single).

- The gift and estate tax exemption has been solidified at $15 million per person starting in 2026 increasing with inflation ($30 million per couple).

- The bill makes permanent the $750,000 mortgage size limit to receive a deduction.

- The bill makes permanent the elimination of miscellaneous itemized deductions (these had been deductions for things such as tax return preparation costs, investment management fees, unreimbursed employee expenses, etc.) Sorry, you can’t write off your advisory fees!

Some new things:

- Effective 2025-2028: New $6,000 personal exemption for those over 65. This is an additional deduction to all the deductions listed above. This exception is subject to income limits and will get phased out: Single filers $75K-175K | Joint filers $150K-250K.

- Effective 2025-2029: The maximum potential deduction for state and local taxes (aka the “SALT” deduction) has been increased from $10,000 to $40,000 starting in 2025 for taxpayers with incomes up to $500,000.

- Effective 2026: Single tax filers can claim the deduction for up to $1,000 of charitable donations. Married Filing Joint filers can claim the deduction for up to $2,000 of charitable donations – even if you don’t itemize!

- Effective 2026: Permanent AGI-based minimum level of charitable donations required in order to be deductible. You’ll only be able to itemize donations to the extent the total of all of your qualified donations exceed 0.5% of your Adjusted Gross Income, or AGI. I guess this is supposed to make up for the charitable donation deduction for those who don’t itemize, but it’s a weird one. All in all, it still allows for most of your donation to be deducted (if you itemize).

- Effective 2025-2028: Up to $25,000, per person, of income from tips would be excluded from federal income tax. This tip income would still be subject to Social Security and Medicare taxes, but it won’t be subject to income tax

- Effective 2025-2028: Up to $12,500 of overtime pay for Single filers, or up to $25,000 for Married Filing Jointly filers, can be excluded from federal income tax.

- Effective September 30th, 2025: Terminates tax credits for purchases of electric vehicles. Specifically, any electric vehicle acquired after September 30, 2025 will not be eligible for any credits.

- Effective January 1, 2025: Terminates tax credits for the cost of certain energy efficiency home improvements. The credit applies to the cost of purchase and installation of certain exterior doors, exterior windows or skylights, certain insulation and air sealing materials, etc. And terminates tax credits for the cost of purchasing and installing certain residential renewable energy systems such as solar, wind, geothermal, batteries, etc.

- Effective 2026: Creation of new “Trump” savings accounts. This is a wild one and we will need some more clarification.Essentially, what I can gather is that an IRA-type of account can be established for children under 18.

- Maximum contribution is $5,000/year.

- There will not be any tax deferral or deductions on contributions.

- The government will be making $1,000 contributions per year to every child born from 2025 through 2028.