Market Update

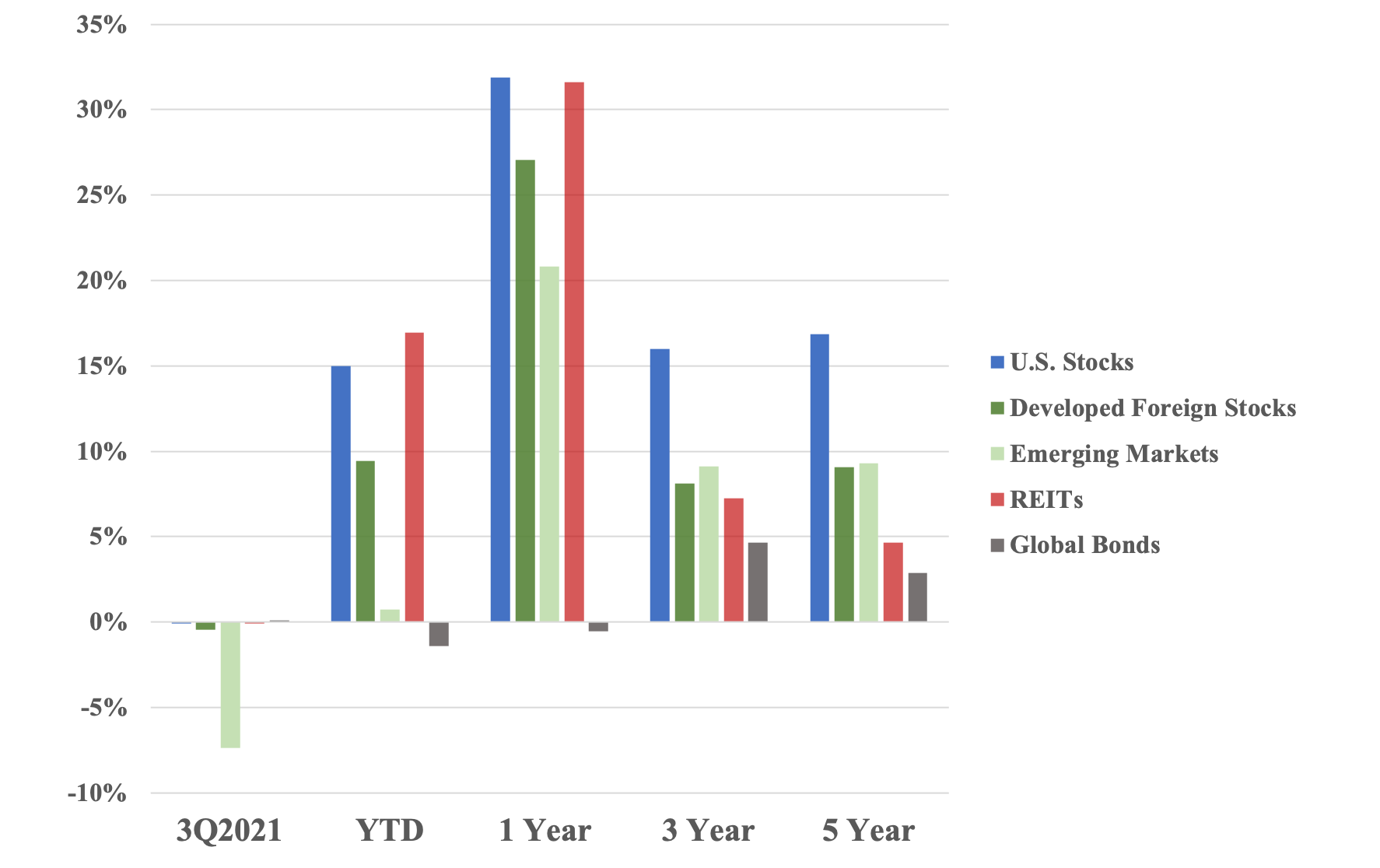

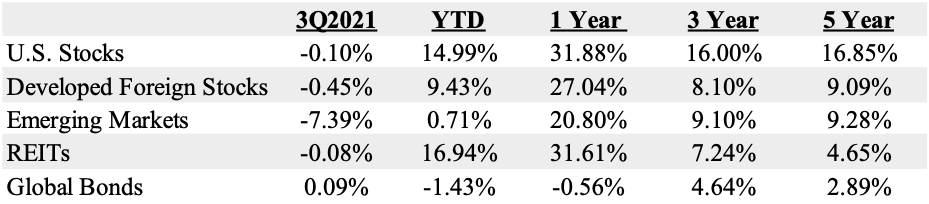

Markets were basically flat in the 3rd quarter. After basically 18 months of great market returns, this past quarter reminded us that excellent returns are not the normal market experience. I definitely wouldn’t get worked up about these numbers, but it did feel a bit uncomfortable to experience some losses when the recent past year amazingly exceeded anyone’s expectations.

In behavioral finance, there’s a mental heuristic called the Gambler’s Fallacy. It’s when you believe a certain random event is less likely or more likely to happen based on the outcome of a previous event. Or when performance has been so good for a period of time, we expect it to continue that way in the future (ie. forever). Unfortunately, past events do not change the probability that certain events will occur in the future (ie. markets not performing well). It’s worth being reminded of this when markets were basically flat versus when they take a big dive (which they will again!).

This was the first quarter for quite some time that major stock indices across the globe were in negative territory (albeit – barely in developed markets). U.S. stocks were down -0.10% with foreign developed markets down -0.45%. Emerging markets took the largest jump backward at -7.39%.

Large caps beat small caps by 4.6%. And growth outperformed value by 1.6%, relatively. Real estate barely dipped negative this quarter (-0.08%), but still are the best asset class performer year-to-date (+16.9%) Bond yields dropped again bringing the returns of bond prices up for the quarter (0.09%), but are still down this year (-1.4%).

As a reminder, we’re invested in the best companies in the world; we have adequate cash and bonds set aside for market downturns; we will rebalance as appropriate; we will keep our focus on playing the long game. That’s the plan and we’re sticking with it.

[Caption] Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI EM Index, S&P Global REIT Index, BBgBarc Global Agg Bond Index. Returns as of 9/30/2021

Economic Update

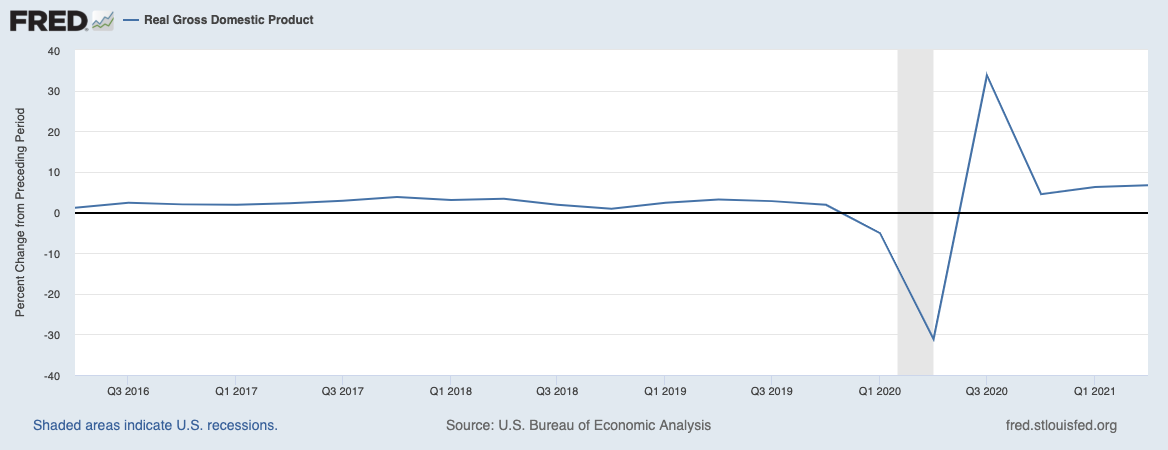

The economy continues its solid performance as officially the news is we are no longer “recovering” from the Coronavirus recession (which, upon hindsight, only lasted a few months in 2020). Real GDP was up 6.7% over the preceding quarter.

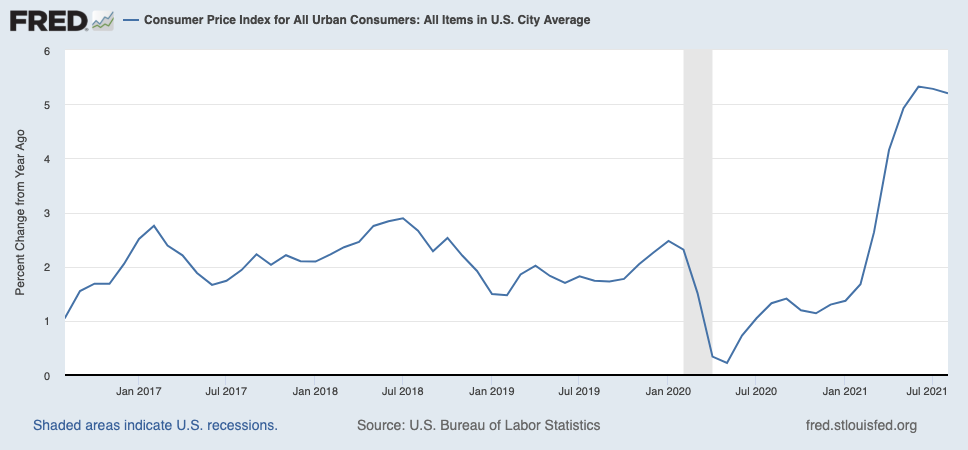

Inflation has been all over the news. It did rise materially over the summer after what has been decades of low inflation. Annual change in CPI was 5.2% through August 2021.

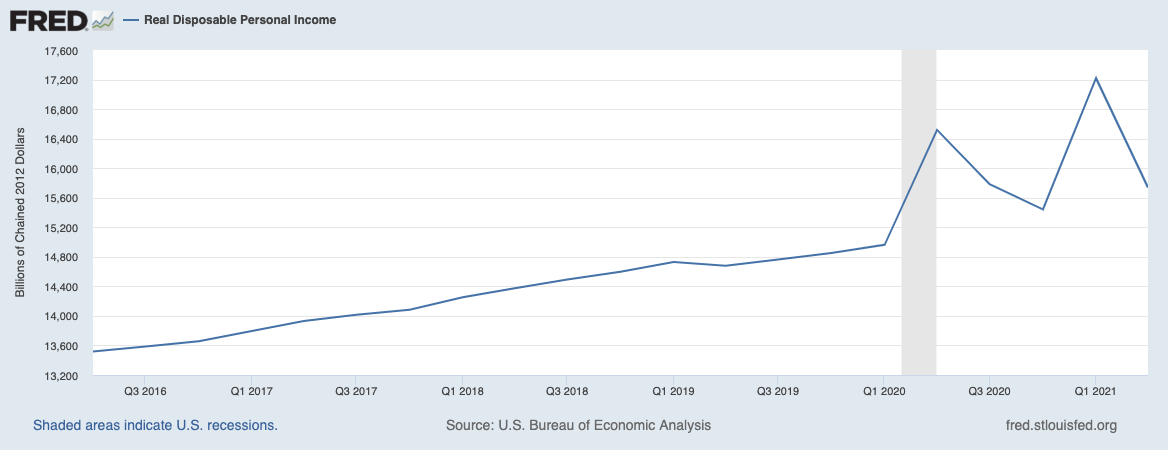

Real Disposable Personal Income continues its up and to the right, positive trend (The spikes are due to the stimulus checks sent to Americans.

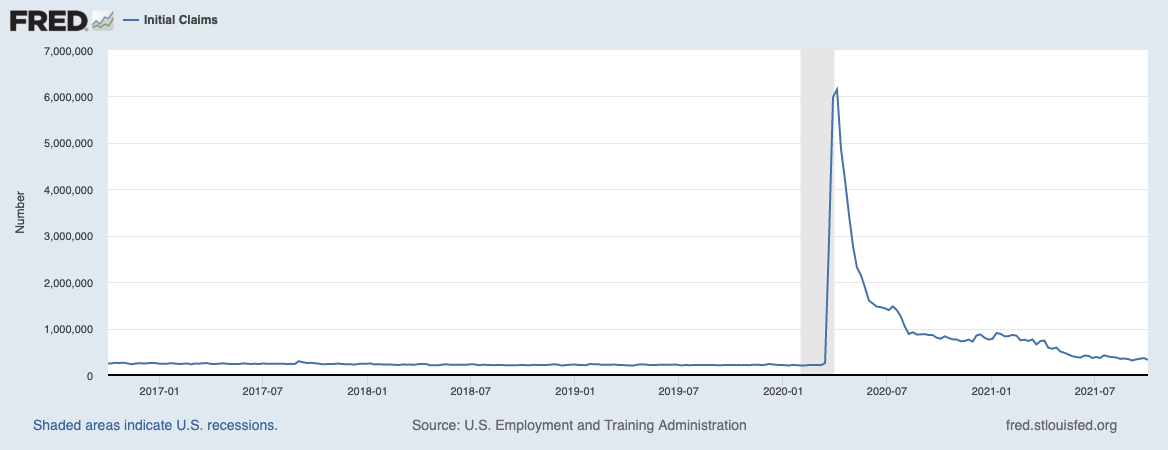

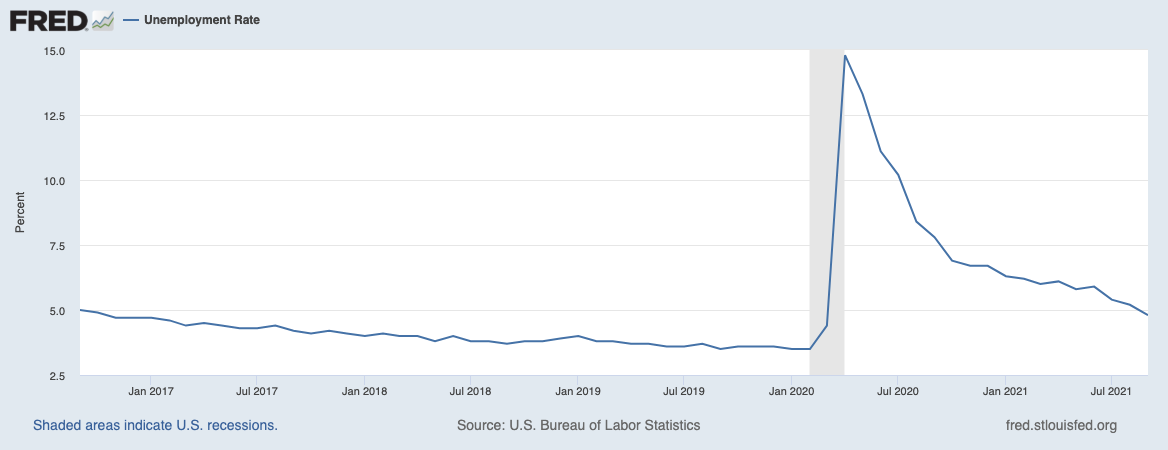

The Unemployment Rate has fallen another percent to 4.8% (We’re at the same unemployment rate as we were in Sept. 2016) The last weekly initial claims number came in at 364,000 – about 38,000 less of where it was when I wrote my last Market Review.

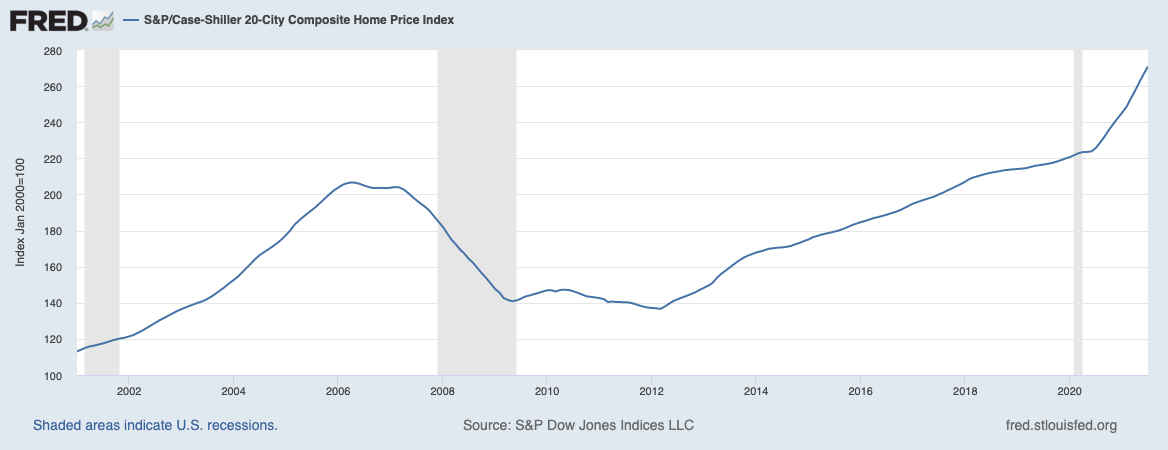

Housing Prices continue to climb. They are up 20% from a year ago. The good news is that housing inventory has finally rebounded. Looks like sellers are motivated by these high prices.

Tax, Legal and Legislative Updates

This spring, the Biden administration has proposed several changes to the current tax code (See 2Q Market Overview). In mid-September, we gained further clarification of how things probably will shake out

Here are the highlights from the newest proposal:

- New top income tax rate (increasing income tax rate for incomes above $450K (joint filers) from 37% to 39.6%)

- New top capital gains rate (Increasing long-term capital gains and qualified dividends to 25% from 20% for incomes above $450K (joint filers)) [**Effective as of 9/14]

- New 3% tax on MAGI over $5 million.

- The personal exemption for estate and gift taxes could fall to about $6 million per individual (from $11.7), accelerating this change from 2026 to 2022.

- Closing the ability for backdoor Roth conversions and Mega-Backdoor Roth IRAs in 2022.

- It seems unlikely that the step-up in cost basis granted at the date of death will be changed at this time

These changes do present a lot of planning opportunities before the year-end. 2021 could prove to be a very valuable year to make lifetime gifts to reduce one’s estate, especially for those over the $6 million estate mark. Depending on income tax status, it could also be an opportunity to sell appreciated assets or accelerate income if faced with higher rates in 2022.

If not this proposal, we have a good chance that taxes in general will increase over the decades to come. That’s why no matter who is in office, we evaluate clients’ tax situations each fall – proactively harvesting gains and performing Roth conversions. We are planning for and trying to reduce lifetime taxes rather than just a single year.