Market Review

I was re-reading a book on my Kindle this week titled “Why Business People Speak Like Idiots.”

The authors highlight the inability of most businesses to speak clearly and frankly especially around situations that aren’t positive. They want to sound smart so they say long sentences with jargon filled verbiage, which are really just empty calories of business communication. It sounds important but doesn’t tell you anything meaningful.

With a year like we’ve had so far, it would be easy to write a quarterly review without really saying anything. So instead, I’ll just say it like it is.

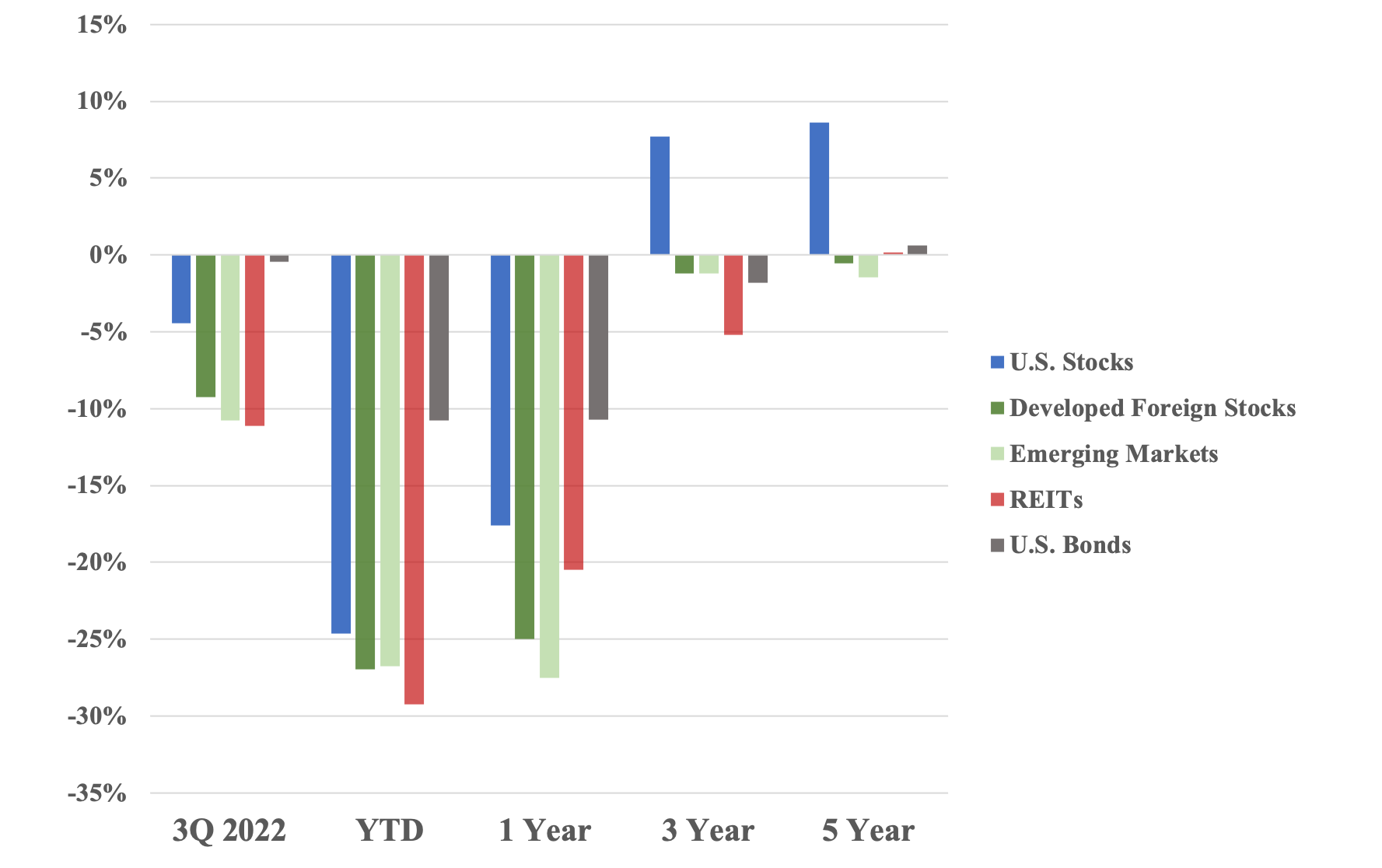

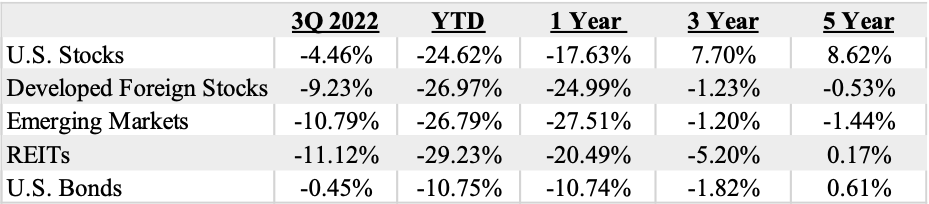

This year has been rough everywhere and last quarter was more of it. No matter what type of investor you are, you’re feeling pain. Typically, bonds perform better when everyone is running from equities. Not this year. The US Aggregate Bond Index is off double digits (-10.75%).

This means that even a diversified portfolio of 60% stocks and 40% bonds is boxing with its arms at its side. The Vanguard Balanced Index is down -20.78% through the end of September.That’s the reality.

I’ll say it as loud as I can again: losses like this are completely normal. I don’t like it any more than the next person, but they happen. In the midst of years like this it’s easy to be upset and forget that the markets were up 28% in 2021, 18% in 2020 and 31% in 2019.

Thankfully, it’s temporary. This means that the markets will be up +33% cumulatively sometime in the future and we’ll be back to whole.

Those returns would put a smile back on anyone’s face.

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI EM Index, S&P Global REIT Index, US Aggregate Bond Index. Returns as of 9/30/2022

Economic Review

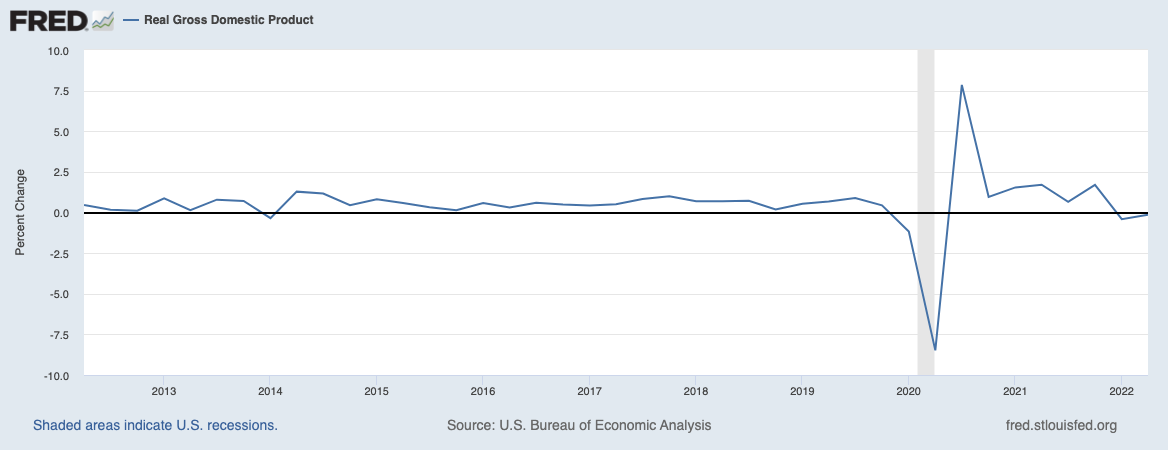

Real GDP has fallen (-0.1%) over the 2nd Quarter in 2022.

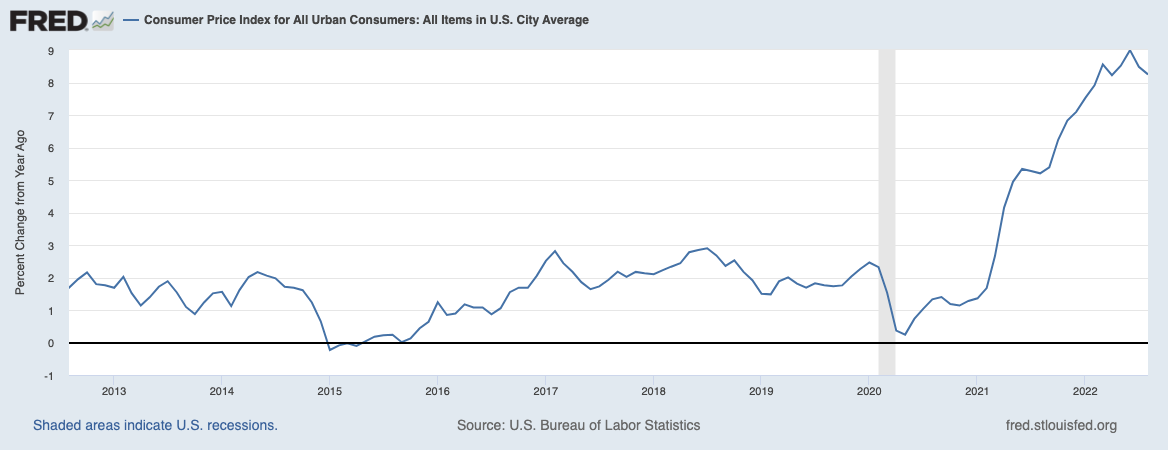

Inflation is still raging. Inflation is up 8.2% in August over the past 12 months.

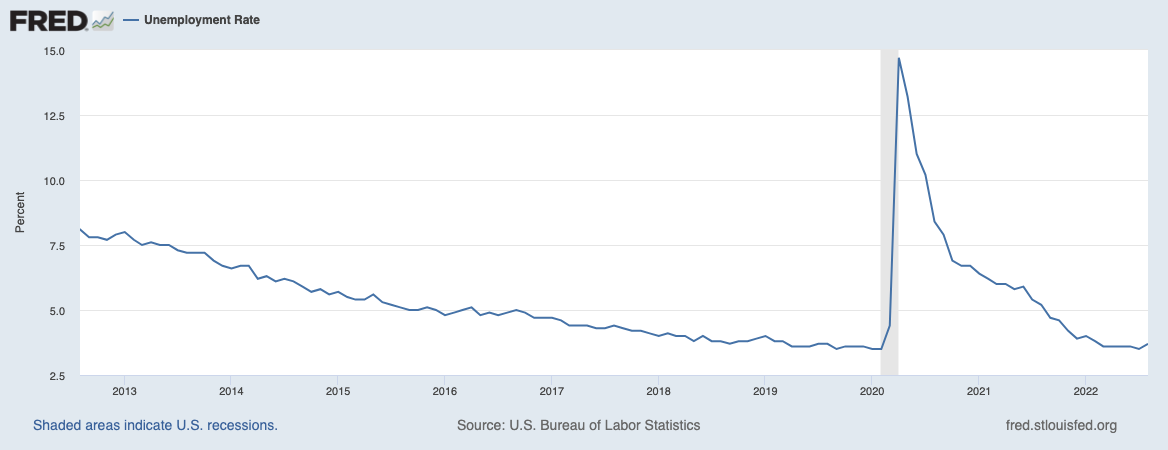

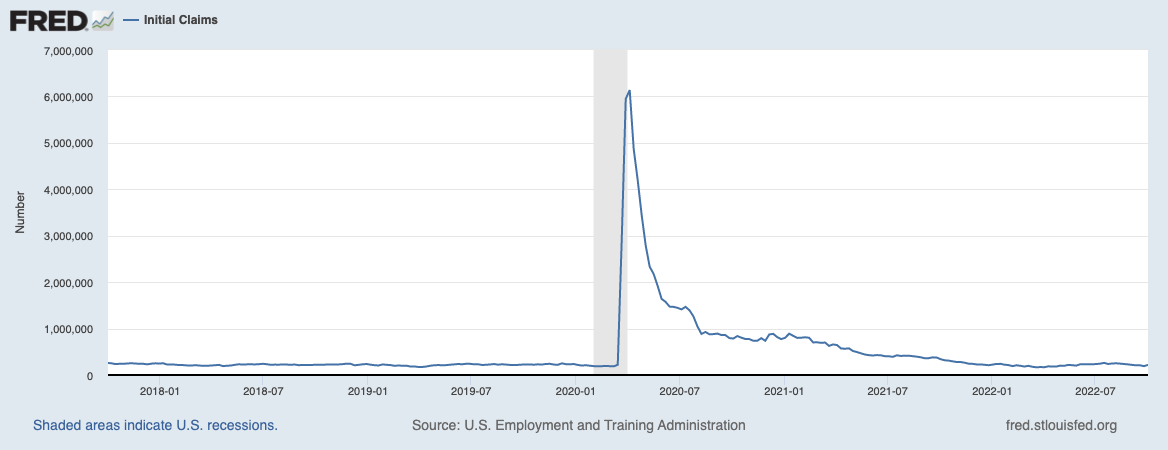

Amongst all the talk about a recession (see negative GDP above), the unemployment sits at 3.7% through August.

Initial unemployment claims have fallen slightly from over the summer.

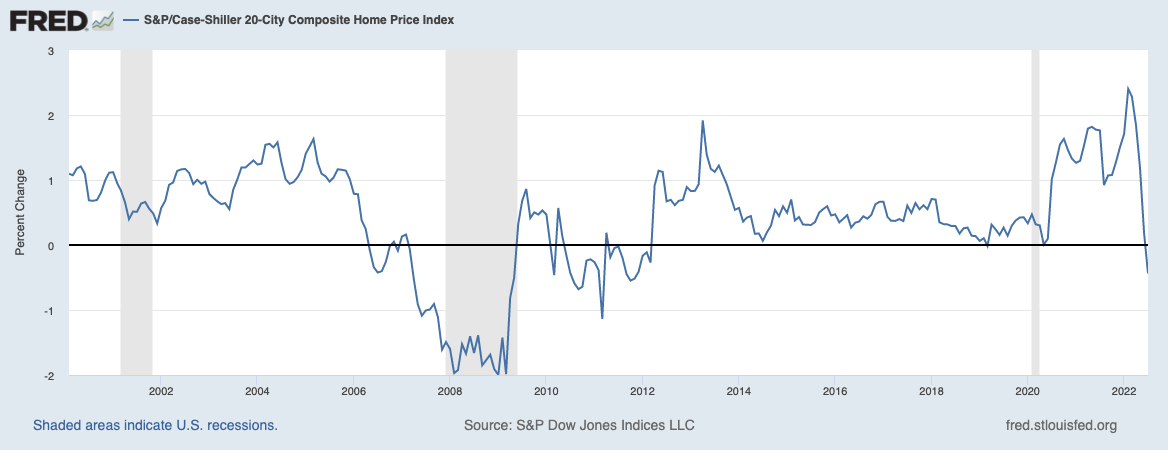

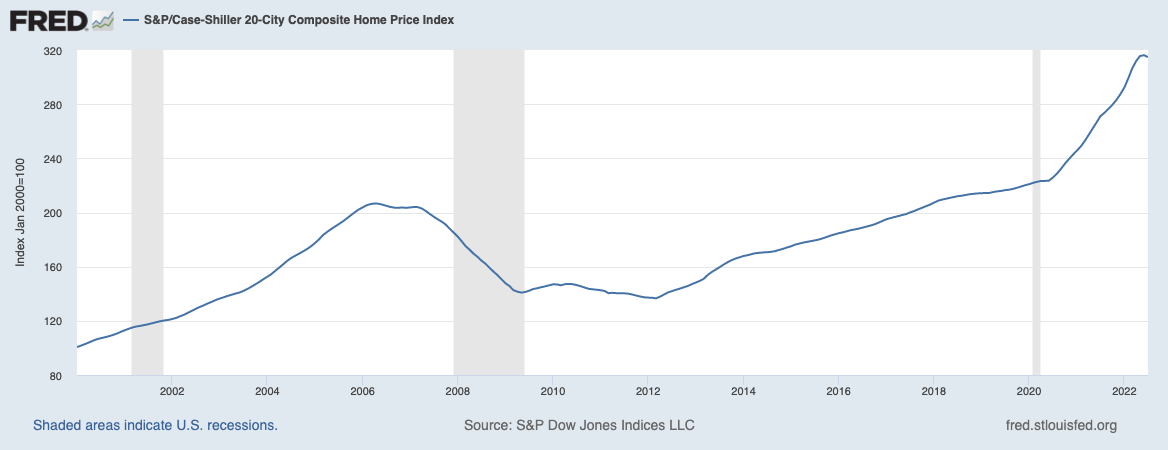

With 30-year mortgages above 7%, we saw our first drop in housing prices in July for the past 10 years.

All in all, housing prices continue to be much higher. I’ll be curious to see how this plays out in the quarters to come.

Tax, Legal & Legislative Review

Back in August, Congress passed the Inflation Reduction Act. While the climate change piece of the bill snatched the headlines, there were some important financial planning provisions in regards to Medicare prescription drugs, continuation of healthcare premium subsidies, and tax credits for energy upgrades to homes.

- Medicare will now be able to negotiate prescription drug costs beginning in 2025. This should provide relief on prescription drug prices

- There’s now a cap on out-of-pocket prescription drugs at $2,000 in 2025

- For individuals enrolled in Affordable Care Act exchange plans, the bill extends the healthcare subsidies to 2025

- Homeowners who spend to improve home energy could receive a 30% tax credit (capped at $1,200). If you do solar, the 30% credit is not subject to the cap.