Where do I begin other than saying welcome to 2021!

For all the craziness that was 2020, the markets as a whole posted some incredible numbers considering the circumstances.

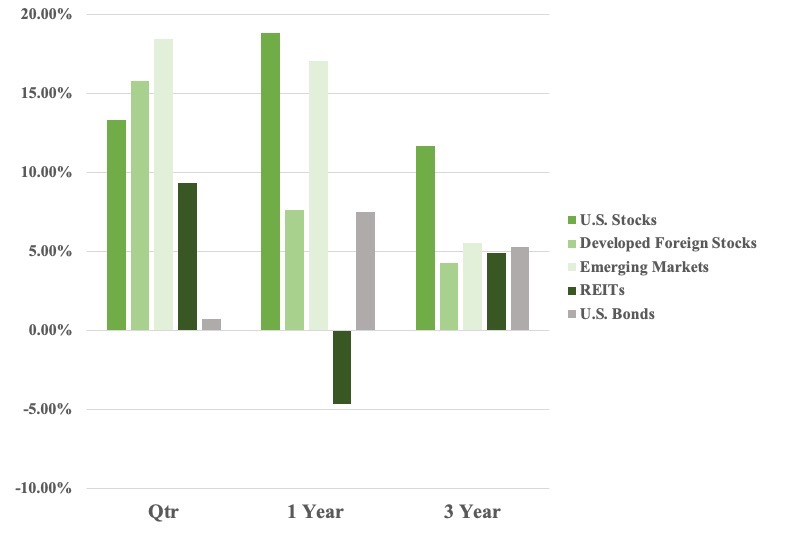

U.S. stocks had a solid last quarter pushing the annual return over double digits for the year. At year end, the annual return for the S&P 500 was 16.26%.(Remember stocks had a big hole to dig out of from last March). This last quarter surge was boosted mainly by the performance in the small cap stocks (20.03%). Bonds were flat with a return of 0.73% for the Barclays Aggregate index, but had an impressive year of 7.48% due to the lowering of interest rates from the Fed earlier this spring.

Leading up to last quarter’s Presidential election, the media touted the market uncertainty (side note: there’s always uncertainty). The U.S. market was up 11.52% this last quarter. I don’t think this could be a better example of how even in times of unease, markets do not care.

We had uncertainty in March, then what looked like a short time being stuck at home has turned into a 9-month+ slog of wondering. Now where do we stand? The point isn’t to debate the merits of ‘the topic of the day,’ as those will unceasingly be thrown at us. It’s key to remember that the world strives on. People keep going to work, looking for work, taking steps to improve their lives and their children’s lives. Yes, pandemics and recessions come. Unpleasant events happen. But they also end. Being able to accept the permanently cyclical nature of economies, markets, and events is a must for any long-term investor.

With that being said, it’s important to remember reflect on what we just went through. This year was scary. Period. Grocery store shelves were empty, the market dropped 30%. It’s easy to stand from the viewpoint now with U.S. stocks up over 18% on the year and to say that it wasn’t so bad in March. It was so bad.

I kept a brief daily diary about the markets and world from February through most of April. It’s good to see that what we know now wasn’t what we knew then. This is how it always is, but we tend to forget that after the fact. I hope the following serves as a good reminder of just how scary things are in the moment.

Daily Coronavirus Diary

| Date | SPX | Price Change | Commentary |

| Wed, 2/19 | 3,386.15 | 0.47% | Market high! |

| Thu, 2/20 | 3,373.23 | -0.38% | |

| Fri, 2/21 | 3,337.75 | -1.05% | |

| Wkend | |||

| Mon, 2/24 | 3,225.89 | -3.35% | |

| Tue, 2/25 | 3,128.21 | -3.03% | Whoa! This is something. |

| Wed, 2/26 | 3,116.39 | -0.38% | |

| Thu, 2/27 | 2,978.76 | -4.42% | This is serious. |

| Fri, 2/28 | 2,954.22 | -0.82% | Called first round of clients. Markets down -13.48% from high. |

| Wkend | |||

| Mon, 3/2 | 3,090.23 | 4.60% | Volatility going bonkers! |

| Tue, 3/3 | 3,003.37 | -2.81% | Fed cuts rates by 0.50% |

| Wed, 3/4 | 3,130.12 | 4.22% | |

| Thu, 3/5 | 3,023.94 | -3.39% | |

| Fri, 3/6 | 2,972.37 | -1.71% | Needed a breather and took some extra time with family today (good use of time). |

| Wkend | |||

| Mon, 3/9 | 2,746.56 | -7.60% | Start of the craziest week ever! Holy smokes. |

| Tue, 3/10 | 2,882.23 | 4.94% | People buying toilet paper, paper towels from Costco. All sold out. |

| Wed, 3/11 | 2,741.38 | -4.89% | President Trump called this an epidemic. |

| Thu, 3/12 | 2,480.64 | -9.51% | Officially entered bear market. “People” started freaking out now. Market down 30%. |

| Fri, 3/13 | 2,710.95 | 9.28% | Largest 1 day return in 12 years. Finished calling every single one of my clients. Probably my hardest day at work. |

| Wkend | Entire grocery stores cleaned out. Fed slashed rates by 1.0%. Current target of 0.00 – 0.25 – wow! | ||

| Mon, 3/16 | 2,386.13 | -11.98% | One of the largest 1 day drops on record. Ever! |

| Tue, 3/17 | 2,529.19 | 6.00% | People over 65 highly encouraged to not go outside, and all restaurants closed except for take-out. Look at the markets being up so much! Crazy! |

| Wed, 3/18 | 2,398.10 | -5.18% | I’m working from home in our bedroom, not too bad |

| Thu, 3/19 | 2,409.39 | 0.47% | Dow Jones went below 20,000 today (where it was in 2017). We had handyman come in to fix a leak in our drywall ceiling. Hope that was a good decision considering outbreak. |

| Fri, 3/20 | 2,304.92 | -4.34% | Congress trying to push through a Coronavirus rescue package of over $1 Trillion, ideas of sending checks to citizens |

| Wkend | |||

| Mon, 3/23 | 2,237.40 | -2.93% | Senate failed to advance the Rescue Package |

| Tue, 3/24 | 2,447.33 | 9.38% | Best day in the markets since 1933. Wow. Costco had plenty of food. Meg (my wife) went to re-stock, wore mask. |

| Wed, 3/25 | 2,475.56 | 1.15% | |

| Thu, 3/26 | 2,630.07 | 6.24% | Last 3 days marked the largest 3 day increase in the Dow since 1931. |

| Fri, 3/27 | 2,541.47 | -3.37% | Unemployment claims surged to a record 3.3 million, Trump signed CARE Act – rescue package worth over $2.2 Trillion!! |

| Wkend | Trump extends “social distancing” mandate through 4/30. I haven’t left home for over a week. | ||

| Mon, 3/30 | 2,626.49 | 3.35% | Tax and financial professionals scrambling to understand the new assistances available: CAREs Act, FFCRA, EDILs. |

| Tue, 3/31 | 2,584.59 | -1.60% | |

| Wed, 4/1 | 2,470.50 | -4.41% | |

| Thu, 4/2 | 2,526.90 | 2.28% | 6.6 million filed for unemployment this week |

| Fri, 4/3 | 2,488.65 | -1.51% |

So far, no client has sold out. Paycheck Protection Act (PPP) rolled out, but guidance is super confusing and small biz/banks having tough time getting funding.

|

| Wkend |

|

||

| Mon, 4/6 | 2,663.68 | 7.03% | Boris Johnson, British PM, in ICU w/ coronavirus |

| Tue, 4/7 | 2,659.41 | -0.16% | |

| Wed, 4/8 | 2,749.98 | 3.41% | |

| Thu, 4/9 | 2,789.82 | 1.45% | |

| Fri, 4/10 | Good Friday | Small cap stocks rose over 18% this week to record their best week ever | |

| Wkend | Easter weekend | ||

| Mon, 4/13 | 2,761.63 | -1.01% | |

| Tue, 4/14 | 2,846.06 | 3.06% | |

| Wed, 4/15 | 2,783.36 | -2.20% | |

| Thu, 4/16 | 2,799.55 | 0.58% | |

| Fri, 4/17 | 2,874.56 | 2.68% | I think we’ve gotten so used to these gyrations that a 3% swing isn’t a big deal when normally it feels like it is. |

| Wkend | Markets are only down a bit over 11% from their high. |

About Those Predictions

It goes to show you that like it or not markets are unpredictable. If this is the first time hearing this from me, I’m going to sound like a broken record for the rest of my career. Get ready. And like our investment philosophy states, this doesn’t mean we throw our hands up in the air. It just means we are honest about our limitations.

Others are focused on the direction of interest rates next year, which vaccine producer’s stock price will jump the most, what a Biden presidency means, geopolitical threats and hundreds of other things. While sounding impressive, it’s sophisticated nonsense. They’ve overcomplicated the task.

To further punch this home, here’s a look back on what experts predicted for 2020.

Economic prediction: no recession

- “Our new recession model suggests just a 20% probability” – Goldman Sachs

- “Don’t bet on a recession in 2020” – The Economist

- “No U.S. recession on the horizon” – BoA Merrill Lynch

S&P 500 prediction: modest gains

- 3,500 – John Stolzfus of Oppenheimer funds

- 3,300 – Maneesh Deshpande of Barclays

- 3,000 – Mike Wilson of Morgan Stanley

All of these market experts undershot the S&P as it ended the year at 3,756 (up 18+%) and we saw unemployment claims above any level seen in the 2008-2009 recession. Needless to say, I think Goldmans’ new model needs some tweaking.

At Birchwood, we don’t know how to predict the future, and we’re OK with that. We’ve ditched the story everyone else is focusing on and are playing the odds. We follow a process-driven thesis that tilts the probabilities in our favor. The bet I make is that holding low-cost funds and being globally diversified pays off because it’s the one that has paid off statistically and historically over the years.

Ok, here’s a look back on the global markets:

Tax, Legal & Legislative Updates

A brief note on the election and the recent Georgia runoff.

Joe Biden is our next President and we will have Democratic control over Congress. We’ve already seen predictions on what this means for tax rates and the how this will affect markets. No matter what happens, it doesn’t mean that one will be horrible for markets and one will be excellent. It just doesn’t work that way. Good and bad markets happen regardless of whether a donkey or elephant stands in the Oval Office.

Furthermore, no one from Congress is going to consult with me on what changes they should or shouldn’t make. We’ll be dealt some cards and it’s my job to work with clients on how to get the most benefit given the situation.

Now more importantly:

“Coronavirus Stimulus 2.0” bill was passed and signed into law on December 21st . The $900 billion relief package was over 5,000 pages (yikes). Instead of providing you a breakdown of all the items, I’ve provided highlights below.

No waiver of future required minimum distributions (RMDs)

- There is no extension of the temporary waiver of RMDs for defined contribution accounts that applied to 2020. Accordingly, individuals should be prepared to resume RMDs, as normal, in 2021

Fresh round of direct stimulus payments

- $600 per eligible family member/ $1,200 for married filing joint returns

- Credit phase-out starting at $75,000 of modified adjusted gross income ($150,000 for married filing jointly)

- Advance payments are based on information on 2019 tax returns

The new $300 above the line deduction for cash contributions to charity extended to 2021

- Increased to $600 for those filing jointly

- Very useful for those who take the standard deduction and give to non-profits

- Full podcast episode on this deduction

The ability to deduct 100% of income from cash contributions to charity extended through 2021

- Remember, this sounds awesome, but isn’t exactly great for tax planning. Because you end up offsetting your income at your highest brackets, but also income taxed at the lowest rates. Tax-wise, likely better off spreading the deduction over multiple years!

Health expenses can now be deducted once expenses total beyond 7.5% of AGI (reduced from 10%)

As usual, we will be incorporating these into your tax planning and financial plans, and making the necessary changes.