Market Update

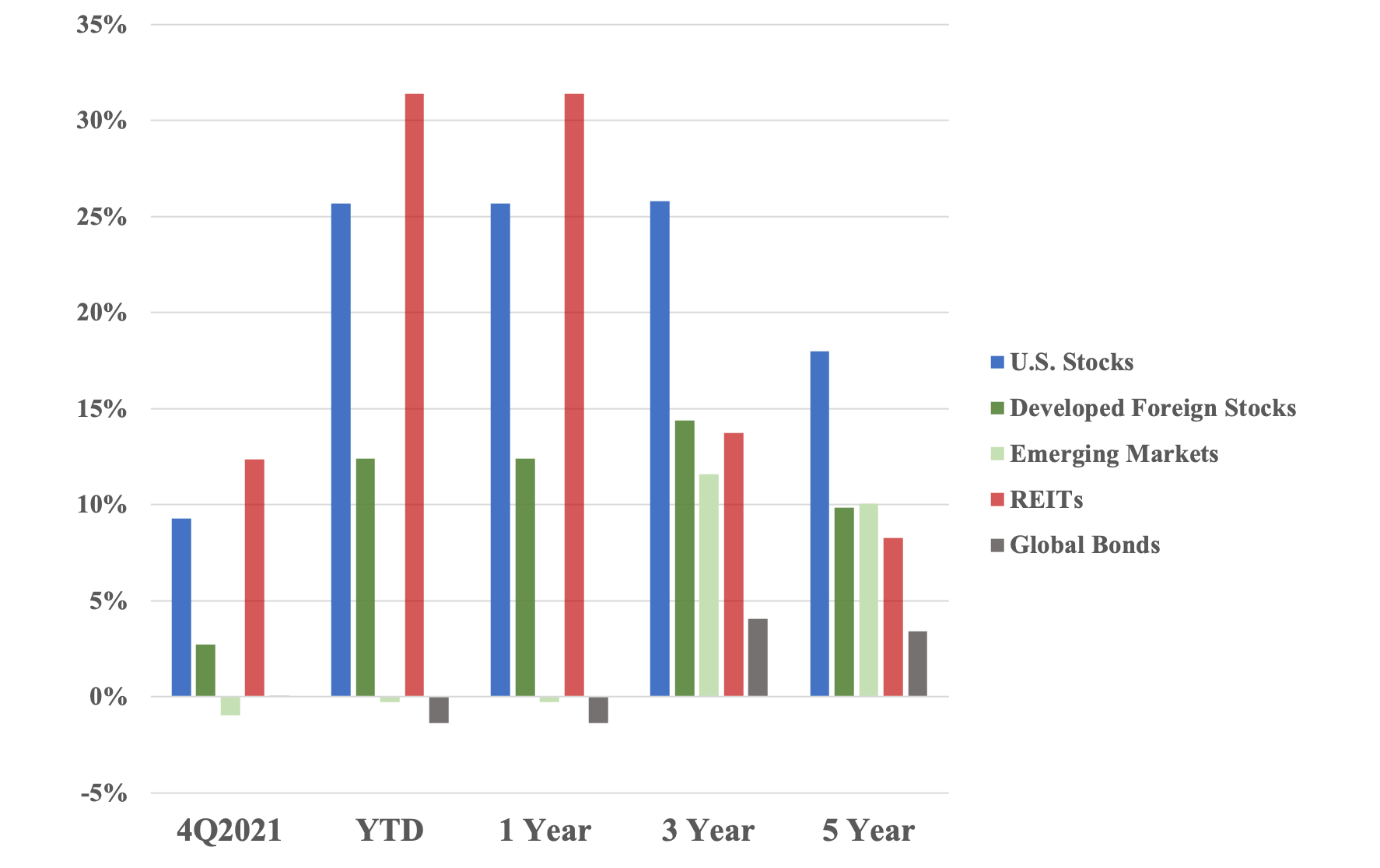

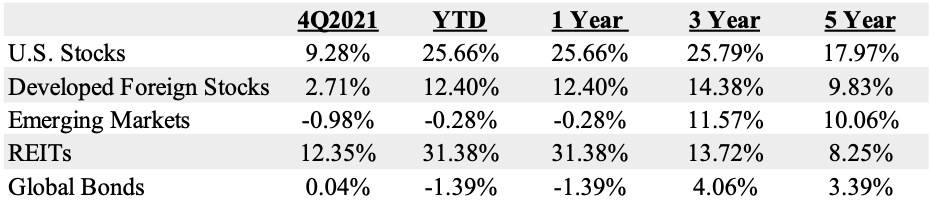

The U.S. and real estate markets surged at the end of the year. The U.S. market was up 9.28% in the 4th quarter as measured by the Russell 3000 (the 3,000 largest U.S. companies) and real estate was up 12.35% in the 4th quarter as reported by the S&P Global REIT Index. Developed foreign (International) stocks ended the quarter up 2.71%. Emerging markets were down -0.98%. Global bonds were up 0.04%.

The U.S. market ended the year up 25.66%. The real estate market finished the year in first place of all asset classes posting a positive 31.38%.

The graph below shows that the last 5 years have been phenomenal to long-term investors.

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI EM Index, S&P Global REIT Index, BBgBarc Global Agg Bond Index. Returns as of 12/31/2021

Economic Update

As wonderful as the year has been in the markets, we know that it’s never that easy. There’s always something to be worrying about. This time it’s inflation. Our inflation hit a multi-decade high in November. Specifically, inflation is up 6.9% through November over this time last year. Fed Chairman Powell has shifted viewpoints from calling this a “phase” to gearing up to take action in the spring of 2022. The fact of the matter is that the Fed has been trying to generate inflation with no success ever since 2008. It took a pandemic, massive supply chain issues and labor shortages to kick inflation into gear. The good news is that if you own stocks, you’re in the best spot to manage inflation.

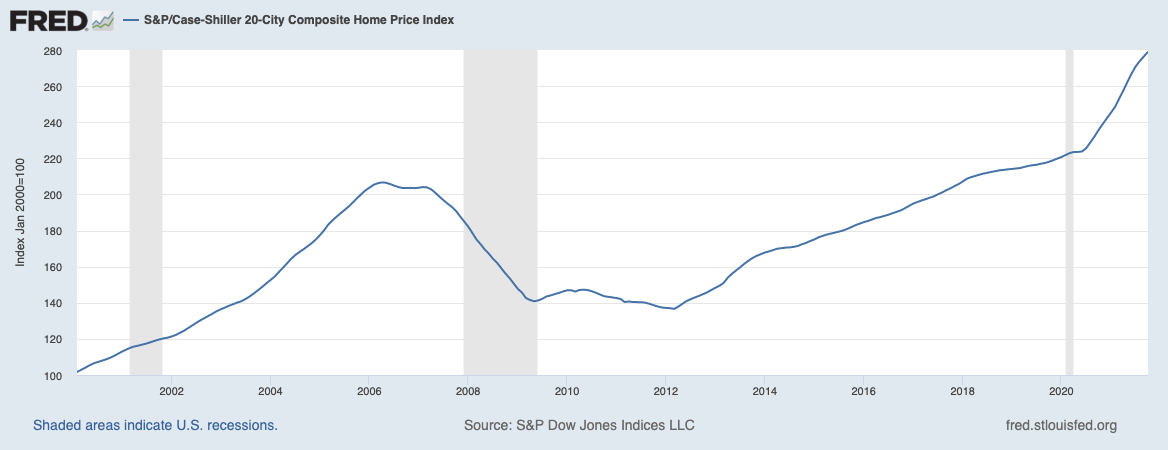

Housing prices continue to grow and are a major contributor to CPI increases (Consumer Price Index – aka: inflation). Millennials are now purchasing homes people thought they never would (funny), interest rates are still low and supply is low. Prices are up over 18% from a year earlier.

We’re in the market for a car and boy can you feel the supply chain issues there. Demand is high, prices are sky high, but sales are down. Supply simply cannot meet the demand. I was recently quoted $6,000 above MSRP for a SUV (don’t worry, dad, I walked away).

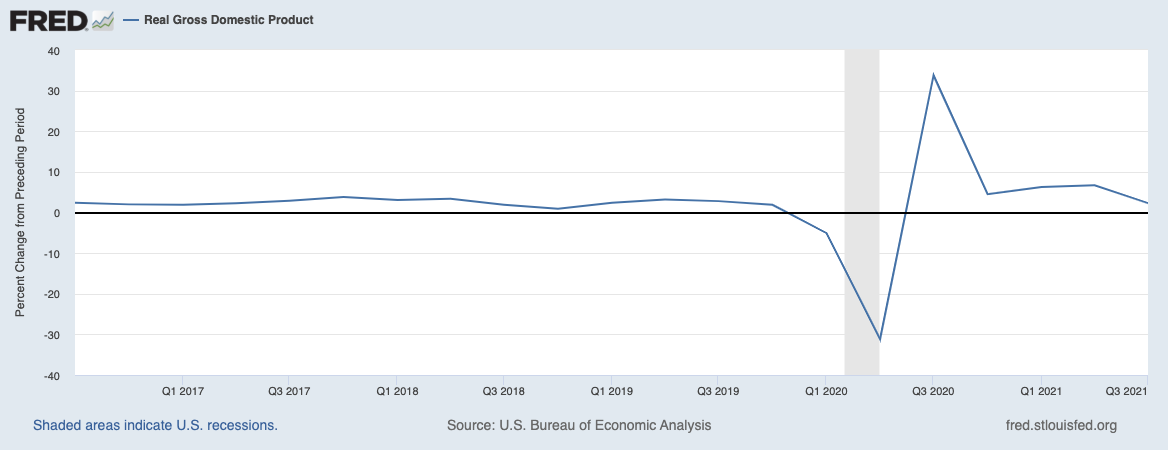

Even amongst new Covid variants, real GDP was up 2.3% over the preceding quarter.

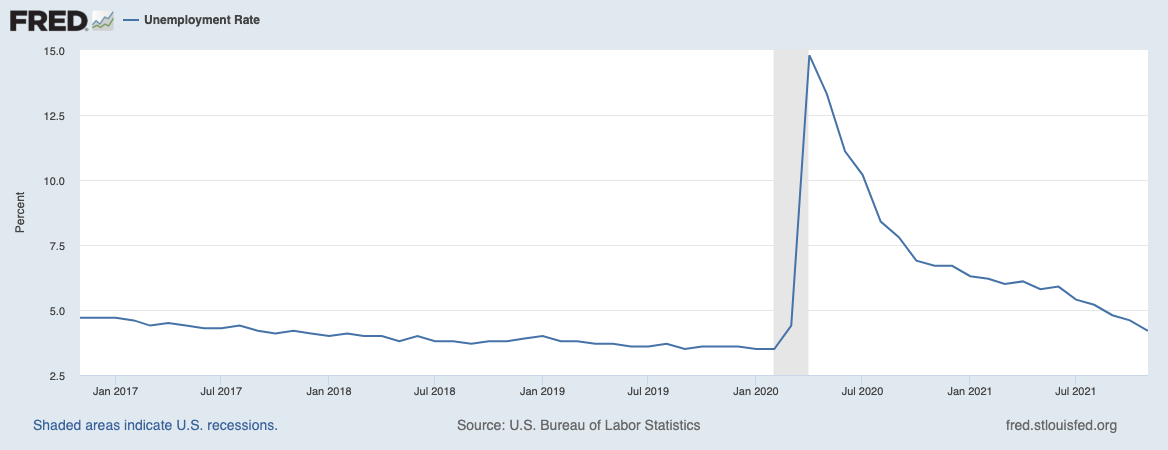

Unemployment continues its downward trend. It now sits at 4.2%.

Tax, Legal & Legislative Updates

For all the hysteria surrounding the what-seemed-to-be an imminent stimulus and tax package – the Build Back Better plan, nothing came of it. Planners and people were worried about the estate exemption being cut in half, tax rates increases, and taxes on unrealized gains. Nothing happened.

We’ll see if anything occurs in 2022.

Below is a brief summary of 2022 laws and contribution limits:

- Taxpayers can put an extra $1,000 into their 401(k) plans. The 2022 contribution limit for 401(k) plans will increase to $20,500.

- IRA/Roth IRA contribution limits remain unchanged at $6,000 (plus $1,000 catch-up for those over 50).

- Social Security recipients will see benefits increase by 5.9%

- The annual gift exclusion increases to $16,000 per person ($1,000 increase).

- The lifetime gift exclusion is now at $12.06 million

- Marginal income and capital gain brackets are unchanged

- Backdoor Roth IRA contributions are still alive and well