Market Review

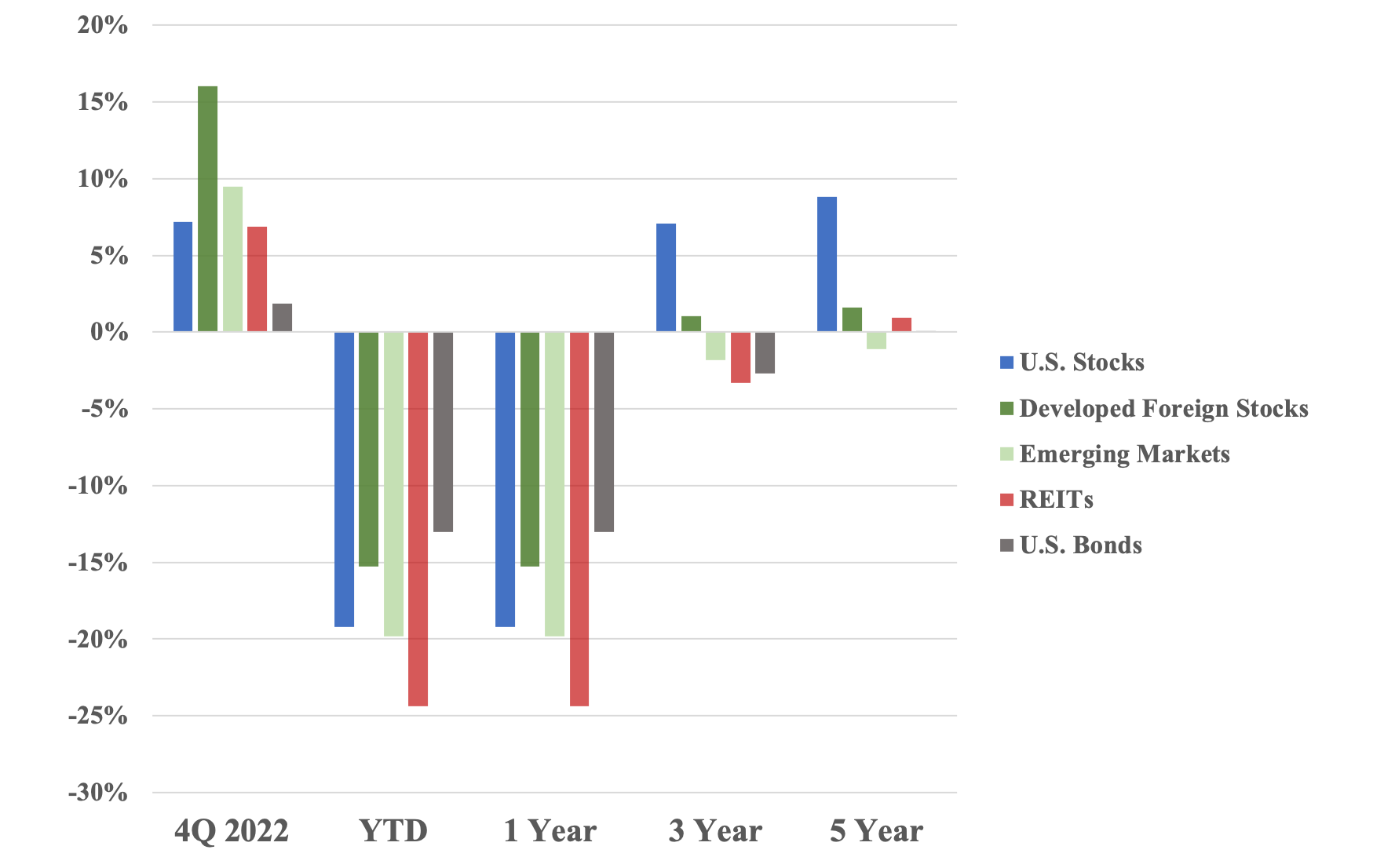

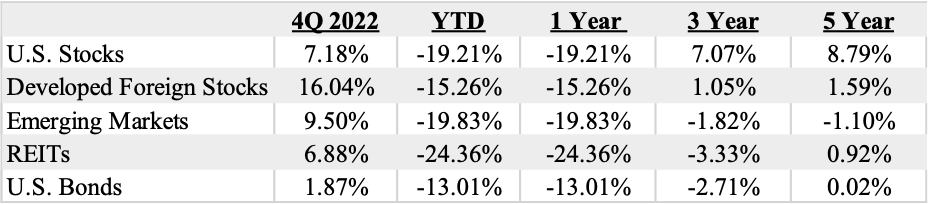

We got a bit of reprieve this last quarter from the onslaught that 2022 has been. US stocks were up over 7% this quarter, and I’m pleased to write that developed international stocks were up 16%! It pays to be globally diversified and we finally got to see those benefits of owning companies beyond our borders.

Real estate was up 6.9% and US bonds were up 1.9% for the last quarter of 2022.

For the year, the markets were hit across the board. There was no place to hide. Stocks, bonds, real estate, cryptocurrencies – everything was down.

And yet, if you were to ask me if I would like 9% returns for the next 5 years, I would take that offer and run before you changed your mind.

Even with all that’s occurred, the US stock market has been up almost 9% each year since 2018 (The past 5 years). If you’ve been investing since 2018, you earned that.

Zoom out. The view is still much, much better.

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI EM Index, S&P Global REIT Index, US Aggregate Bond Index. Returns as of 12/31/2022

Tax, Legal & Legislative Review

In December of 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act brought many changes to the retirement environment (death of the stretch IRA, raising RMD age to 72, etc.). Before the end of this year, President Biden signed an omnibus spending package which contained the SECURE Act 2.0 – another retirement reform package.

Here are some major takeaways. I’m writing a deeper write up in my January blog post (EDIT: This has been posted).

- RMD age was raised to age 73 for individuals born between 1951 and 1959 and age 75 for those born in 1960 or later.

- QCDs still can happen at 70.5

- More time for Roth conversions and to defer the Medicare Part B/D premiums

- Roth changes

- No elimination of any Roth strategies (backdoor Roth contributions still OK)

- Creation of Roth Simple/SEP IRA accountsLimited 529 plan to Roth IRA transfer

- New post-death option for surviving-spouse beneficiaries to be treated as the deceased spouse (this may allow for further delay of RMD and a lower uniform lifetime factor – meaning a smaller RMD amount initially)

- 529-to-Roth IRA Transfers

- 529 plan must have been established for 15 years

- Maximum lifetime transfer to beneficiary is $35,000

- IRA catch-up contributions to be indexed for inflation

- Higher retirement plan catch-up amounts for those ages 60-63

- QCD amount linked to inflation (currently at $100,000)

- Missed RMD penalty reduced from 50% to 25%

Economic Review

Real GDP has increased 0.8% in the 3rd quarter over Q2.

Inflation in November was up 7.1% over the past 12 months. We’ve seen inflation fall, but time will tell if we’ve already hit the peak.

Unemployment stayed the same at 3.7% through November 2022.

3-month US Treasury bills are paying 4.25% in December. Look at the rapid rise in 2022!

30-year mortgage rates are at 6.4% through the end of December.

U.S. home prices continued to drop over the summer through October.