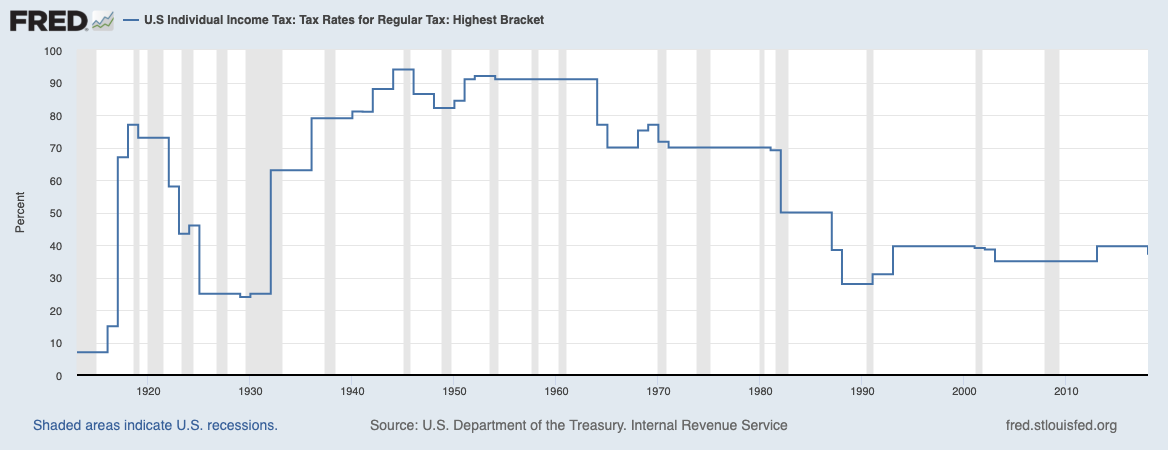

Here’s how the top marginal tax brackets have changed over the last 100 years or so:

I don’t know how or when tax rates will change, but if this graph tells us anything it’s that they probably will. As I write this, tax policies have been proposed, but nothing has been implemented yet.

Lower tax rates usually don’t bug people as much (Hey – I get more in my paycheck!) But higher taxes usually cause some anxiety. As a result, it’s prudent to plan for the un-likable scenarios. If higher taxes are in our future what can we do now?

Two strategies:

Roth Conversions

When you’re saving into an IRA during your working years, you have the option of funding a Roth IRA or a Traditional IRA. Some people think that Roth IRA’s earn people more money. A Roth or a regular IRA don’t do anything regarding how money grows, the only thing that makes one better than the other is what your tax rate is when you put money in versus what your tax rate is when you take it out.

If tax rates are the same then mathematically a Roth and Traditional IRA both end up with the same amount of money. A Roth IRA comes out ahead if tax rates are going to be higher and a Traditional wins if tax rates are going to be lower.

Roth Conversions are another way of funding a Roth IRA (ie. planning for tax rates to be higher). This is the issue we’re trying to hedge for you in retirement.

A Roth Conversion involves taking money that is currently in a Traditional IRA and moving it (converting) to a Roth IRA. Whenever you take money out of a Traditional IRA you owe taxes on that amount, but then once it’s inside the Roth IRA, you’ll never owe taxes again.

The whole idea is that you are prepaying a little tax now, to avoid a larger tax later (if tax rates rise).

The very best times to do this are during years of lower income or if you still have a little bit of room in your current tax bracket.

Usually when you retire, your income goes down due to you no longer working and earning a wage. But then you start taking Social Security (which may be taxed up to 85%) and then at age 72 you’re required to take your RMD. Throw in any other source of income like a rental property or pension and you might be in a higher tax bracket in retirement than when you were working! Sometimes there’s a gap between when Social Security and RMDs start, so you may have a few years when your income is lower. This is the perfect time to do some Roth Conversions.

Furthermore, if you still have some room in your current income bracket, this is also a good time to do a Roth Conversion. To illustrate, let’s say you’re in the 20% tax bracket and your income is $90,000 and the next tax bracket is at 25% for income above $100,000. You have $10,000 of income or “room” left in your bracket that you can have and still remain within the 20% bracket. A Roth Conversion would help you capture that extra room.

The benefit of doing Roth Conversions is three-fold:

- You pay taxes at lower rates (if rates are expected to go up)

- You lower the amount that will be subject to RMDs (Your RMD is partly based off the value of your pre-tax accounts – like a Traditional IRA)

- You have a tax-free pile that can be used for a big purchase or unforeseen expense.

Capital Gain Harvesting

This term might be familiar to you, but it might be its cousin the “Tax Loss Harvesting” that you’re thinking of. Tax Loss Harvesting is a decent strategy but it doesn’t eliminate any tax you pay. It just kicks the can down the road into a later year (which might be very harmful if tax rates rise).

The better strategy is called Capital Gain Harvesting. The reason why you don’t hear about this stratety more often is that most people are asset managers rather than financial planners. They only can touch an investment portfolio and generating losses to offset gains is a short-term solution that no one will complain about. But a real planner will look at your complete picture and that means reviewing your return and doing tax planning for you.

CGH (Capital Gain Harvesting) is similar to one of the scenarios for doing a Roth Conversion – wanting to fill up a lower tax bracket. In this case, it is the capital gain tax bracket you’re looking to impact and this strategy is done in a taxable account rather than a retirement account.

You have to be careful though because while realizing gains will be taxed at the lower rates, the amount realized will still be counted as total income and may impact other breakpoints like IRMAA premiums, medical deductions, and different types of credits. This is why you need to know the complete picture.

The premise of CGH is that you purposely sell a specified quantity of securities that have gone up in value and repurchase the same securities at current market prices.

The benefit of doing this is:

- You pay taxes at lower rates now – potentially even 0% (especially value if tax rates are expected to increase)

- Future growth gets taxed less. By harvesting gains and re-buying the security, you step-up the basis to current market value.

Both of these strategies should be evaluated for your situation every year, regardless of the current tax policy. But it is even more necessary that you implement both of these strategies this year to hedge against future tax increases given the way things are looking in Washington.