Over the years, we’ve gotten to have many conversations with folks who are looking to hire a Financial Advisor.

It can be an arduous and confusing process and we’ve heard from all types of people looking for different things. While we’d love to help everyone, we aren’t always the best fit (e.g. one person asked if we pursue oil and gas limited partnerships for tax write-off purposes. We think going to Vegas achieves the same goal of losing money for tax purposes, albeit with maybe some more entertainment).

Birchwood clients are typically people approaching retirement who want to reduce the taxes they pay, agree with a passive investment philosophy, and value the flat-fee model. These folks are wonderfully kind and down-to-earth.

We’ve been in the industry long enough to know what’s out there (hence, why we started the firm that we did). At the very basic level we’d like to share what we believe are the “table stakes” attributes of a great financial advisor. If they don’t have these, then it’d be a red flag and make me think twice about “passing go.”

Here are five questions that can be asked to help find an advisor who provides great advice at the best possible price:

- What services will be provided by the advisor?

- What professional certifications does the advisor have?

- Is the advisor a fee-only fiduciary 100% of the time?

- How much will I be charged and what is the fee based on?

- What is the advisor’s investment philosophy?

1. What services will be provided by the advisor?

→ Some advisors focus solely on investment management while others provide a comprehensive suite of services.

A growing number of advisors are broadening the menu of services that they provide for their clients – often at no additional cost. Some of the most valuable services to look for include:

- financial planning – developing clear plans to achieve specific goals like retirement or paying for college;

- tax planning – using all available strategies to minimize the lifetime tax bill for clients;

- insurance/risk management – regularly reviewing all property & casualty insurance policies (home/auto) as well as making recommendations for life insurance to best manage your risk;

- estate planning – ensuring clients have the most critical parts of an estate plan in place (e.g. establishing guardianship for any dependent minors, power of attorney, updated beneficiary designations).

2. What professional certifications does the advisor have?

→ The most widely recognized credentials are the CFP and the CFA.

There is a long and growing list of certifications that financial professionals can attain to increase the number of letters after their names. While many of these certifications show competence or specialization in certain areas, in our view, the CFP and CFA represent the most relevant certifications for advisors that provide financial planning and investment management.

The Certified Financial Planner (CFP) designation is the most respected credential for financial planners. The CFP exam tests for knowledge in tax planning, risk management/insurance, and estate planning. More importantly, CFPs are required to act as fiduciaries when providing financial advice which means they have a legal obligation to prioritize their clients’ financial wellbeing above their own.

The Chartered Financial Analyst (CFA) designation is the most widely recognized credential in the investment industry, signifying a deep understanding of financial analysis. If your advisor is going to be managing your investments, then it can only help if they have spent the 3,000+ hours studying required to pass the three CFA exams. If an advisor has this, then they have gone above and beyond.

3. Is the advisor a fee-only fiduciary 100% of the time?

→ Seek out a “fee-only” fiduciary advisor.

This is a very important question that often gets overlooked. The key concept here is how exactly does your advisor get paid. We’re talking about aligning interests in the best way possible.

For example, if your financial advisor gets paid by third parties (i.e. investment managers and/or insurance companies) to sell products, is he incentivized in your best interest or in the interest that makes him the most money?

We fully believe that most folks aren’t out there trying to take advantage of others. But our point is that when it comes to how you get compensated, it’s very easy to justify one product over another. As Upton Sinclair said, “It is difficult to get a man to understand something, when his salary depends upon his not understanding it!”

For reference, industry research firm Cerulli estimates that 23% of the average advisor’s revenue is from commissions (and if that’s the average, then some are much higher).

“Fee-only” is an important term, which simply means that your financial advisor (and their firm) will receive 100% of their revenues from the clients they serve (ie. NO COMMISSIONS). In a fee-only arrangement, the advisor does not receive commissions for recommending certain products over others and thus is fully aligned with providing the best outcome for the client. While there are an overwhelming number of industry groups and alliances, the largest fee-only association is called NAPFA (the National Association of Personal Financial Advisors) and NAPFA has a tool that can be used to help find fee-only financial advisors.

The last most important term is “Fiduciary.” Some advisors skate around this term like they are Connor McDavid on ice, but it’s probably the most basic gut check there is. Fiduciary means – “are you legally obligated to look after my best interests.” Sounds like a no-brainer but this industry is full of non-fiduciaries. And even worse, people who say they are fiduciaries and then mutter under their breath, “some of the time.” We’re serious! The easiest way to tell if they are a fiduciary is to 1) see if their firm is a Registered Investment Advisor (RIA) AND 2) ask them to state in writing if they are a fiduciary 100% of the time.

4. How much will I be charged and what is the fee based on?

→ A flat fee structure will save clients money long-term relative to an AUM structure.

Currently, the vast majority of the wealth management industry charges client fees based on a fixed percentage of the clients’ assets. Using a very simple example, a common pricing structure is for an advisor to charge 1% of client assets under management (AUM). In this example, a client with $1 million of investable assets pays $10,000 in annual fees while a client with $3 million in assets pays $30,000 in fees. One question that must be asked from this arrangement is whether a $3 million client is receiving 3x more value from their advisor relative to a $1 million client?

Our view at Birchwood is that, over time, a growing number of advisors will be moving to a flat fee structure where the client is charged a fixed annual fee based on the complexity of their situation rather than simply the size of their portfolio. We expect that flat fee pricing structures will continue to grow in popularity because this structure saves clients money over the long run. For example, a client with a $5 million portfolio earning 7% annual return for 20 years would end up $3 million wealthier having paid their advisor a $10,000 flat fee instead of 1% AUM fee.

Again, any advisor should be able to disclose what their fee is. Keep in mind that this doesn’t include the fees of the investments themselves. If your advisor is using a 3rd party investment manager to help allocate the portfolio, there could be 0.5-1% in additional fees that you will be paying for.

5. What is the advisor’s investment philosophy?

→ Choose an advisor who offers passive investing strategies (or can clearly justify a different approach).

It is very important to understand how your advisor will be investing your money, but it can feel complex and overwhelming. We believe strongly that low-cost, diversified, passively managed index funds are the best strategy for long-term investing (see below for more detail). If your advisor is picking individual stocks, can they show a performance track record which supports this approach? If your advisor is investing client money with other active managers (i.e. actively managed mutual funds or alternative asset managers), do those managers and/or their particular strategies have track records of outperforming passively managed equity funds (VTI is our favorite) to justify the allocation?

This might seem trivial but seemingly small amounts of performance leakage (i.e. paying higher fees and/or worse performance) can compound into large dollars over time. Using another example, for a client with a $1 million portfolio, the difference between earning annual returns of 5% vs. 6% over a 20-year period turns into roughly $550,000 – equivalent to ending with 17% less wealth than you’d have if you earned just 1% more per year.

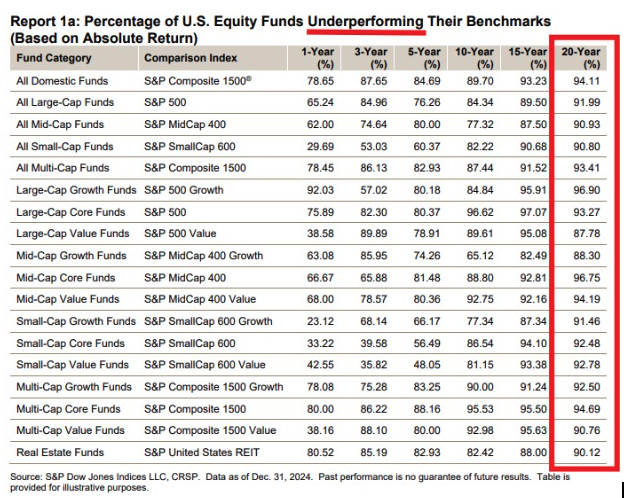

In what appears to us to be the single most under-rated piece of research in the financial services industry, S&P publishes a bi-annual report which consistently shows that 90+% of actively managed U.S. equity funds underperform their benchmarks over trailing 20-year periods. Page 10 of the report is shown below and the following page of the study shows that the stats are even worse if looking on a risk-adjusted basis. This report should be the first thing that comes to mind any time someone tries to convince you that they can do better than passive index funds (which effectively just own the benchmark). See here for more detail on our investment philosophy.

As Stephen has articulated in past annual letters, our goal here at Birchwood is to be a blessing to our communities. If you have questions about finding a financial advisor, or if you’d like to chat with us about becoming a Birchwood client, we would love to speak with you – you can request a meeting here.

Sources / Helpful Links:

https://www.cfp.net/why-cfp-certification/the-standard-of-excellence

https://www.cfainstitute.org/programs/cfa-program

https://www.napfa.org/financial-planning/what-is-fee-only-advising

https://www.humaninvesting.com/450-journal/only-5-percent-of-advisors-are-true-fiduciaries