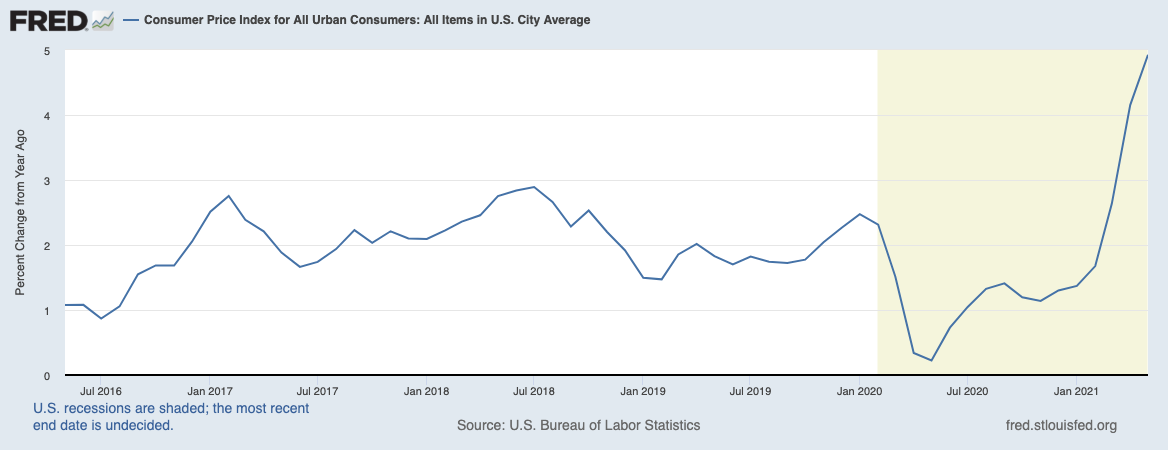

Inflation heating up has hit the headlines again (U.S. Inflation is Highest in 13 Years).

And it appears that inflation is increasing at an alarming rate: 5% over last year!

But remember, compared to where inflation was at this time last year, where prices were actually depressed, of course inflation looks like it’s flaming up. The year-over-year comparison has created a very much distorted view from what reality is like.

For example, the WSJ reports that “earnings per share for companies that make up the S&P 500 index were up 225% in the first quarter from a year earlier.” This is mainly because earnings were so bad during the first quarter of 2020. The large numbers make it appear that profits are soaring when really things are just getting back on track.

The same thing is happening with inflation. If we compare this last inflation report to two years ago (May 2019) we find that overall prices rose at a more moderate 2.5% in May.

You can torture the data to get it to say what you want to raise hairs and draw eyeballs to your news reporting. Always be alert for that.

That’s the current scenario right now, but what if inflation does come roaring back? What do we do then?

Inflation in Retirement

When you approach retirement, you’re not only concerned about having enough money, but if that money will still be able to buy the things you need to live. Your concern is over the real (not nominal) value of your money.

For clients, we’ve incorporated a real life “perfect storm” into their plan: a severe market decline in the initial retirement years combined with inflation in the first decade of retirement that was three times the historical norm (Think 1970’s). That’s what we’ve already planned for.

Inflation is just one of the myriad of risk factors that long-term investors will face over the course of their investing horizon. In other words, if inflation does heat up, this isn’t a surprise to us. I can’t say if it will or won’t but in the case of a surprise scenario, we’ve got a plan.

Globally diversified equities have shown to dominate any upticks in inflation. Since 1928, stocks have grown nearly 7% more than the rate of inflation. Furthermore, short-duration bonds hold up exceeding well as rates increase in the short term and put downward pressure on bonds. These interest and principal payments will occur sooner allowing us to reinvest at higher rates.

There you have it – our strategy for the long and short-term.

Gold

Naturally, when we talk about inflation the question of “should I own gold?” comes up.

The short answer is “No.”

As much as gold is marketed on TV these days, you would think that it’s the solution for every problem. Sorry, but there are no cash flows (dividends, interest) associated with owning gold, only people’s opinions on what it should be worth. The narrative that gold is an inflation hedge is so often repeated it has made people believe it’s true. Gold prices do whatever they want to do in whatever market they want to do it in. You can find cases where gold beats inflation (1973-1979) and cases when it does the exact opposite (1980-1984, 1988-1991).

We enter into murky waters when we start talking about what we can add or remove from a portfolio given a current environment. What we are essentially trying to do is predict the future. We want to put our assets in the correct places so that if B or C or D, E, F… happens we’re ready.

The problem is no one does this very well. You make the exact opposite move from what precisely ends up occurring. This is a losing proposition and frankly, I’m not too fond of losing.

However, if you widen your horizon, you’ll easily see the play for winning: broadly diversify across markets, rebalance, and keep costs down.

You can’t control markets. What you can do is prepare yourself for what you’ll do in case bad events happen.