The U.S. market toyed with being in correction territory last month (being down 10%), and we saw tech stocks, as measured by the NASDAQ, fall below that measure. What do we make of this?

Investor and writer Howard Marks has a great illustration that helps us think of markets. Picture a pendulum, maybe one from a grandfather clock or a large one they have at science exhibits. If you were to find the midpoint (average) of the pendulum’s swing it would be dead-center pointing toward the floor. However, by observing the pendulum’s arc we realize that it spends very little time on that midpoint and much greater time at either extreme. This is exactly like the markets. Average returns are one thing, but the observed experience is much more from wild optimism to extreme pessimism. The market arcs from exuberance, where nothing can go wrong, to dire straights, where the future doesn’t have any hope.

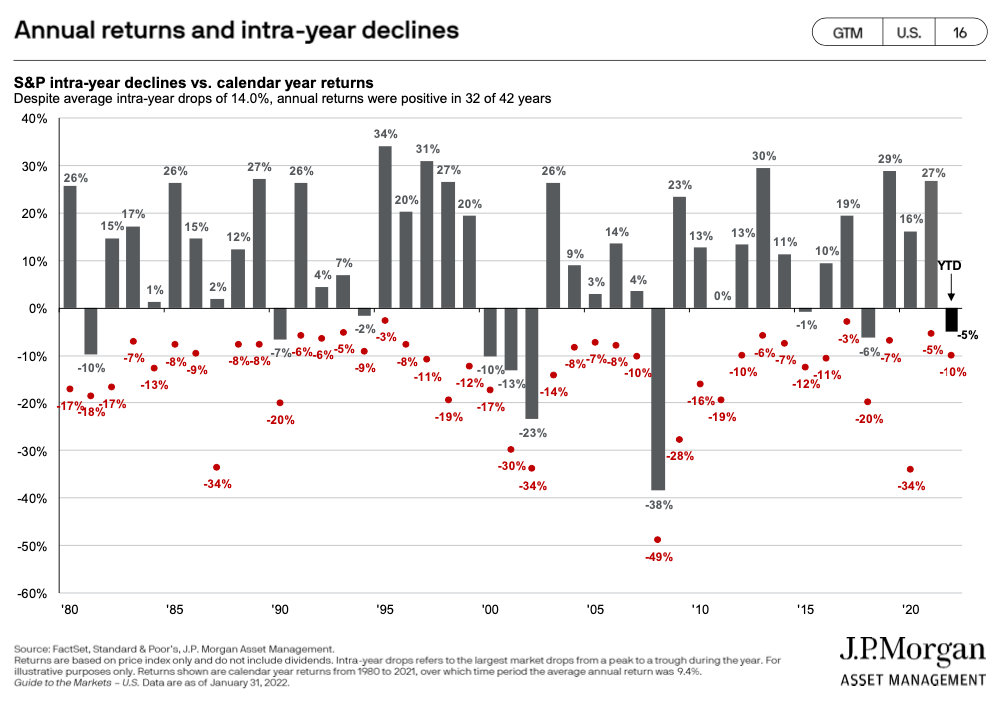

Here’s a visual example:

The gray bars represent the end-of-year return for the S&P500 and the red dots are the intra-year drawdown (at some point during that year the market was down that far).

Going back to 1928, the average drawdown is -16.5%. Yet, given that – the market has incredible resilience. “When there has been a correction of 10% or worse, 3 out of every 5 years have ended with a positive return. And 2 out of every 5 years has experienced double-digit correction but still finished the year with double-digit gains” (A Wealth of Common Sense).

As uncomfortable as it is, we must have the wherewithal to understand that this is how the market works. It is completely normal. There is no bug in the system and no one is out to get you.

Many people believe either a) that there’s gurus who can predict when the next fall will occur and make changes before it happens or b) their advisor is that person.

We don’t think those hold any muster when held up to actual track records.

Our response on this subject is simple:

- We accept that we’re among the many who do not know what the future holds.

- It is for this reason that we’ve chosen to invest in low-cost, global index funds and put our time and attention into inefficient areas where specialization, skill and hard work can add value and lead to more money in clients pockets after-taxes. Those specific ares are: tax planning, charitable giving, and estate planning.

- To make it perfectly clear, we fully acknowledge our limitations (of not knowing the future or what the next global macroeconomic move will be) and put the highest priority in being low-cost, tax efficient and long-term owners of equities. There is no desire to execute bold strategies on our end.

The markets will throw its tantrums and things will look dire from time to time. Actually, it is exactly because of these fits that we get the great returns that we do. With no risk, the markets wouldn’t produce good returns as everyone would hold the consensus opinion.

It’s our belief that the best way to “win” at this game of investing for retirement is to view the markets as businesses instead of blips on a screen that change color. And these businesses are ones that will make us incredible wealth if we can hold onto them. The good news is that the decision to hang onto these phenomenal businesses is completely ours.

We’ll keep our business ownerships right where they are.