“My investments don’t seem to be working”

“Something should be changed”

Have you ever thought that?

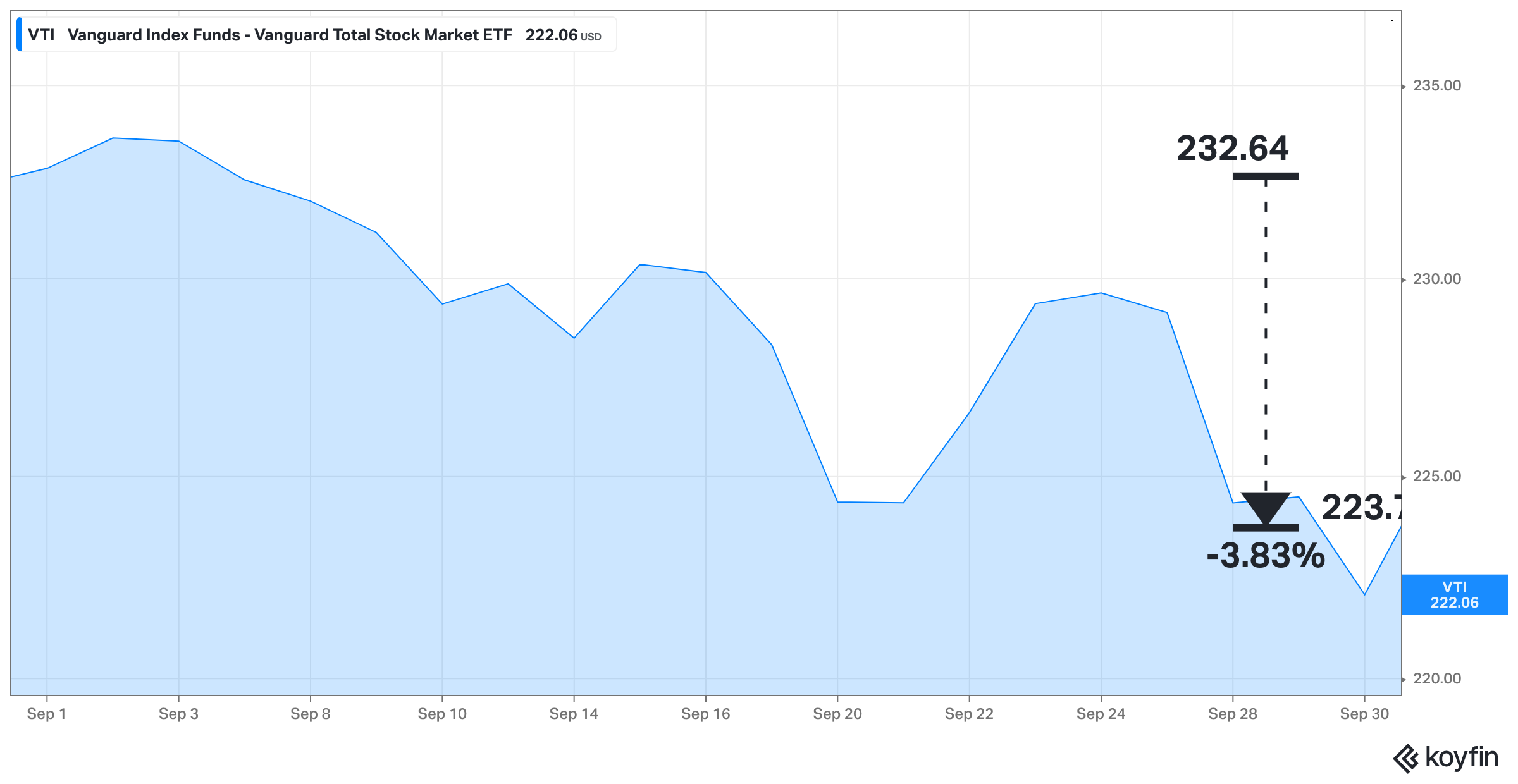

Take a look at this investment and you tell me if it seems to be working.

Whatever that investment is should be replaced! And fast! It lost almost 4%!

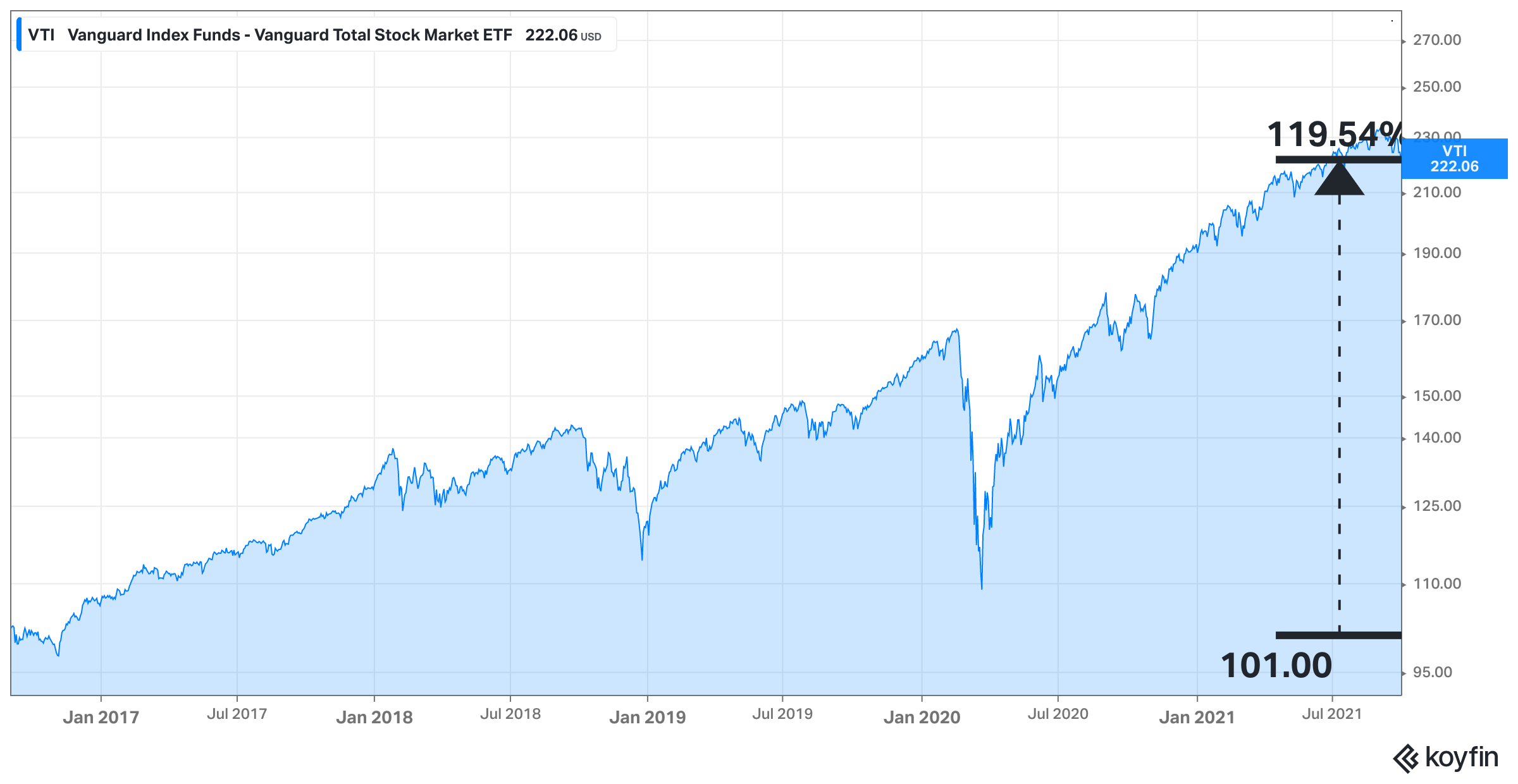

Alright, let’s do one more. Look at this investment and tell me if it seems to be working.

Whoa! That investment did amazing! It’s up almost 120%! Let’s put more money in that!

Both of these illustrations were the same investment – U.S Stocks. The first graph was this last month of September and the second graph was a 5 year look-back through September.

Even with all the events that have taken place – elections (2016, 2020), the worst quarter since the financial crisis (Dec 2018) only to be topped by a worldwide pandemic (2020) – the market still doubled.

Just because an investment drops doesn’t make it a bad investment and doesn’t warrant its immediate replacement. We tend to take recent events (usually bad things) and extrapolate them into the future (what has happened will continue to happen). If we’re able to take a step back we see the fruits of being patient and long-term oriented.

In order to get 120% cumulative returns, you need to handle months like September (and the many more that will come). By broadening your time horizon, the outcome looks completely different. That ‘bad investment’ has actually been a phenomenal place to invest. Birchwood Capital believes in holding the best companies in the U.S and around the world. Why would we stop doing what works?

Here’s what I know definitely doesn’t work and will never work:

- Buying funds with high expense ratios/fees

- Trying to beat the market (and incurring a lot of transaction costs and taxes to boot)

- Concentrating your wealth into a few securities to give you a better chance of making your wealth last

- Thinking yourself (or your advisor) can ‘get you out’ before a crash

- Thinking markets give you 6-10% per year every year

- Not considering income needs and holding little to no cash/bonds because you want to maximize returns