In an environment of high inflation, investors search for ways to combat it in their portfolios. One of such investments you’ve probably heard about recently is TIPS or Treasury Inflation Protected Securities.

TIPS are securities whose principal is tied to the Consumer Price Index (inflation). As inflation increases, the principal increases. With deflation (a general decrease in prices), the principal decreases. When the security matures, the U.S. Treasury pays the original or adjusted principal, whichever is greater. This sounds like an investor’s solution to inflation.

So when inflation is rising, you buy TIPS? Sounds easy enough.

Here’s why it isn’t:

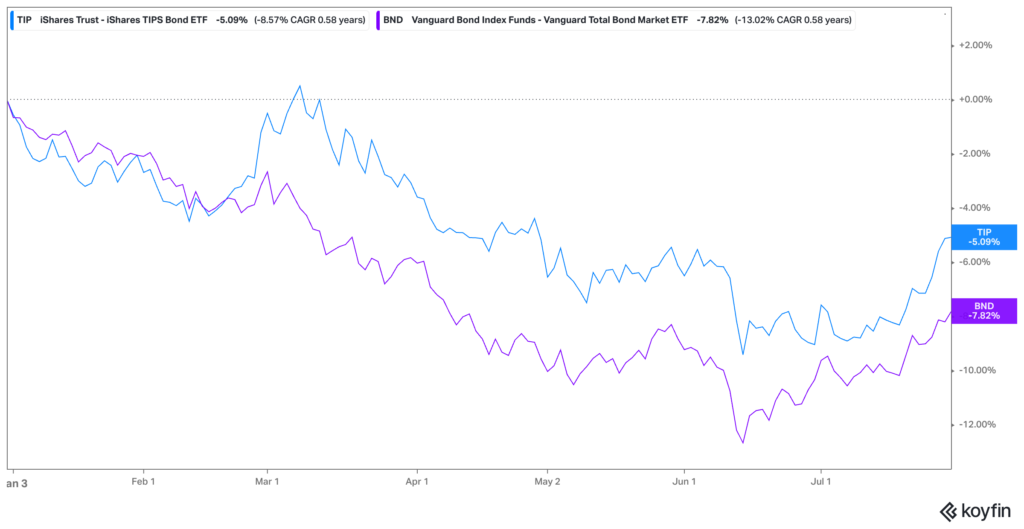

Year-to-Date through July, U.S. bond indexes are down -7.8% (As measured by Vanguard Bond Index ETF -BND) and TIPS are down -5.1% (as measured by iShares TIPS Bond ETF – TIP).

Wait…it doesn’t seem as if TIPS did their job. Inflation is at +8-9% but TIPS are down 5% just like regular bonds! That’s more than 12% of underperformance to inflation! What gives!?

The big mistake is thinking that by owning TIPS you’re escaping from any damage. It is far too simplistic. If that were the case, then no one would be worried about inflation since they would all just buy TIPS themselves.

How TIPS Work

TIPS prices incorporate not only the current level of inflation but the expectation of future changes of inflation.

Whether you buy TIPS directly or via an ETF you’re participating in an auction with constant bidders and sellers. If sentiment changes on what future inflation might be, then the value of those securities will fluctuate. With the Federal Reserve signaling that it plans to fight inflation by raising rates, the expectation of future inflation is now lower so buyers are less willing to pay higher prices.

Example:

- A 5-year TIPS auctioned on Oct. 21st, 2021 sold for 109.51

- A 5-year TIPS auctioned on Apr. 21, 2022 sold for 102.76

- This is 6.2% decline in TIPS value

Just like any trade made to capture short-term fluctuations, you have to incorporate second level thinking. It’s one thing to know the result (inflation is rising), but it’s an extra degree to know how people (the market) will respond to that news. And just like any market timing strategy, you’re usually wrong!

If you realize that inflation is here, you can’t buy a TIPS ETF and expect to avoid losses. The markets are too smart and have already anticipated this.

The Benefit of Owning TIPS

Now, this doesn’t mean that TIPS are broken and don’t do what they clearly state they do. In fact, a TIPS ETF (like iShares TIPS Bond ETF) has earned about 3% each year for the past 5 years, slightly edging inflation. As you expand horizons, the goal (keeping pace with inflation) and investment performance converge, but in the near-term, things can look chaotic (TIPS down 5% and inflation up 8%)

Another work around is to own TIPS directly. You can hold the bond until maturity and you’ll be guaranteed its full face value and approximately its yield to maturity. This is technically the same thing as owning an ETF as the value continually fluctuates but you won’t see it, which can help psychologically.

Ultimately, TIPS – whether bought directly from the Treasury or via an ETF – may be most useful as a way to hedge against long-term, unexpected increases in inflation, because regardless of how they are purchased, their price already reflects the market’s expectations for future inflation.

Here are some other “inflation hedges” that don’t work:

- Gold. It’s been a cruddy hedge since we went off the gold standard. Gold has kept pace with inflation over many decades, but doesn’t rise when inflation is rising. Go figure.

- Commodities. Commodities do better during bouts of inflation but do nothing in between those times. Are you OK to invest in securities that stink for a long period of time?

- Bitcoin. Not enough history for me to say anything useful

Stocks as Long-Term Inflation Hedge

Even stocks, which are the best long-term inflation hedge, don’t always move in tandem with inflation year to year.

Even now It’s hard to make the connection of stocks being a good hedge when inflation is up 8% and stocks are down 20%.

But here’s the facts about stocks:

- U.S. stocks have never posted a negative real return for 20 years or longer

- Stocks have averaged around 6.5% real return (after inflation)

For a long-time horizon, the plan for inflation is already there – own stocks! Don’t try to fix the inflation problem with an investment security that you don’t already own. There’s no perfect solution out there.