Market Review In the second quarter, U.S. stocks returned 3.2% and developed international stocks were down just under -1%. Emerging markets pulled their weight and were up over 5%. U.S. bonds were flat and REITs were down -1.5% for the quarter. We’re all familiar with the U.S. stock and bond markets, but just in case…

Read More

Writings

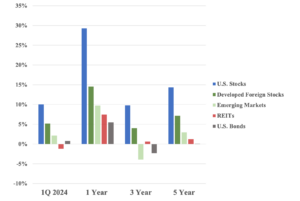

1Q 2024 Market Overview

Market Review 1st quarter in the books. Let’s check out what transpired. U.S. stocks returned 10% and developed international stocks earned over 5%. U.S. bonds were up a hair at 0.8% and REITs were down -1.2%. While we all know this, it’s worth repeating: stocks are volatile and for the last 3 months they were…

Read More

2023 Annual Letter

Life and the outcomes of our days can either be seen through the lens of gain or gifts. As I reflect back on this year, there were times, I admit, when I was overwhelmingly frustrated with myself, my work, and my health. When the results of the day didn’t seem to meet my expectations, I…

Read More

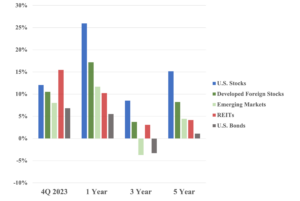

4Q 2023 Market Overview

Market Review My, what a year! Who would have thought the stock market would have ended up 26%? Me either. For the quarter, U.S. stocks returned 12.07% and developed international stocks earned 10.52%. U.S. bonds were up 6.82% and REITs rebounded 15.47% to close out the year up over 10%. After all we’ve been through…

Read More

How You Should Build a Portfolio

You can go down the rabbit whole of building the most efficient or ‘ideal’ portfolio per the textbook. You can look at Modern Portfolio Theory and Mean Variance Optimization. You can run historical data returns and calculate variations ad nauseum then find the exact point on the Efficient Frontier to allocate assets. Of course, the…

Read More

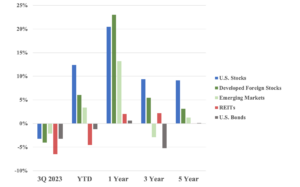

3Q 2023 Market Overview

Market Review This last quarter took a bit of the fun out of the year we were having so far. Markets were down across all asset classes. U.S. stocks were off -3.25%, Real Estate’s quarter drop pulled its year-to-date return into negative territory, and Bonds were down similar to stocks at -3.23%. Do we like…

Read More